Can SUN Price Hit $0.01? Sun Token Shows No Signs of Slowing Down?

SUN crypto surges higher as Justin Sun pledges perpetual buybacks – raising a fresh question: can momentum hold above $0.3 and push toward new cycle highs?

Sun Token (SUN), the governance coin of TRON’s DeFi hub SUN.io, surged on Sept. 22, after founder Justin Sun confirmed that revenue from a new perpetual exchange will be used to buy back the token.

SUN traded between $0.034 and $0.035 over the past day, with 24-hour volume near $950M and a market capitalization of around $656M. The session’s range extended from $0.0258 to $0.0412, marking a gain of more than +22%.

(Source: Coinmarketcap)

The move followed the official launch of SunPerp, a TRON-based perpetuals DEX that promoted “the lowest trading fees in the market” and emphasized its revenue-to-buyback model.

A press release on Monday said: “The $SUN token will be further empowered, with SunPerp’s revenue used to buy back $SUN to strengthen its value and stability.”

The structure means every dollar of exchange revenue will be directed toward purchasing SUN on the open market, effectively tying token demand to trading activity.

According to Justin Sun’s X post, SunPerp will allocate 100% of protocol income to buybacks to reduce circulating supply and reinforce value capture within the SUN.io ecosystem.

Can SUN Maintain Momentum Above $0.03 After the Liquidation Spike?

According to Coinglass data, the SUN token has faced a sharp wave of liquidations over the past few days, with both long and short positions hit.

(Source: Coinglass)

As the token pushed past $0.03, it saw its strongest rally in months, and liquidations surged above $1.5M.

Although there had been little activity in previous sessions, the breakout prompted a series of short squeezes and long wipeouts.

As leveraged trades continue to unwind, the move highlights the increasing volatility in SUN.

The $0.03 level will be a crucial indicator of whether the token can maintain momentum or reverse recent gains.

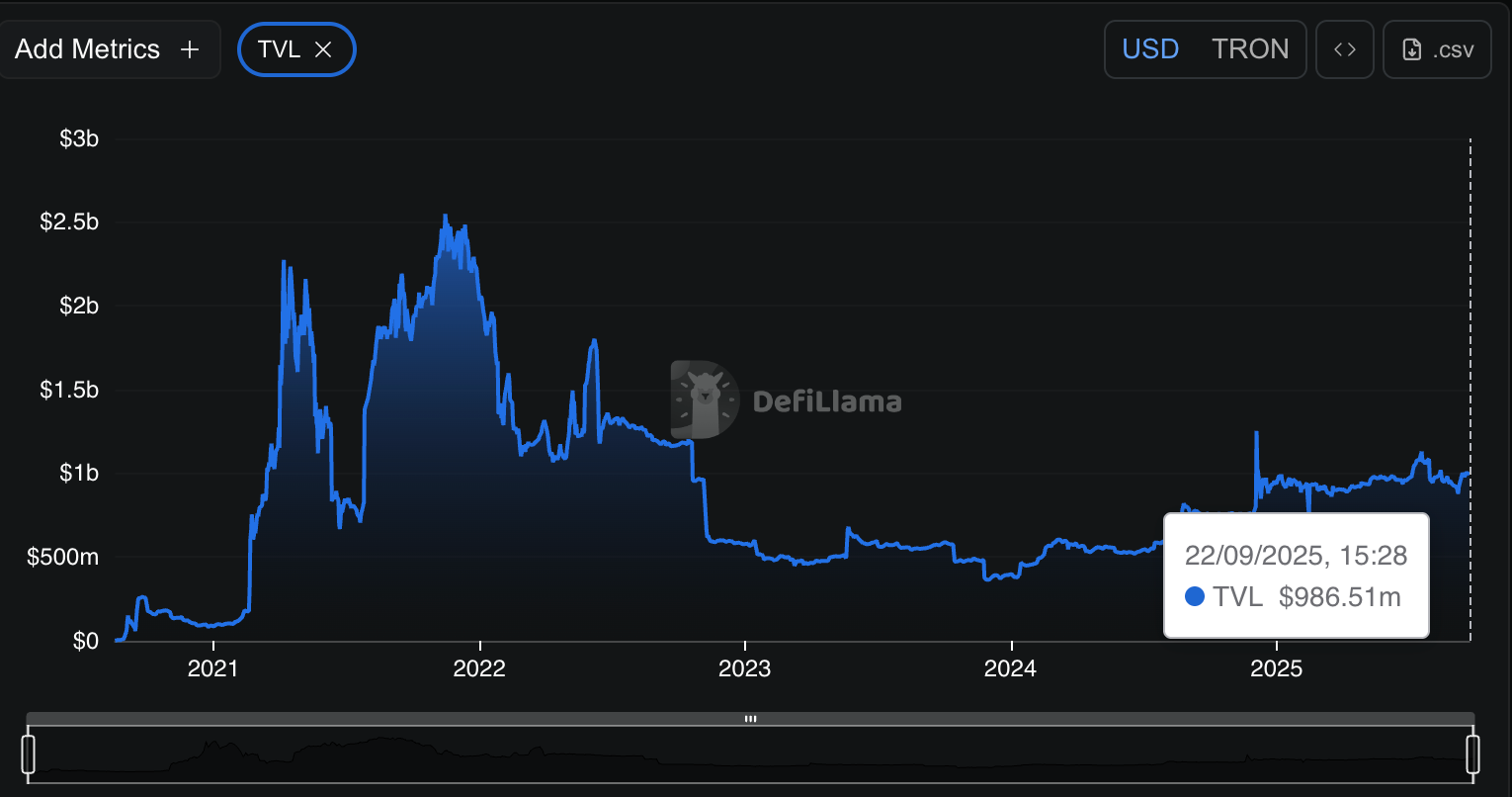

According to DeFiLlama, Sun’s total value locked (TVL) is $986.5M as of September 22.

(Source: DefiLlama)

That figure is far below the $2.5Bn peak in 2021-2022, but above the 2023 low of under $500M.

Despite less market activity than previous highs, TVL has maintained a stable user base over the past year, circling the $1Bn mark with few fluctuations.

Sun still plays a significant role in DeFi even though it has lost much of its previous dominance.

Read More: Will TradFi Kill BTC USD Volatility? Lessons From Forex?

SUN Price Prediction: What Does the Surge in Trading Volume Mean for SUN’s Price Action?

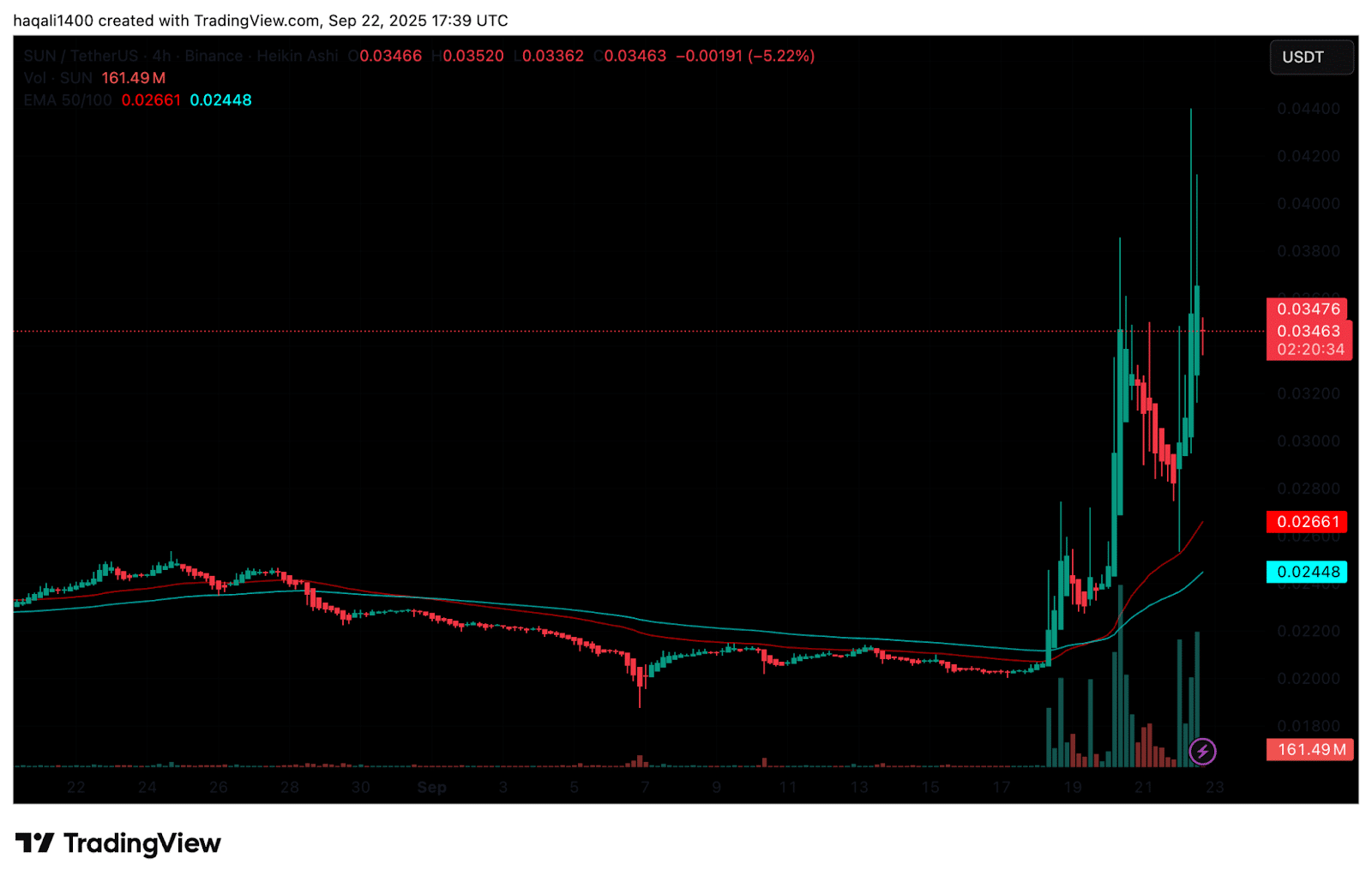

Sun (SUN USDT) has made a significant recovery on the 4-hour chart, after a period of weak performance that started in late August.

(Source: SUN USDT, TradingView)

After weeks of trading under $0.02, the token burst into action on September 18, pushing through key moving averages and drawing new interest from traders.

The breakout lifted SUN above the 50- and 100-period exponential moving averages ($0.02448 and $0.02661), turning them into short-term support.

Prices then surged past $0.04 before settling near $0.034 at the time of writing. Trading volume jumped to more than $161M, a sharp rise highlighting renewed speculative activity.

The rally has come with volatility. Candles show long wicks on both sides, indicating heavy buying and quick profit-taking.

Immediate support sits near $0.03, which buyers defended during the last pullback. If that floor holds, bulls may push for another test of $0.04.

Still, the sharp climb also raises caution. The rejection above $0.04 shows that profit-taking is already in play. A drop below $0.03 could see SUN sliding back toward the $0.026-$0.028 zone, where the moving averages cluster.

For now, momentum favors the bulls. The key question is whether SUN can hold above $0.03 in the coming sessions, or if volatility sends the token into another round of correction.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

The post Can SUN Price Hit $0.01? Sun Token Shows No Signs of Slowing Down? appeared first on 99Bitcoins.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

Bank of Canada cuts rate to 2.5% as tariffs and weak hiring hit economy