Daily Market Update: Stock Futures Slide While Bitcoin Holds Steady as Markets Brace for Fed Data

TLDR

- Stock futures dropped Tuesday with S&P 500 futures declining 0.4% and Nasdaq 100 futures falling 0.7% as AI disruption concerns persist

- Bitcoin remained stable at $68,000 during light holiday trading while down nearly 50% from its October record high

- Federal Reserve policy uncertainty under Trump nominee Kevin Warsh has pressured both cryptocurrency and equity markets

- Major Bitcoin holders Strategy Inc and Metaplanet Inc disclosed substantial losses on their cryptocurrency investments

- Key inflation data and Fed meeting minutes scheduled for release this week will guide market direction

U.S. stock futures opened lower on Tuesday following the Presidents Day holiday weekend. S&P 500 futures fell 0.4% while Nasdaq 100 futures dropped 0.7%. Dow Jones Industrial Average futures decreased 0.3%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Technology stocks continued to face pressure from artificial intelligence disruption concerns. Multiple industries including wealth management, transportation, and logistics remain under scrutiny. The Nasdaq Composite recorded its fifth straight weekly decline on Friday, the longest streak since 2022.

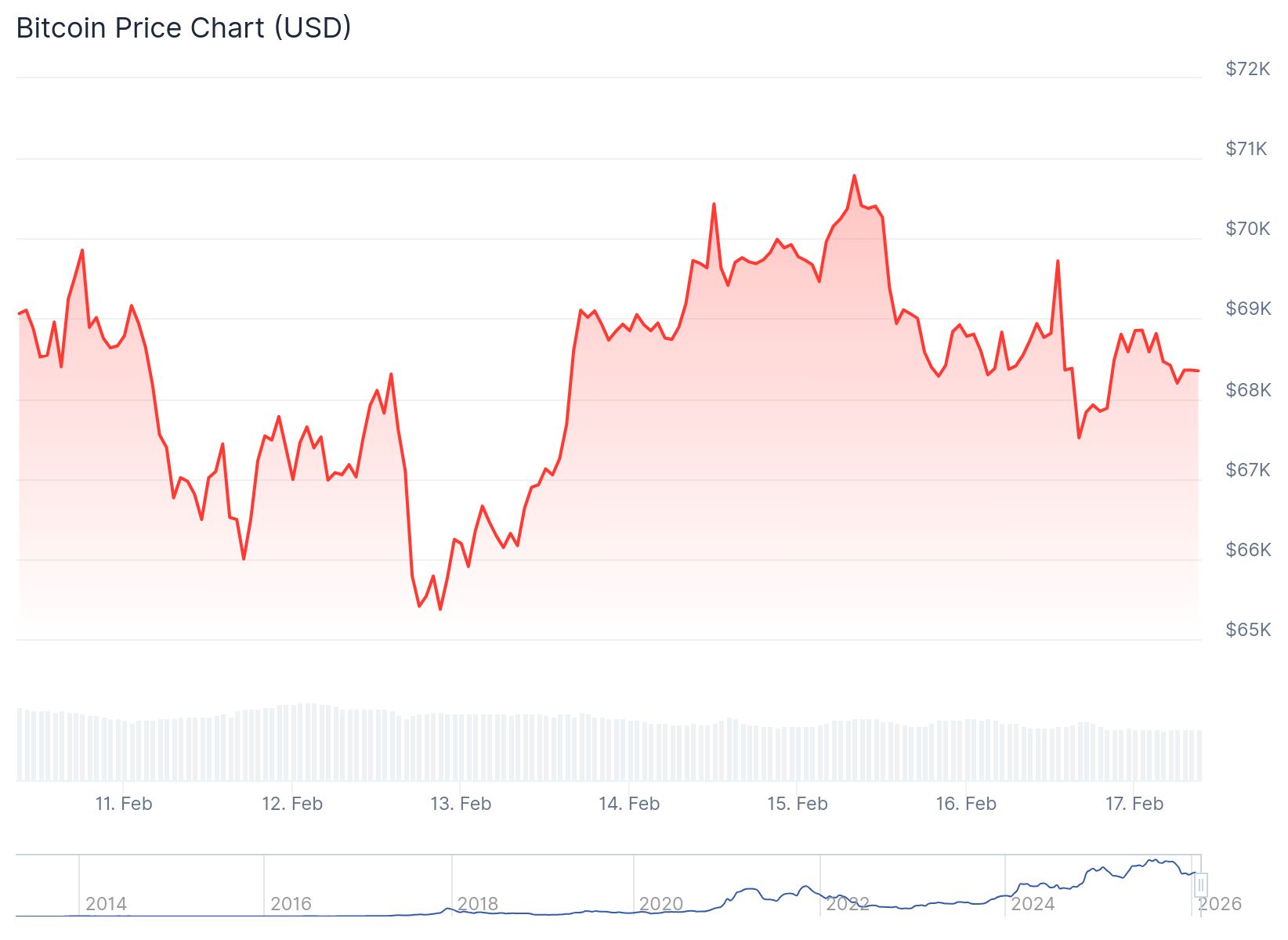

Bitcoin maintained a steady price near $68,000 despite thin trading volumes. Major market holidays reduced cryptocurrency trading activity across global exchanges. Investors remained cautious ahead of critical U.S. economic data releases scheduled for later this week.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The cryptocurrency market has experienced months of downward pressure. Bitcoin has surrendered nearly 50% of its value since reaching an all-time high in October. Multiple headwinds have contributed to the extended sell-off in digital assets.

Uncertainty surrounding Federal Reserve leadership has weighed on risk assets. Kevin Warsh, nominated by President Trump to lead the Federal Reserve, is perceived as less dovish. Markets fear monetary policy will remain tighter than previously expected, hurting speculative investments.

Questions about a reported “loyalty pledge” signed by Warsh have emerged. The situation has raised concerns about Federal Reserve independence. Investors continue to monitor developments regarding the central bank’s future direction.

Corporate Bitcoin Treasury Losses Mount

Strategy Inc revealed it could survive a Bitcoin price decline to $8,000 per coin. The company reported deep losses in the fourth quarter on its cryptocurrency holdings. Part of Strategy’s debt is linked to the value of its Bitcoin position, creating additional risk exposure.

Japanese company Metaplanet Inc disclosed a valuation loss of roughly 102.2 billion yen. The hotelier-turned-Bitcoin treasury faced steep declines on its cryptocurrency investments. These corporate losses demonstrate the volatility risks of large Bitcoin positions.

Other cryptocurrencies posted modest gains on Tuesday. Ethereum climbed 0.9% to $1,976 while XRP advanced 1.4% to $1.48. BNB, Solana, and Cardano rose between 1.7% and 3%.

Memecoin tokens lagged the broader cryptocurrency market. Dogecoin declined 2.2% while $TRUMP fell 3.7%. The mixed performance shows ongoing volatility across different digital asset categories.

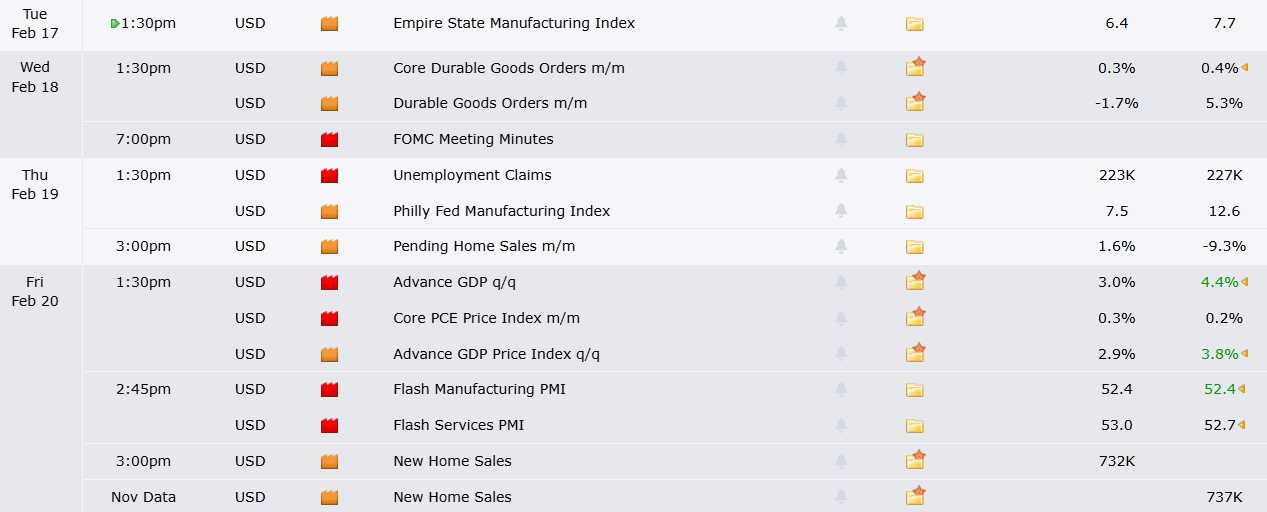

Key Economic Data on Horizon

Several important economic indicators are due for release this week. Industrial production figures and trade data will provide insight into economic health. The Personal Consumption Expenditures index arrives Friday as the Fed’s preferred inflation measure.

Source: Forex Factory

Source: Forex Factory

Federal Reserve meeting minutes from January will be published Wednesday. Market participants will analyze the minutes for policy direction clues. The combination of data and Fed communications will likely move markets.

Consumer price index data released Friday showed cooler-than-expected inflation for January. The below-estimate reading offered some relief on price pressure concerns. However, growth worries and sector disruption fears have prevented sustained rallies.

Corporate earnings continue throughout the shortened trading week. Walmart, DoorDash, and Molson Coors are scheduled to report quarterly results. These earnings will shed light on consumer spending patterns and business conditions.

Investors shifted toward physical assets like gold and precious metals. Risk aversion has grown amid volatility in technology stocks. Bitcoin typically tracks tech stock movements, contributing to cryptocurrency market weakness.

The post Daily Market Update: Stock Futures Slide While Bitcoin Holds Steady as Markets Brace for Fed Data appeared first on Blockonomi.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

The Italian banking giant held approximately $96 million worth of Bitcoin spot ETFs last December, hedged with Strategy put options.