CleanSpark Secures $100M Bitcoin-Backed Loan from Coinbase Prime for Expansion

TLDR

- CleanSpark shares gained 5% after announcing $100M Bitcoin-backed loan from Coinbase Prime

- The company will use its BTC holdings as collateral to fund mining, high-performance computing, and energy portfolio expansion

- This brings total Bitcoin-backed financing from Coinbase Prime to approximately $300M

- CleanSpark recently posted record quarterly revenue of $198.6M

- The company mined 657 BTC in August, a 37.5% increase year-over-year

CleanSpark, a Bitcoin mining company, saw its stock price rise by 5% in after-hours trading following the announcement of a $100 million financing deal with Coinbase Prime. The company revealed the news on Monday, stating it would use a portion of its 13,000 Bitcoin holdings as collateral for the loan.

The Bitcoin mining firm plans to use the capital to expand its Bitcoin mining operations, high-performance computing (HPC) capabilities, and energy portfolio. This strategic move comes as the company looks to diversify and strengthen its position in the market.

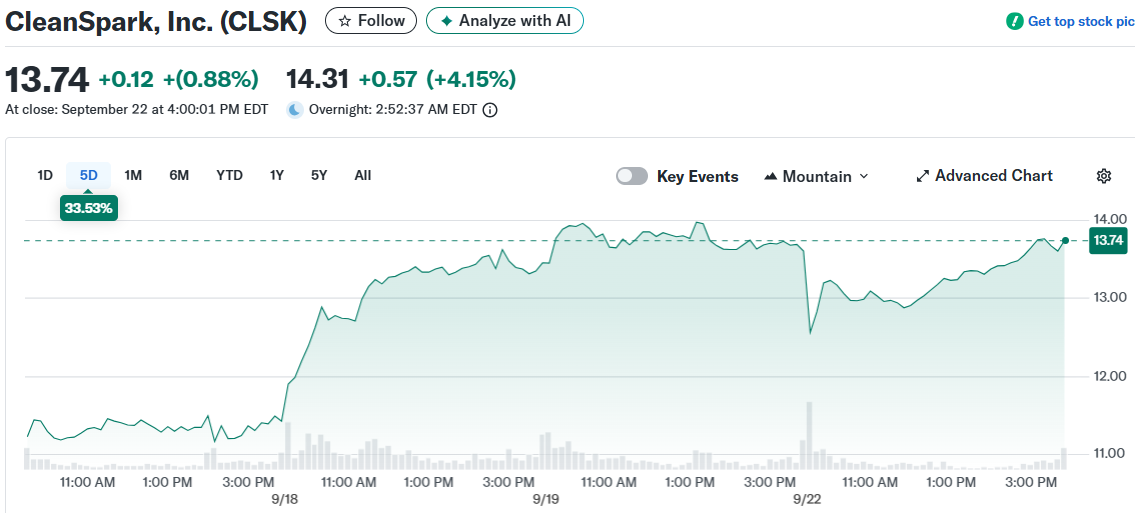

CleanSpark shares closed at $13.74 on September 22 before climbing to $14.44 in after-hours trading after the announcement was made public. This price movement shows investor confidence in the company’s expansion plans.

The $100 million loan is part of an ongoing partnership with Coinbase Prime. To date, CleanSpark has secured approximately $300 million in Bitcoin-backed financing through this relationship.

Harry Sudock, CleanSpark’s chief business officer, explained the company’s approach in an interview with Cointelegraph. “We’re not really thinking about it in terms of a ratio across the portfolio. What we’re really looking to do is maximize the value of every asset,” he said.

Strategic Diversification

Sudock emphasized that versatility is a key component of CleanSpark’s strategy. The company believes this approach will help them compete effectively in the years ahead.

“There are portions of our power pipeline that might not be a good fit for Bitcoin mining, but would be a phenomenal fit for high-performance computing,” Sudock stated. He added that having both capabilities within their skill set would create larger growth opportunities than focusing on just one area.

The company joins several other major Bitcoin mining firms that have pivoted toward AI and high-performance computing in recent years. However, CleanSpark appears to be pursuing a balanced approach rather than shifting focus entirely.

Sudock highlighted that the company is being selective about which Bitcoin they use as collateral. “We’re holding nearly 13,000 Bitcoin on the balance sheet. And we want to make that Bitcoin go to work for us and for our shareholders,” he explained.

Record-Breaking Performance

The financing announcement follows CleanSpark’s best quarter in company history. The firm reported record revenue of $198.6 million for the third quarter, showing strong financial performance.

CleanSpark’s mining operations have also been growing steadily. In August, the company mined a total of 657 Bitcoin, representing a 37.5% increase compared to the same month in 2023.

CleanSpark, Inc. (CLSK)

CleanSpark, Inc. (CLSK)

This production growth and the new financing deal position CleanSpark to continue expanding its operations across mining, computing, and energy sectors. The company appears to be leveraging its Bitcoin holdings effectively to fuel future growth without liquidating its entire position.

The $100 million loan demonstrates how Bitcoin mining companies are finding new ways to access capital using their cryptocurrency holdings. This approach allows firms like CleanSpark to expand operations while maintaining exposure to potential Bitcoin price appreciation.

CleanSpark’s strategy of using Bitcoin as collateral rather than selling it outright may appeal to investors who want exposure to both Bitcoin and traditional equity markets. The company’s stock price increase suggests that investors view this approach favorably.

The Bitcoin mining industry continues to evolve, with companies like CleanSpark exploring hybrid models that combine mining operations with other computing and energy initiatives. This diversification may help these firms weather Bitcoin’s price volatility and adapt to changing market conditions.

The post CleanSpark Secures $100M Bitcoin-Backed Loan from Coinbase Prime for Expansion appeared first on Blockonomi.

You May Also Like

XRP Price Prediction: Ripple CEO at Davos Predicts Crypto ATHs This Year – $5 XRP Next?

What Is Jawboning? Jimmy Kimmel Suspension Sparks Legal Concerns About Trump Administration