Why Kinto’s K Token Collapsed Before Unlocking

Kinto (K) announced it is shutting down after failing to recover from a series of blows, including a $1 million debt burden and the lingering effects of a July exploit.

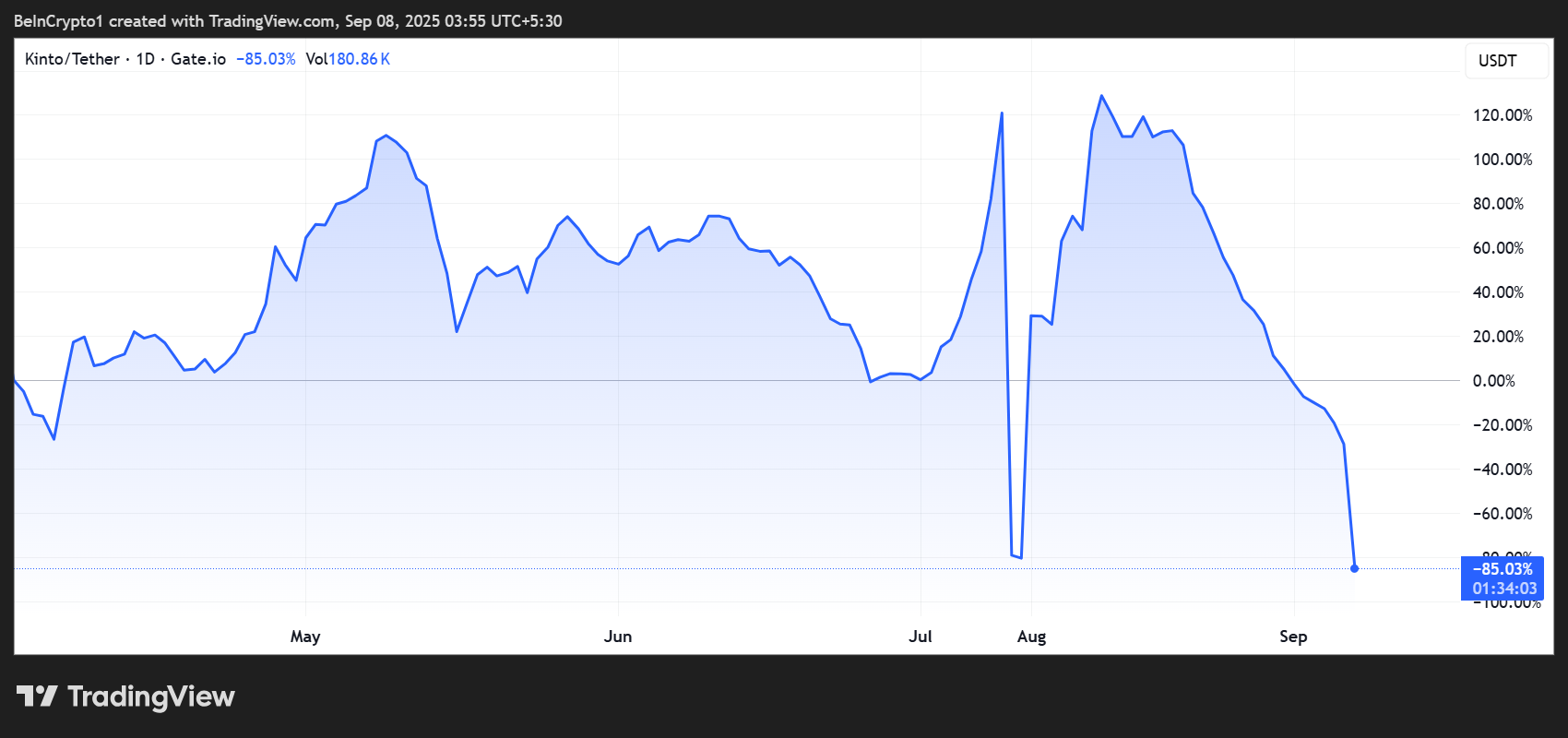

The news triggered a dramatic sell-off, with the K token plunging almost 85% in the past 24 hours.

Kinto Shuts Down: Everything Users Need to Know

The DeFi project revealed the decision in a statement posted to X (Twitter), conceding that it had exhausted every possible avenue to continue. With every effort proving unsuccessful, it is now conducting an orderly wind-down.

The project emphasized that users can still withdraw their assets until September 30. Meanwhile, Phoenix lenders will recover around 76% of their principal.

Morpho victims, who were hit hardest by the July exploit, can claim up to $1,100 each from a goodwill fund set up by the founder.

The project stressed that while its wallets, Layer-2 infrastructure, and core systems were never hacked, the July CPIMP proxy exploit drained 577 ETH. Reportedly, this compelled Kinto to raise debt in a desperate attempt to recover.

The incident caused the K price to drop by over 90% on July 10. Since the announcement to shut down, the Kinto ecosystem’s powering token has decreased by over 85%.

Kinto (K) Price Performance. Source: TradingView

Kinto (K) Price Performance. Source: TradingView

Market conditions, combined with the new liabilities, ultimately killed its chances of further fundraising.

What Users Need To Do Amid Withdrawal Difficulty

The sudden closure has sparked backlash from some users, with some slamming the Ethereum L2 for winding down after making money.

However, Kinto insists that neither the team nor investors had unlocked a single token, disputing the idea that the shutdown was a rug pull.

Other users call for leeway to withdraw their assets, so Kinto urged users to submit requests for assistance to customer support.

Security researchers are reportedly still tracing the stolen 577 ETH, with Kinto pledging that any recovery will first go to the victims.

A perpetual claim contract is also expected to handle outstanding withdrawals and repayments in early October.

Against this backdrop,Kinto has begun consolidating roughly $800,000 of the remaining assets into a Foundation SAFE. Allegedly, all funds are earmarked to repay creditors and victims.

Despite the wind-down, the project also confirmed that the pending ERA crypto airdrop will still be distributed in October.

While Kinto insists it is shutting down responsibly, the collapse is a stark reminder of the fragility of early-stage DeFi projects.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Your Crypto Companion: Navigating the Fast-Paced Digital Market