APAC Leads Global Crypto Uptick, Japan Records Strongest Growth

Asia Pacific (APAC) is pulling ahead in the crypto market because policy is tilting toward clarity while consumer rails scale fast.

From late 2023 through mid 2025, the region’s on-chain value received rose sharply, climbing from about $81b a month in mid 2022 to a peak near $244b in Dec. 2024, and holding above $185b per month this year, according to a Chainalysis report published Wednesday.

Japan is now the standout. On-chain value received rose 120% in the 12 months to June 2025, outpacing South Korea, India and Vietnam. Growth follows rule changes that treat more tokens as investment instruments, planned updates to crypto taxation, and the licensing of the first yen-backed stablecoin issuer.

With stablecoin listings beginning to loosen, traders channeled heavy volumes into XRP, then BTC and ETH, while markets watch how USDC and JPYC gain traction.

India’s Oversight Tightens Without Choking Fintech, Supporting Sustained Crypto Use

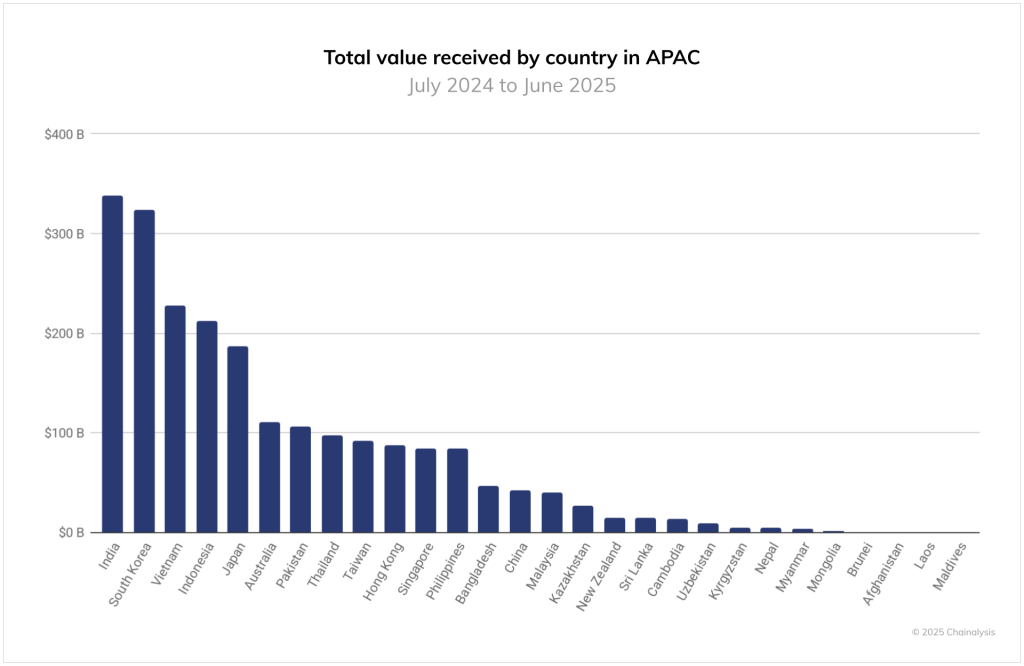

India follows with scale and depth. It leads APAC in total on-chain value at about $338b dollars, supported by UPI rails, a large diaspora that uses crypto for remittances, and young investors who trade for supplementary income. Industry groups are helping normalize usage, while authorities build clearer oversight without stifling fintech growth.

South Korea’s market looks distinctly professional. Nearly half of on-chain activity sits in the $10,000 to $1m band. The 2024 Virtual Asset User Protection Act is reshaping exchange practices, and growing USDT and KRW stablecoin pairs have lifted volumes.

Image Source: Chainalysis

Policymakers are debating KRW-backed stablecoins, with rules expected to address issuance, distribution and secondary trading.

Tighter Supervision In Australia Sets The Stage For Institutional Entry

Vietnam shows everyday utility. Crypto supports remittances, gaming and savings, reflecting wide grassroots adoption. Activity has matured, which explains slower percentage growth compared with Japan, yet usage remains deeply embedded in daily flows.

Australia is laying foundations. Steps to modernize AML and CFT rules and to clean up inactive exchange licences point to tighter supervision and a more durable market structure. That groundwork matters as institutions seek clearer counterparties.

Hong Kong and Singapore continue to shape policy in different ways. Hong Kong’s Policy Statement 2.0 accelerated local activity by signalling a path for regulated trading. Singapore’s measured stance has shifted flows toward stablecoins, which now surpass bitcoin pairs as institutions use them for payments, liquidity and hedging.

Across APAC, monthly on-chain value received climbed from about $81b in July 2022 to that Dec. 2024 peak. Volumes eased afterward but stayed high through mid-2025. The region frequently ranks second to Europe and at times outpaces North America, underscoring its growing influence on global flows.

Beyond Trading, New Use Cases Keep Volumes Elevated Into 2025

Market triggers were clear. Late 2023 and early 2024 produced the first months above $100b as prices recovered. Q4 2024 delivered the top prints, helped by a global risk rally. The trend persisted into 2025 even as prices cooled, pointing to broader use cases beyond trading alone.

APAC’s diversity is the driver. Japan’s reform cycle, India’s digital public infrastructure, Korea’s trader centric market, Vietnam’s everyday use, Australia’s compliance push, and the twin hubs of Hong Kong and Singapore together create multiple paths to adoption.

That mix also buffers the region. When trading slows in one market, remittances, payments or treasury activity sustain volumes elsewhere. As rules continue to harden, APAC’s role as a bellwether for how crypto will be used at scale looks set to grow.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias