ETF Inflows Could Push Bitcoin to $150,000 by December—And Fuel Explosive Growth in the Meme Presale

Big Money Is Pouring Into Bitcoin ETFs

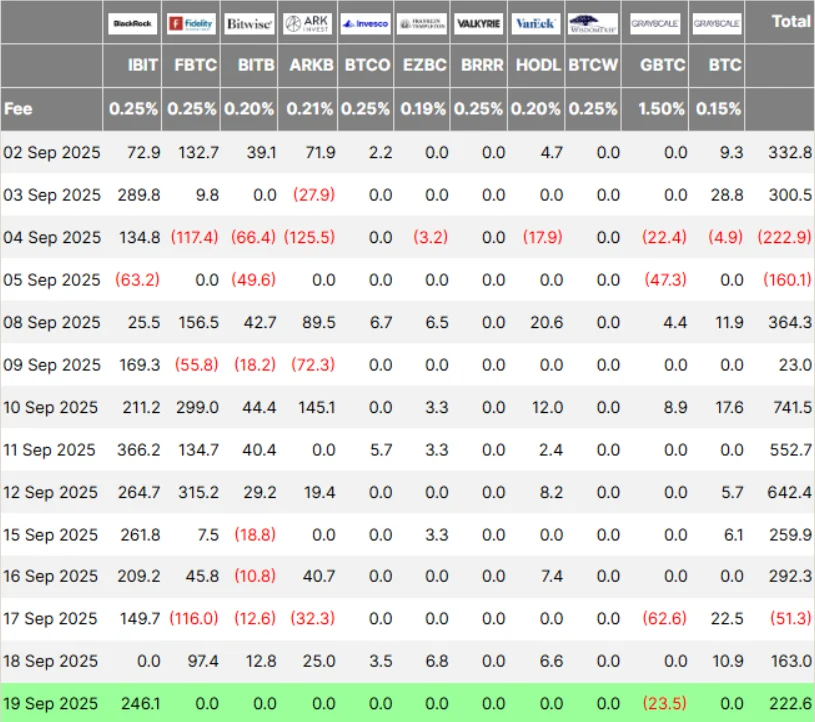

Recent weeks have seen a surge of institutional interest in Bitcoin via ETFs. U.S. spot Bitcoin ETFs recorded over $2.3 billion in inflows as of mid-September, marking one of the strongest weeks on record. Analysts point to this influx, combined with expectations of Federal Reserve rate cuts and favorable macroeconomic signals, as the key catalysts driving forecasts that BTC could reach $150,000 by December.

In short, the institutional pipeline is pushing Bitcoin’s liquidity, price momentum, and investor sentiment upward—creating tailwinds for those who get in early.

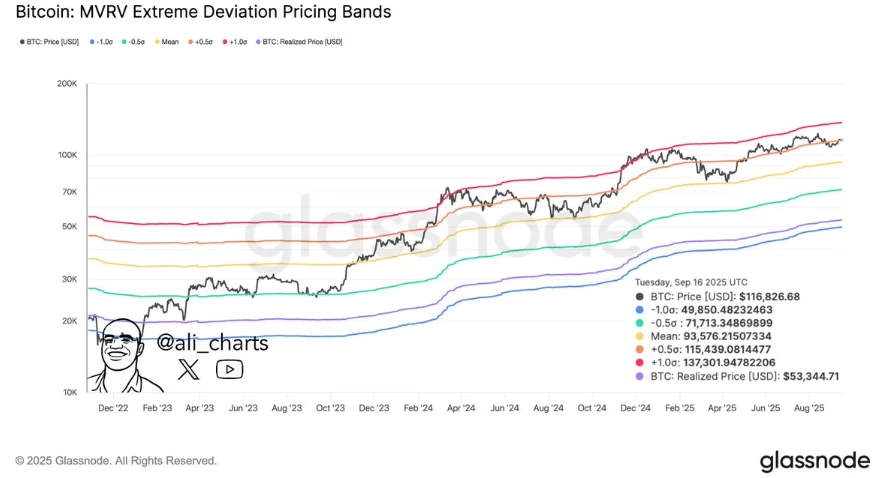

Bitcoin Price Prediction

Why $150K Is Looking Possible to Achieve

Several technical and macro indicators are aligning in favor of a BTC rally:

- ETF fund flows are not only large, but they’ve shown consistency—suggesting institutional buyers believe in longer-term price gains.

- Analysts point to historical Q4 rallies in Bitcoin, where favorable rules, demand, and rate cuts contribute to big upside.

- Key support levels near $115,000–$120,000 are being maintained, and resistance levels are being tested. If these breakouts hold, many models suggest $150,000 or higher becomes realistic through December.

Bitcoin ETF Inflow | Source: Farside Investors, X

MAGAX: Positioned to Benefit from the BTC Surge

While Bitcoin soaks up institutional capital and headlines, presale projects that are built well stand to gain disproportionately. Enter MAGAX—a Meme-to-Earn presale that offers early investors a chance to ride the same macro wave with much higher leverage.

Here’s how MAGAX could benefit if Bitcoin makes its push toward $150,000:

- Correlation of Investor Sentiment

As Bitcoin rises, more investment flows tend to spill over into altcoins and presales. Investors who see the BTC rally often look for high-risk, high-reward projects for bigger returns. MAGAX is well placed to capture that overflow interest. - Scarcity and Presale Stage Timing

MAGAX’s presale is in Stage 2, where tokens are still priced low but demand is heating up. As institutional money drives BTC upward, presales like MAGAX often see rising entry costs. Early entry means much better upside potential before price increases. - Utility + Fairness Toolkit

MAGAX isn’t just another meme coin. It integrates tools like Loomint AI, which rewards genuine engagement and helps prevent fake or inflated metrics. It also has a CertiK audit, adding a layer of trust crucial in volatile environments. This kind of legitimacy matters when people are choosing which presales to trust.

What To Watch For Through December

- ETF Inflows & Regulatory Moves: If ETFs continue to receive regulatory green lights or generic listing standards expand, more capital could flow in faster. Significant inflows are already setting up BTC for a big macro run.

- Key Price Levels: Maintaining support above $115,000 and breaking resistance at $120,000 will signal strength. Failure to hold these could mean more sideways action or volatility.

- Presale Stage Transitions: For MAGAX, moving from Stage 2 to Stage 3 will likely raise prices. The earlier participants get in, the greater their multiplier potential.

This is The Time to Join MAGAX to See Exponential Growth In December

If $150,000 Bitcoin is more than just talk, then presales happening now are some of the best entry points of 2025. MAGAX is offering that precise opportunity: low price, credible audit, utility-driven design, and community energy.

Delaying presale participation often means buying in at higher stages, missing bonuses, or even waiting on the sidelines as momentum pushes downward unseen. Given the macro trend, each day counts.

Join MAGAX Stage 2 today to lock in against Stage 3 price rises and claim any presale bonuses available. Between large-scale ETF inflows, projected BTC gains, and your own presale leverage, the chance for major return is setting up now.

This article is not intended as financial advice. Educational purposes only.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

BlackRock Increases U.S. Stock Exposure Amid AI Surge

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse