ETH Price Analysis: Adam and Eve Pattern Points to $2.5K, But $2,200 Is Key

Ethereum ETH $1 978 24h volatility: 0.5% Market cap: $240.20 B Vol. 24h: $18.80 B is showing potential signs of stabilisation following a strong decline in February, with price analysis indicators suggesting a reversal setup. ETH price is currently forming what analysts identify as an “Adam and Eve” bottom pattern near the $1,970 range. While short-term pressure persists, data suggests that if specific resistance levels are reclaimed, ETH could undergo a relief rally targeting $2,500.

ETH is now trading right above crucial support zones, and holding these levels is the necessary step to set up a potential run back. For now, it’s a red month.

EXPLORE: What is the Next Crypto to Explode in 2026?

Adam and Eve: Understanding the Technical Setup Underpinning ETH USD

The emerging market structure is centred on an Adam-and-Eve formation: a double-bottom pattern characterised by a strong, V-shaped rebound (Adam) followed by a broader, rounded consolidation (Eve). This setup typically indicates a shift from bearish distribution to accumulation. Despite Ether trading down approximately 20% in February, on-chain data reveals a divergence between price action and investor behaviour.

Accumulation addresses added over 2.5 million ETH in February, bringing total holdings in these wallets to 26.7 million. This aggressive buying behavior mirrors historical trends where smart money absorbs liquidity during capitulation events. While price remains suppressed, the fact that long-term holders are buying the dip provides fundamental support to the bullish technical thesis.

Ethereum Accumulation Wallets Source: CryptoQuant

The critical invalidation level for the Adam and Eve pattern sits at the local low of $1,909. If support at $1,970 fails to hold, analysts warn that the setup could break down, favoring the bearish continuity seen in the broader 2025-2026 market cycle.

DISCOVER: Best Solana Meme Coins By Market Cap 2026

ETH Price Analysis – Key Levels to Watch

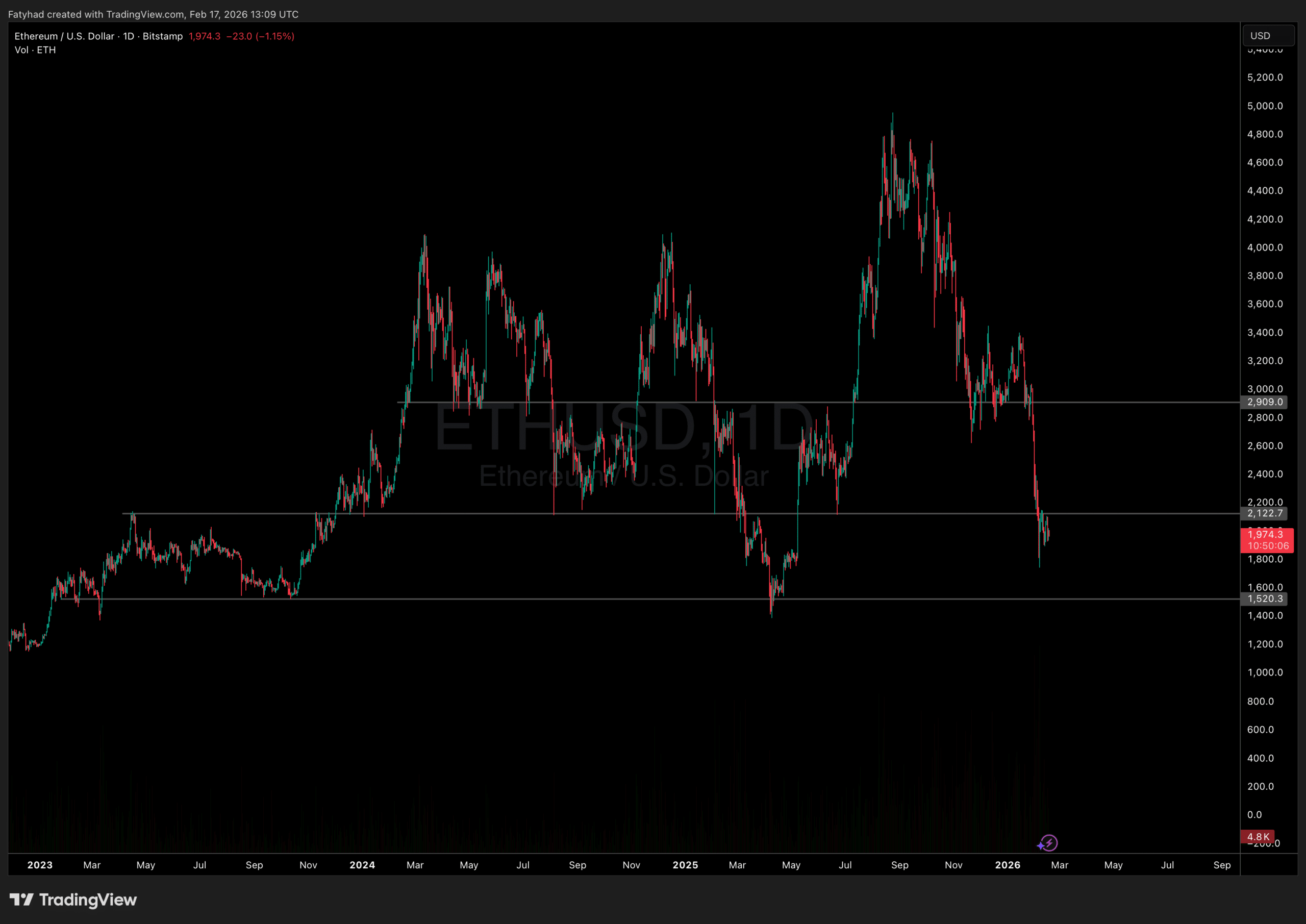

ETH Price Analysis Source: TradingView

Based on other price analysis, for the projected rally to happen, ETH needs to overcome its immediate resistance levels. Currently, it’s consolidating within a range of $1,970–$2,000 with weak momentum. Key support lies at $1,850–$1,900 while resistance is at $2,100–$2,200. Breaking the support could potentially allow for lower levels like $1500.

Derivatives data show significant short-term liquidation clusters stacked near $2,200. A decisive break above this level could trigger a short squeeze, propelling the price toward the technical pattern’s implied target of $2,500. Additionally, Open Interest (OI)has cooled significantly to $23 billion, resetting the leverage ratio and potentially reducing the risk of a long-squeeze cascade.

However, downside risks remain prominent. Recent reports indicate that a major Ethereum whale offloaded $543 million in ETH, adding supply pressure that challenges the bullish outlook.

Furthermore, the broader sentiment is complicated by structural debates within the ecosystem. As Vitalik Buterin addresses Layer 2 scaling narratives, investors are weighing Ethereum’s long-term utility against immediate price performance. A reclaim of the $2,200 level with rising volume would be the primary signal for trend reversal.

EXPLORE: 10 New Upcoming Binance Listings to Watch in February 2026

nextThe post ETH Price Analysis: Adam and Eve Pattern Points to $2.5K, But $2,200 Is Key appeared first on Coinspeaker.

You May Also Like

Will Crypto Market Rally or Face Fed Shock?

CME Group to Launch Solana and XRP Futures Options