Solana, Worldcoin, and Trump among $517m unlocks this week: Here’s how to profit

The Solana price faces pressure with an unlock worth $116 million, while Worldcoin will unlock $53 million worth of tokens.

- Solana, Worldcoin, and AVAX are among the tokens facing major unlock events this week

- 1.52% of all TRUMP token circulating supply will be hitting the markets

- Minor tokens like PARTI, Nillion, and MetaBank Global will see extreme unlock events

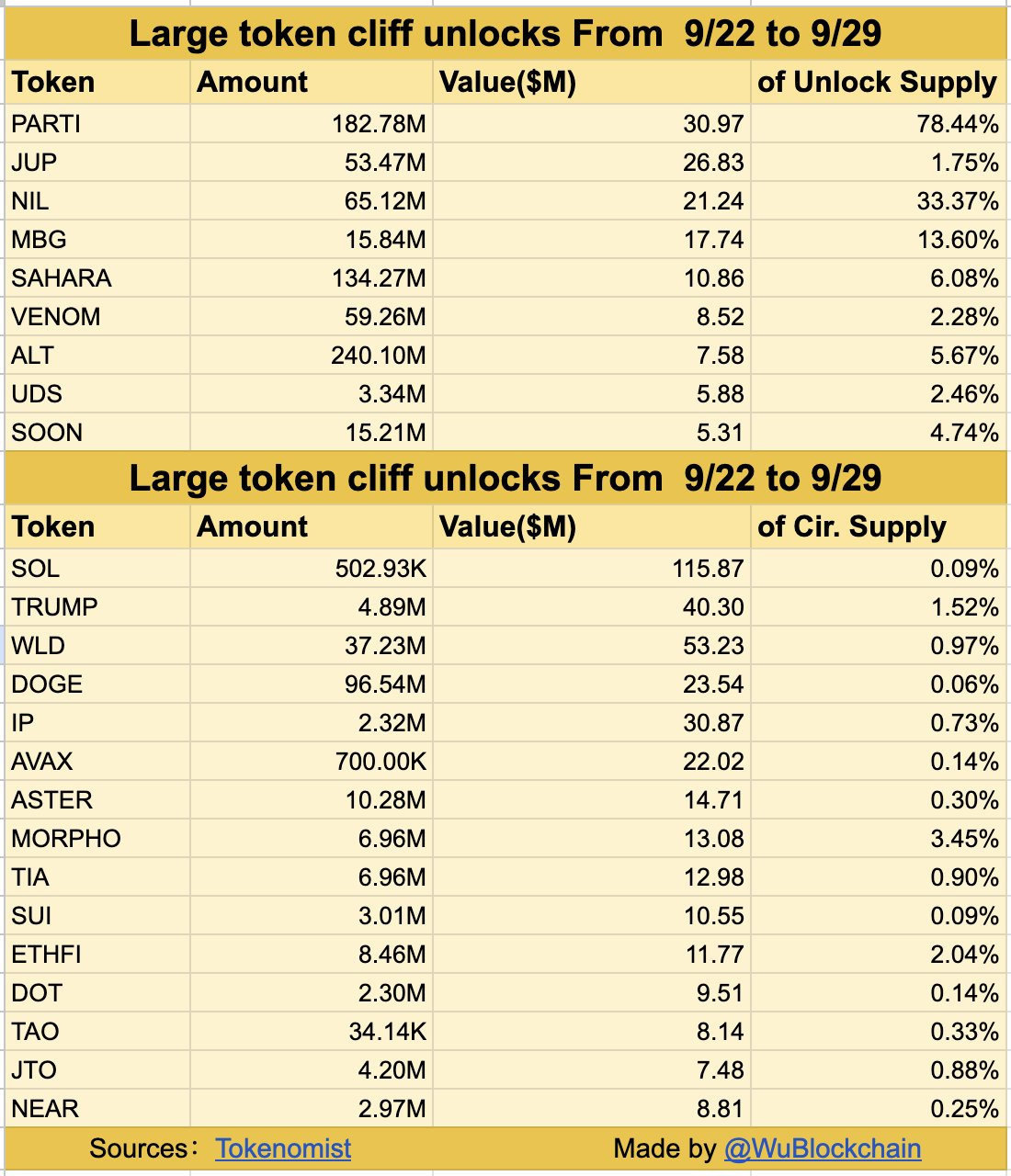

Crypto markets are facing a potential increase in selling pressure as major altcoins unlock millions worth of new tokens. In the week starting on September 22, more than $517 million in locked tokens will hit the market, according to data from Tokenomist.

Several minor tokens will likely be impacted the most. This includes Particle Network, Nillion, and Multibank Group. The DeFi platform Particle Network’s token will see the most extreme event on September 25, with $34 million in PARTI tokens unlocked. Since this represents 78.44% of the supply, there will likely be significant downward pressure on the price.

Moreover, the infrastructure token Nillion will unlock 65.12 million NIL on September 24, worth $21.4 million and amounting to 33.37% of its circulating supply. For the crypto platform Multibank Group, the September 22 unlock will release 13.60% of the circulating supply.

TRUMP, Solana, WLD among major players seeing unlocks

Among the major players in the lineup are Solana (SOL), Official Trump token (TRUMP), Wordcoin (WLD), Dogecoin (DOGE), Celestia (TIA), and more. Solana will see an unlock of 502,930 SOL, worth about $115.9 million. While this represents just 0.09% of the circulating supply, the sheer value of the unlock makes it worth watching.

On the other hand, 4.89 million Official Trump tokens will enter circulation this week, worth about $40 million. This could have a more significant impact, as these tokens represent 1.52% of the TRUMP token’s circulating supply. Celestia will also likely face significant price pressure, with 0.9% or $13 million in tokens unlocked.

How to profit from token unlocks

Major token unlocks often prompt traders to short, especially in the case of small-cap tokens. However, shorting is inherently risky due to the lack of a cap on potential losses. What is more, the markets may already have accounted for the unlocks, and the teams may announce lockup extensions, leading to a short squeeze.

A safer alternative may be to buy the post-unlock dip. As the dip is likely, traders who believe in the project may benefit from a temporary drop in prices. However, jumping too early may cause further losses, and there is no guarantee that projects will recover after insiders and whales start selling.

Traders can also rotate into altcoins that will not face token unlocks in that particular week to hedge themselves. However, if unlocks are priced in, this strategy may underperform compared to simple long-term holding.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

Bank of Canada cuts rate to 2.5% as tariffs and weak hiring hit economy