800,000 LINK Bought by Whales as 5.5M Tokens Exit Exchanges

TL;DR

- Whales holding 100K–1M LINK added 800K tokens as the price dipped near $21.5.

- Exchange balances fell 5.5M LINK in 24 hours, extending steady withdrawals since July.

- Active addresses recovered from 4K to 5.8K, hinting at renewed participation despite a weak price.

Whales Accumulate as Price Weakens

Chainlink (LINK) whales added to their holdings during the latest price drop. Analyst Ali Martinez reported that addresses holding between 100,000 and 1,000,000 LINK increased their balances by more than 800,000 tokens as the price slipped toward $21.

Wallets in this range now control about 179.45 million LINK. He wrote,

Interestingly, toward the end of last week, similar wallets added nearly 2 million LINK in just 48 hours, as CryptoPotato reported. At that time, the asset traded close to $24, with price action staying stable despite heavy buying.

Exchange Balances Fall With Heavy Withdrawals

In the same period, around 5.5 million LINK left exchanges in 24 hours. Data shows a sharp decline in supply on trading platforms, alongside a spike in outflow activity.

LINK has retreated from late August highs near $26–27 and now trades closer to $21. Despite this, exchange balances have been trending lower since July, pointing to steady withdrawals. Removing tokens from exchanges is usually linked with long-term storage in private wallets, which reduces immediate selling pressure.

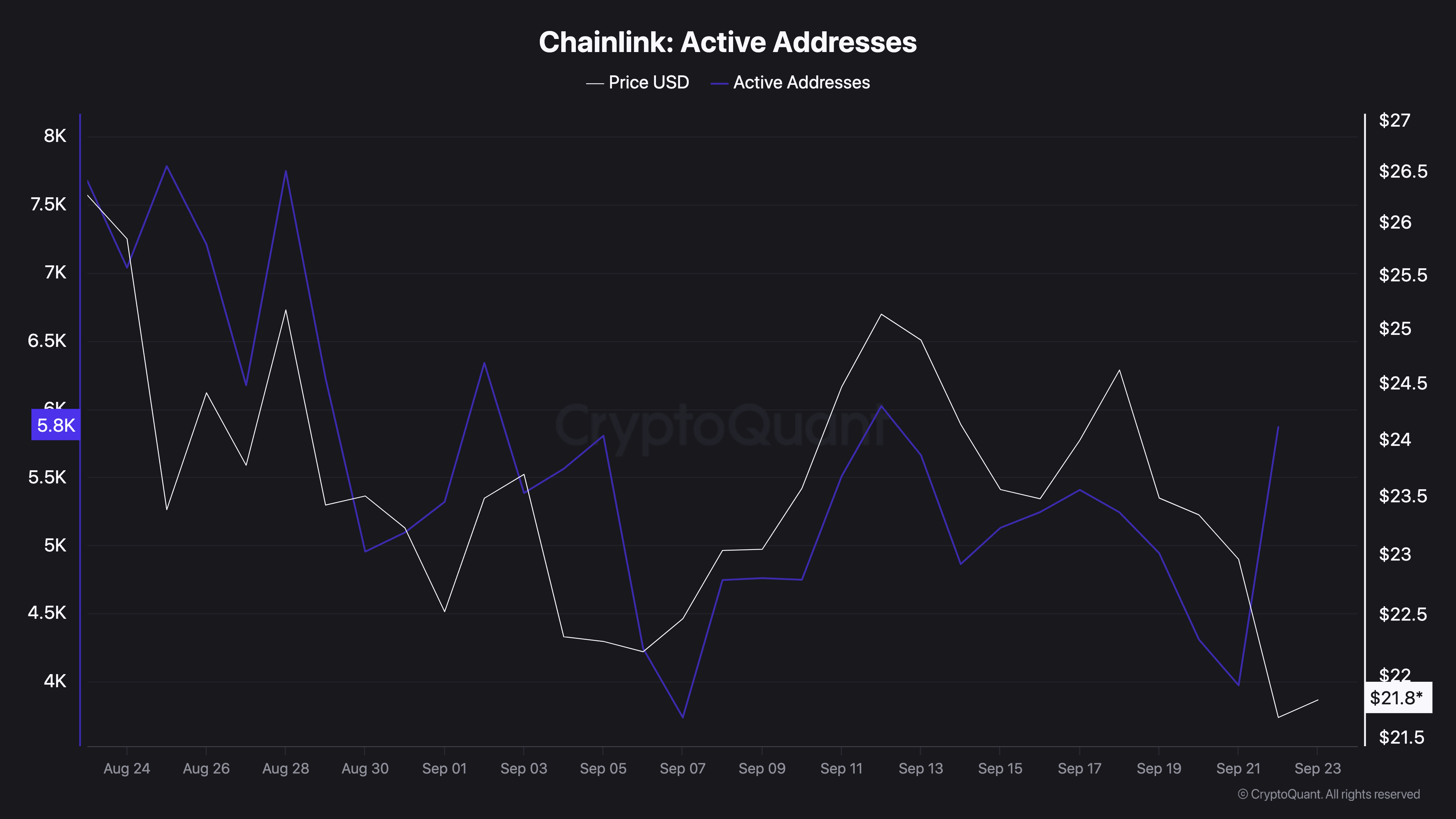

Additionally, on-chain data from CryptoQuant places current active addresses at 5,800, with a price of around $21.8. Both metrics have fallen since late August, when active addresses reached nearly 8,000 and LINK traded above $26.

Source: CryptoQuant

Source: CryptoQuant

Notably, the most recent readings show a lift from a mid-September low near 4,000 active addresses. This rebound suggests network use is recovering slightly, even while the token price remains close to its recent lows.

Technical Levels To Watch

Analyst CryptoWzrd noted that daily candles for LINK and LINKBTC closed bearish. They said,

They identified $30 as resistance and $20 as key support. In the short term, maintaining levels above $22 may open a move toward $24, while rejection could see the price slide to $19.80. Intraday charts remain volatile, and traders are watching for a clearer structure before confirming the next setup.

At the time of writing, Chainlink trades at around $22, with a 24-hour trading volume of $928.6 million. The token is up 3% in the past day but down 8% over the week.

The post 800,000 LINK Bought by Whales as 5.5M Tokens Exit Exchanges appeared first on CryptoPotato.

You May Also Like

Trump dealt another major ICE setback by a judge he appointed

Last Rites’ Is New On Streaming This Week