Altcoin season on the way? Ethereum accelerates while Bitcoin Dominance is at a crossroads

Ethereum sets the pace again. After weeks of consolidation, ETH has made a decisive rise, returning to touch the psychological threshold of $4900. Traders’ attention is now focused on Bitcoin dominance, which has fallen below 58%, a level that could pave the way for a possible rally for altcoins. The question is inevitable: are we on the verge of a new altcoin season or is it just a temporary rebound?

Figure 1 – Bitcoin dominance falls below 58%

Figure 1 – Bitcoin dominance falls below 58%

Ethereum leads the market: has the altcoin rally begun?

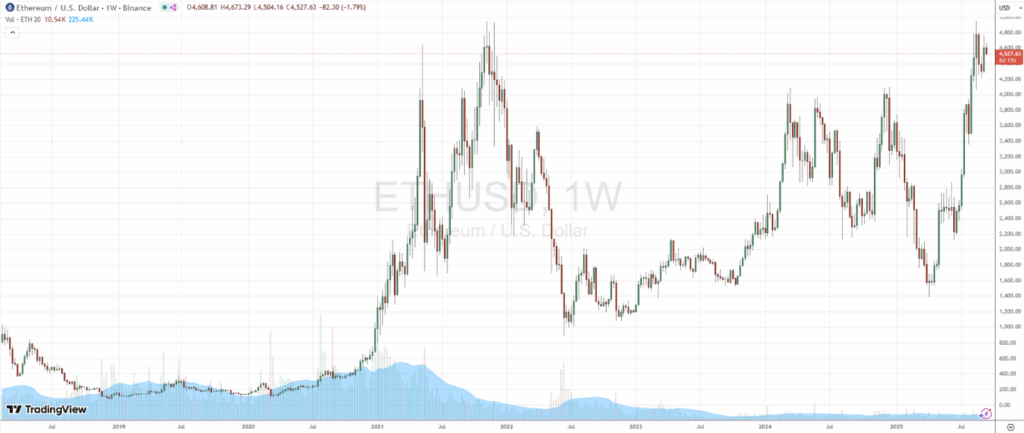

The recovery of Ethereum is not a matter of chance. In recent weeks, the price has broken upward through a resistance that had blocked every attempt to restart for months. This breakout has generated a significant increase in volumes, a signal that the market was waiting for the right moment to re-enter. The technical movement has been accompanied by solid fundamental factors: the supply of ETH continues to decrease thanks to staking, which holds an increasingly higher share of tokens out of the market, and network upgrades that are making the ecosystem more scalable and cost-effective for users.

Figure 2 – ETH/USD Chart: Ethereum breaks resistance and accelerates

Figure 2 – ETH/USD Chart: Ethereum breaks resistance and accelerates

The sentiment of institutional investors has also contributed to the rally. Rumors about the possible approval of new spot ETFs on some altcoins, in addition to those on ETH, have fueled optimism, while on-chain data highlights accumulations by whale wallets, a signal that usually precedes further upward movements. All these elements have brought Ethereum back into the spotlight, giving momentum to the altcoin sector.

Bitcoin dominance is at a crossroads

Parallel to the ETH rally, the dominance of Bitcoin recorded a decline, falling below 58% for the first time after months of stability. This indicator, which measures the share of BTC capitalization relative to the total crypto market, is one of the most watched thermometers by analysts because it provides an immediate overview of where capital is heading.

Historically, when Bitcoin dominance decreases, altcoins begin to outperform. This happens because investors, after consolidating positions on BTC, start seeking higher returns in cryptocurrencies with greater volatility, giving rise to genuine altcoin seasons.

Another significant signal comes from the ETH/BTC pair, which measures the relative strength of Ethereum compared to Bitcoin. In recent days, the ratio has recorded a breakout from a long consolidation channel, suggesting that ETH is not only growing in dollars but is also gaining ground against BTC. This type of movement is particularly relevant: when ETH/BTC rises, it means that capital is shifting towards the Ethereum ecosystem, a signal that often precedes a broader rotation towards altcoins.

The current situation is therefore one of unstable equilibrium: the combination of declining dominance and rising ETH/BTC strengthens the narrative of a possible altcoin season, but a potential rebound of BTC could quickly overturn the scenario. The coming weeks will thus be crucial to understand which of the two scenarios will prevail.

Figure 3 – ETH/BTC Chart: ETH gains ground against BTC, possible signal of alt season.

Figure 3 – ETH/BTC Chart: ETH gains ground against BTC, possible signal of alt season.

Macroeconomics and Liquidity: Favorable Winds for Altcoins?

The current movement fits into a macroeconomic context that is becoming more favorable. Expectations of a loosening of monetary policies, with possible rate cuts by central banks, are bringing investors back to riskier assets, including cryptocurrencies. On the regulatory front, there are also signs of greater clarity, with more open discussions on spot ETFs and guidelines for exchanges, factors that improve market confidence.

Data on inflows into index funds indicates a renewed interest not only in Bitcoin but also in Ethereum and layer 2 solutions, suggesting that the new incoming liquidity is not limited to BTC but is being distributed across the entire ecosystem. For DeFi, this can translate into an increase in Total Value Locked (TVL) and an expansion in the use of stablecoins and lending protocols, as well as greater experimentation and new growth opportunities for emerging projects.

But the macroeconomic picture alone does not fully explain Ethereum’s recent momentum: there is a factor gaining importance that could become a decisive accelerator. It is the tokenization of real world assets (RWA), meaning real-world assets represented on the blockchain in the form of tokens. In this scenario, ETH emerges as a leading platform, thanks to its widespread use in DeFi applications and the robust ecosystem that offers infrastructure, security, and liquidity, but Solana, BNB chain, and Tron are also making significant strides in the sector.

A recent example is XStocks, the tokenized stocks product by Backed Finance, which has officially launched over 60 stock titles on the Ethereum network, including names such as Nvidia, Amazon, Tesla, Meta, and Walmart. The decision to move to Ethereum (a network that already holds a very significant TVL) is not coincidental: it offers access to a wide base of DeFi users and leverages the mature smart contract infrastructure.

This trend confirms that investors and projects are no longer looking solely at the speculative return of crypto assets, but also at the possibility of creating new markets for tokenized real assets, with lower entry barriers, greater transparency, and interoperability. Ethereum, being already well-established, is in a prime position to benefit from this expansion.

From the perspective of the relationship between ETH and BTC, tokenization represents an additional strength factor for Ethereum. The constant increase in volumes and interest towards real tokenized assets on its network helps to consolidate ETH not only as a speculative tool but as an infrastructural platform with concrete use value. In this perspective, every new tokenization initiative strengthens the narrative of Ethereum as a structural alternative to Bitcoin and as a pillar of the on-chain economy, making it less dependent on short-term speculative dynamics alone.

However, risks are not lacking: the regulatory framework remains uncertain; issues related to the legal rights of tokenized shareholders, such as voting rights or ownership, are not always clear; the security of smart contracts and the transparency of the tokenization process are elements that can make a difference, and any negative episode could undermine market confidence.

Conclusion: altcoin season or just fleeting enthusiasm?

Ethereum is showing technical and narrative strength, and the declining Bitcoin dominance leaves room for the idea that a new altcoin season might be on the horizon, but it should not be forgotten that the market remains extremely volatile and sensitive to macroeconomic events.

For those operating in the sector, the moment is interesting but requires discipline. The best approach might be to follow confirmation signals before increasing exposure to altcoins and maintain a balanced portfolio, ready to adapt to sudden changes. The coming weeks will be decisive in understanding whether it is a new bull cycle or just a rebound before a further consolidation phase.

See you next time and happy trading!

Andrea Unger

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

QNT Technical Analysis Jan 21