Digital Transformation in Insurance Industry Statistics 2026: Market Shift Now

The insurance industry has always been about managing risk and providing security. Today, the sector is undergoing an unprecedented digital transformation. Once reliant on manual processes and paper trails, insurance companies are now embracing new technologies that are redefining the way they operate.

The shift isn’t just about efficiency; it’s about survival in an increasingly competitive market. With the advent of artificial intelligence (AI), automation, and a greater focus on customer experience, insurers are leveraging these innovations to enhance services, cut costs, and provide better coverage to their clients.

Editor’s Choice

- Global insurance IT spending will reach $374.88 billion in 2026 and grow at an 11.1% CAGR through 2030.

- Worldwide IT spending will hit $6.08 trillion in 2026, rising 9.8% from 2025, largely driven by AI and digital initiatives.

- The global digital economy will expand to $28 trillion by 2026, accounting for about 22% of global GDP.

- U.S. insurance IT spending will total $173 billion in 2026, representing roughly 6% of total U.S. tech spending.

- Digital spending in the U.S. insurance market will surpass $14 billion in 2026, reflecting accelerated investment in AI and automation.

- The insurance IT spending market will grow to $514.51 billion by 2029, supported by increased telematics adoption and real-time fraud detection.

Recent Developments

- AI-generated systems now compose 50,000+ Allstate customer emails daily, increasing satisfaction and accelerating resolution times.

- Allstate’s cognitive agent Amelia manages over 250,000 monthly conversations and resolves about 75% of inquiries on first contact.

- U.S. insurance technology budgets will reach $173 billion in 2026, growing 7.8% year over year and accounting for 6% of total U.S. tech spending.

- Global technology spending will rise 7.8% to $5.6 trillion in 2026, driven by AI and cloud investments across industries, including insurance.

- Forrester expects cyber insurance premiums to increase by 15% in 2026 as AI-related risks expand.

- Automation and AI will reduce expense ratios by about 2 percentage points at leading insurers in 2026.

- IoT expansion will unlock a $1.1 trillion insurance premium opportunity by 2030, improving loss ratios by 20–40% and boosting retention by 15–25% through connected engagement.

- Leading carriers like Chubb now invest over $1 billion annually in technology to scale AI and automation capabilities.

Artificial Intelligence (AI) in the Insurance Market Growth

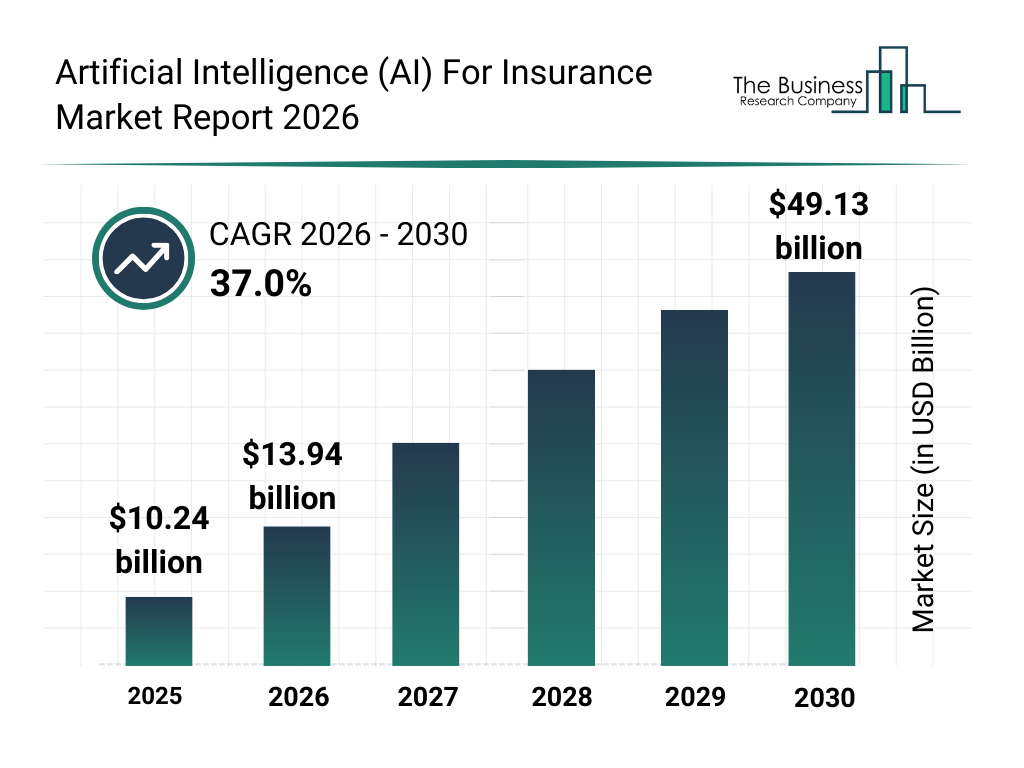

- The global AI in insurance market reached $10.24 billion in 2025, reflecting accelerating digital adoption among insurers.

- The market will grow to $13.94 billion in 2026, signaling strong early-stage expansion.

- By 2027, the market will reach approximately $19.1 billion, driven by automation and advanced analytics.

- Continued AI adoption will push the market to around $26.1 billion in 2028.

- Rapid scaling across underwriting, claims, and customer service will increase the market to roughly $35.6 billion in 2029.

- By 2030, the sector will hit $49.13 billion, highlighting substantial long-term growth potential.

- Overall, the market will expand at a 37.0% CAGR between 2026 and 2030, marking one of the fastest growth rates in insurance technology.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Key Insights on Barriers to Digital Transformation

- 23.87% of resistance is attributed to CEOs or boards, making them the top perceived blockers of digital transformation.

- Senior executive teams (excluding the CEO) account for 20.65% of perceived barriers to advancing digital initiatives.

- 20.65% of respondents report that no one is obstructing digital initiatives, indicating strong internal readiness in these organizations.

- Department heads represent 16.77% of resistance, underscoring the influence of mid-level leadership on transformation outcomes.

- Middle managers are cited by 11.61% of respondents as key obstacles, suggesting they are less frequently viewed as major hurdles.

- Only 6.45% of respondents see line employees as blockers, implying resistance is concentrated in upper and mid-level management layers.

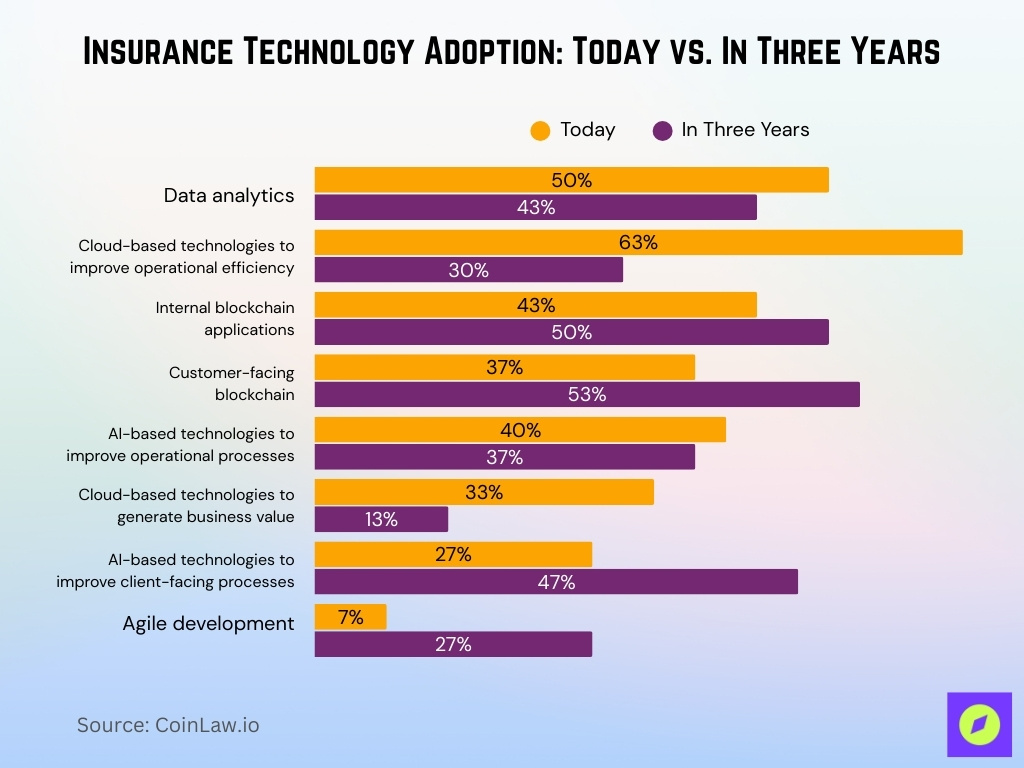

Insurance Technology Adoption: Today vs. In Three Years

- Data analytics is widely adopted today at 50%, but is expected to moderate to 43% in three years as focus shifts to advanced tools.

- Cloud technologies for operational efficiency lead current adoption at 63%, though usage may decline to 30% as systems mature.

- Internal blockchain applications are projected to grow from 43% today to 50%, reflecting increasing back-office integration.

- Customer-facing blockchain solutions show strong momentum, rising from 37% to 53%, signaling expanding real-world use cases.

- AI for operational processes remains relatively stable, moving slightly from 40% to 37% over the next three years.

- Cloud technologies for business value creation may drop significantly from 33% to 13%, indicating a shift toward more specialized innovations.

- AI for client-facing processes is expected to surge from 27% to 47%, highlighting growing investment in customer experience automation.

- Agile development adoption could nearly quadruple, climbing from just 7% today to 27%, reflecting the modernization of development practices.

(Reference: Accenture)

(Reference: Accenture)

Core System Modernization and Legacy System Challenges

- 68% of insurance companies are upgrading core systems to cloud-based platforms, boosting agility and market speed.

- Up to 70% of insurers’ IT budgets go to maintaining legacy systems, creating a heavy financial load.

- 41% of CIOs identify legacy systems as the primary obstacle to technological advancement.

- 67% of insurance executives view API strategy as vital for digital transformation and ecosystem integration.

- 71% of insurance executives see cloud investments as key to gaining a competitive edge.

- Policy IT costs rise by 41% on legacy platforms due to inherent inefficiencies.

How Digital Transformation Benefits Insurance Companies

- Digital claims processing reduces settlement times by 50%, streamlining operations and boosting efficiency.

- Cloud adoption increases agility, accelerating product development by over 50%.

- Mature CDP implementations yield 36% higher cross-sell rates and 28% better retention via partnerships.

- AI automation cuts claims costs by up to 30%, improving overall productivity.

- 70% of insurers are adopting usage-based policies for market adaptability.

Cybersecurity and Data Protection Challenges

- Global cyber insurance premiums are projected to reach $23 billion by the end of 2026 amid rising demand.

- Cyber insurance premiums are growing 15–20% annually, driven by escalating cyber threats.

- Cybercrime costs are estimated at $10.5 trillion annually by 2025, demanding robust cybersecurity.

- The average data breach cost in the finance and insurance sectors stands at $5.9 million.

- 75% of insurance firms are investing in advanced encryption to protect customer data.

Insurance Digitisation Index: Country Rankings

- United States leads with 88% digital insurance platform adoption, fueled by InsurTech and AI investments.

- Germany is second with 80% of insurers providing digital claims and AI chatbot services.

- Japan is third at 77% adoption, focusing on IoT for home and auto risk assessment.

- United Kingdom is fourth with 75% cloud platform migration for better efficiency.

- France is fifth at 70% fully digital policy management through mobile apps.

- India is sixth with 68% digitization rate via embedded insurance growth.

- Australia is seventh, as 65% integrate AI fraud detection tools.

Impact of Climate Risk on Insurance Models

- Global insured nat cat losses reached $108 billion in 2025, with weather events causing 97% of insured losses.

- Insured losses from nat cats are trending to $145 billion in 2025 amid secondary perils dominance.

- H1 2025 insured losses hit $100 billion, the second-highest on record, driven by US wildfires and storms.

- Palisades and Eaton wildfires caused $41 billion in insured losses, the costliest on record.

- Los Angeles wildfires generated $40 billion in insured losses from the Palisades Fire alone.

- Nonpeak perils like wildfires and floods drove record $98 billion insured losses in 2025.

Frequently Asked Questions (FAQs)

47% of all insurance policy purchases now happen through digital channels.

76% of US insurance executives have implemented generative AI in one or more business functions.

Digital claims processing reduces settlement times by 50%.

68% of insurance companies are upgrading their core systems to cloud-based platforms.

Conclusion

The insurance industry’s digital transformation is reshaping how insurers operate, engage with customers, and assess risks. Technologies such as AI, IoT, and blockchain are driving unprecedented efficiencies and cost savings, while cybersecurity and customer experience remain critical focuses. The rapid growth of embedded insurance and the integration of climate risk assessments highlight the industry’s adaptation to both technological advancements and global challenges. As we move forward, the continued digitization of insurance will be pivotal in determining the future success of the industry.

The post Digital Transformation in Insurance Industry Statistics 2026: Market Shift Now appeared first on CoinLaw.

You May Also Like

Today’s Biggest Crypto Movers: Winners & Losers

Altcoins Poised to Benefit from SEC’s New ETF Listing Standards