USDT Is Coming To Bitcoin: Tether Unveils Launch Via RGB

Tether has announced USDT is set to see a launch on Bitcoin’s RGB protocol, allowing users to hold BTC and the stablecoin in the same wallet.

Bitcoin Users Will Have Native Access To USDT Via RGB Protocol

As revealed by Tether in a website announcement, its stablecoin USDT will be coming to the RGB protocol. RGB allows users to create, send, and manage smart contracts directly on the BTC blockchain.

The protocol launched on the BTC mainnet in July with its 0.11.1 release. Thanks to this release, stablecoins, non-fungible tokens (NFTs), and community tokens are all now possible natively on the BTC network, just like on Ethereum and other newer blockchains.

Something to note is that RGB isn’t a network layer on top of Bitcoin. Rather, it makes use of only client-side validation to confirm transactions. “RGB operates with no trusted third parties, no federations, no validators, and no coordinators,” said RGB Hub in the 0.11.1 launch announcement.

USDT is the largest stablecoin in the cryptocurrency sector, circulating on a slew of networks, and with Tether’s latest move, the token would finally become accessible to users of the original digital asset, Bitcoin.

Tether noted in the press release:

So far, the stablecoin issuer hasn’t confirmed any date, but once launched, users will be able to hold and transfer both BTC and USDT directly from the same wallet. Paolo Ardoino, Tether CEO, said:

In some other news, the Bitcoin spot exchange-traded funds (ETFs) have seen their largest drawdown from the all-time high (ATH) since April, as CryptoQuant community analyst Maartunn has pointed out in an X post.

As displayed in the above chart, the spot ETFs currently have their holdings around $813.9 million down since the peak. These latest outflows have occurred alongside BTC’s price decline.

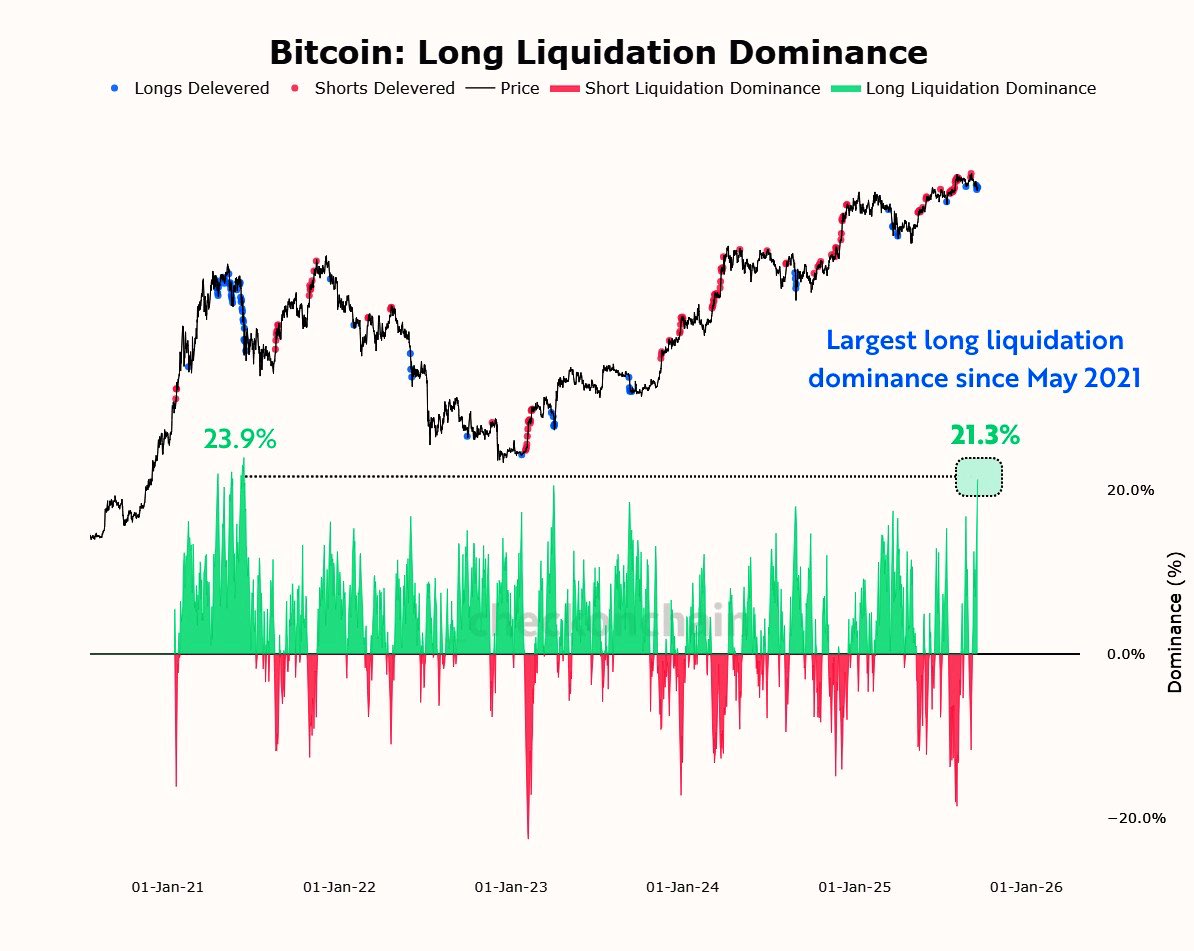

Another thing that has come with the drawdown in the cryptocurrency is a surge in long liquidations. As quant Frank has noted in an X post, long liquidations recently hit their highest level of dominance in four years.

The last time that long liquidations were this dominant was in May 2021. Back then, bulls were flushed by a massive crash in the Bitcoin price that put the bull run on pause for a few months.

BTC Price

Bitcoin has slowly been climbing up since its low earlier in the week as its price has now reached the $112,400 mark.

You May Also Like

Pi Network Maps 50M Coins Daily as Mainnet Tops 9B

FCA, crackdown on crypto