US software stocks have been caught in a violent downdraft since the start of 2026, with the iShares Expanded Tech-Software Sector ETF (ticker symbol IGV) crashingUS software stocks have been caught in a violent downdraft since the start of 2026, with the iShares Expanded Tech-Software Sector ETF (ticker symbol IGV) crashing

Citi names non-Mag 7 software stocks worth buying amidst AI-driven rout

US software stocks have been caught in a violent downdraft since the start of 2026, with the iShares Expanded Tech-Software Sector ETF (ticker symbol IGV) crashing more than 20% year-to-date. Investors are worried that generative artificial intelligence (AI) agents – like Anthropic’s recently expanded Claude Cowork – will dismantle the traditional Software-as-a-Service (SaaS) economic engine. Still, Citi’s senior analyst Drew Pettit suggests this panic has created a rare “de-risked” entry point, adding that fundamental strength will eventually trump the current AI-phobia atmosphere. After filtering for companies with falling share prices whose earnings estimates rose, he believes the following three are particularly well-positioned to recover as the year unfolds. AppLovin Corp (NASDAQ: APP) Citi maintains a “buy” rating on AppLovin stock…

Market Opportunity

RWAX Price(APP)

$0.0001243

$0.0001243$0.0001243

USD

RWAX (APP) Live Price Chart

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

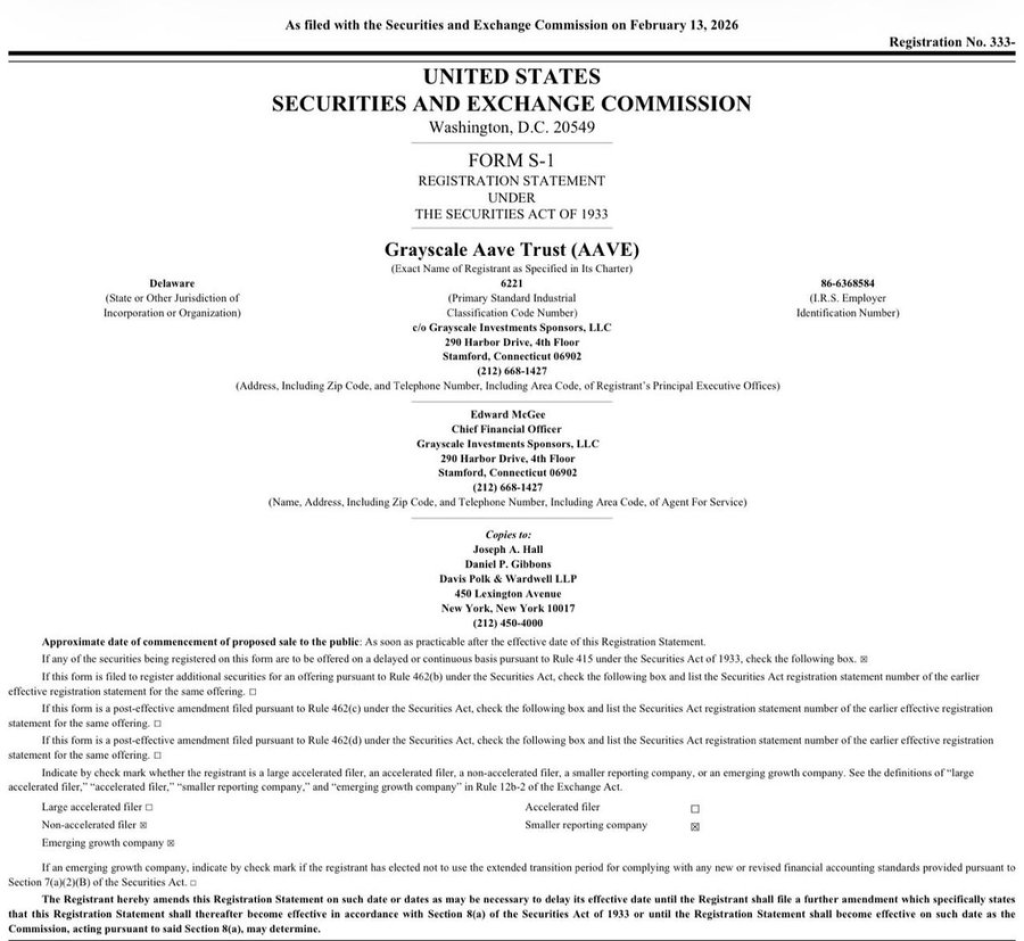

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

A quiet regulatory document can sometimes carry more weight than a loud market rally. That idea comes into focus after a new filing connected to AAVE appeared at

Share

Captainaltcoin2026/02/17 15:30

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More

The post Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More appeared on BitcoinEthereumNews.com. Crypto Careers Surge as Top Financial Institutions

Share

BitcoinEthereumNews2026/02/17 15:20

Will HBAR’s Remarkable Technology Propel It To $0.5?

The post Will HBAR’s Remarkable Technology Propel It To $0.5? appeared on BitcoinEthereumNews.com. Hedera Price Prediction 2026-2030: Will HBAR’s Remarkable Technology

Share

BitcoinEthereumNews2026/02/17 14:47