From 1 ETH to 30 ETH—Why Ozak AI Presale Could Deliver a Massive Flip

The post From 1 ETH to 30 ETH—Why Ozak AI Presale Could Deliver a Massive Flip appeared first on Coinpedia Fintech News

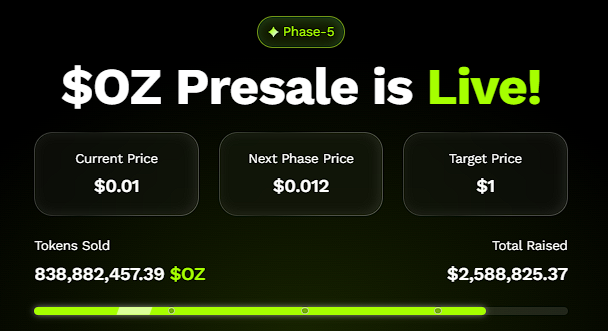

Ozak AI is emerging as one of the most explosive presales in the crypto market, capturing attention from both retail and institutional investors. Currently in its 5th presale stage, priced at just $0.01 per token, Ozak AI has already raised over $2.5 million and sold more than 830 million tokens.

The hype surrounding this AI-powered project stems from its unique mix of cutting-edge technology, strong tokenomics, and the potential to replicate the parabolic success once seen with early Ethereum, Solana, and meme coin investors. Analysts now suggest that a modest entry of 1 ETH into the Ozak AI presale could realistically flip into as much as 30 ETH once the token lists on major exchanges.

Youtube embed:

Next 500X AI Altcoin

Why Ozak AI Stands Out in a Crowded Market

Crypto presales come and go, but few reveal the traction and basics that Ozak AI has showcased in such a quick time. While meme coins like Shiba Inu and Pepe surged on hype alone, Ozak AI combines community-pushed momentum with tangible utility. Its core proposition is the combination of artificial intelligence with blockchain to revolutionize crypto market predictions, giving traders data-driven insights that may enhance funding choices.

The project’s infrastructure is anchored by way of the Ozak Stream Network (OSN), a decentralized device designed to soundly ingest and process real-time market statistics. This powers Ozak AI’s Prediction Agents (PAs), customizable machines that get to know fashions that adapt to user techniques. The inclusion of AI-pushed forecasting equipment straight away differentiates Ozak AI from speculative initiatives and sets the project for long-term adoption.

OZ Presale Momentum Points to Explosive Growth

The OZ presale performance alone signals massive investor confidence. With over $2.5 million raised, Ozak AI has already surpassed many early-stage blockchain projects that later delivered outsized returns. Priced at only $0.01, the token offers an accessible entry point for investors seeking exponential gains. If Ozak AI were to mirror the trajectories of successful launches like Solana or Cardano, early presale buyers could be looking at returns well beyond 30x once listings and broader adoption kick in.

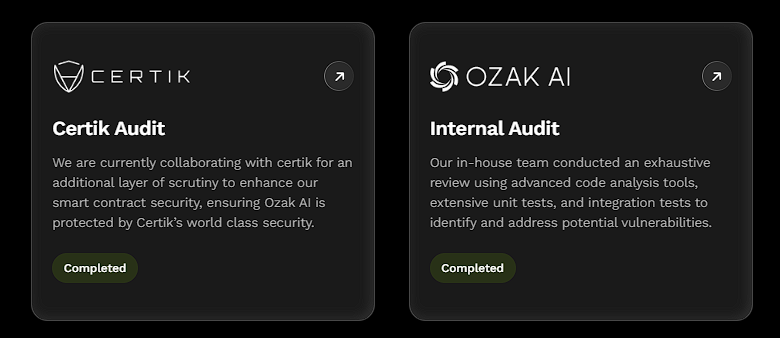

Furthermore, the project is taking transparency seriously. Ozak AI has undergone a Certik audit alongside internal audits, ensuring the platform’s smart contracts and architecture are secure. Early listings on CoinMarketCap and CoinGecko have also given it legitimacy and visibility, two crucial factors for building early momentum. This level of preparation before a token even launches is rare and underscores the team’s commitment to long-term success.

Comparing Ozak AI to Past Crypto Success Stories

History shows that the biggest flips in crypto often come from those who take early presale risks. Ethereum’s presale back in 2014 allowed early adopters to acquire ETH for less than $1—returns that turned small investments into millions. Solana, once trading below $1, reached nearly $260 at its peak, minting fortunes for early backers. Even meme coins like Shiba Inu saw early entrants turn modest amounts into millions through sheer price momentum.

Ozak AI sits at a similar crossroads but with an even stronger foundation. Unlike meme tokens, it is backed by utility in AI-driven crypto forecasting, partnerships in development, and a growing global community. This balance of speculative hype and functional utility makes it a rare opportunity in today’s market.

Why 1 ETH Could Become 30 ETH

At its current presale price of $0.01, Ozak AI presents a risk-reward ratio that heavily favors early investors. If the token launches even at a conservative $0.30, a 1 ETH investment today could turn into roughly 30 ETH. Given its strong presale numbers and increasing visibility, some analysts argue that even higher post-launch valuations are possible, making the potential returns even more compelling.

This forecast isn’t just about hype—it’s rooted in a clear roadmap. Ozak AI plans to expand its AI suite, launch prediction marketplaces, and scale its decentralized infrastructure, ensuring the token remains valuable long after its exchange debut.

Ozak AI is proving that the next big crypto opportunity doesn’t have to be just another meme coin—it can be a project with real-world utility, strong presale traction, and enormous upside potential. With its $0.01 presale price, over $2.5 million raised, and advanced AI-powered prediction tools, it offers investors a unique chance to secure early exposure before mainstream adoption drives prices higher. For those looking at presales that could deliver a game-changing flip, Ozak AI might be the project that turns 1 ETH into 30 ETH and cements itself as one of 2025’s most profitable investments.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides an innovative platform that focuses on predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized community technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto lovers and corporations make the perfect choices.

For more, visit

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

Jett Nisay, endorser of Marcos impeach complaint, is a public works contractor