Malaysia’s Central Bank Launches Stablecoin, Tokenised Deposit Pilots

- The Malaysian central bank’s Digital Asset Innovation Hub has launched three pilot initiatives to explore the use of stablecoins and tokenised deposits.

- The initiatives will explore the use of Malaysian ringgit-pegged stablecoins and tokenised deposits for both domestic and cross-border transactions, with the outcomes used to inform future policy direction including the possible future launch of a wholesale CBDC.

Malaysia’s central bank is set to launch three regulatory sandbox initiatives to explore the use of distributed ledger technology (DLT) in “real-world applications.”

The Bank Negara Malaysia (BNM) announced February 11 that its Digital Asset Innovation Hub (DAIH) will deliver the pilot projects, with a focus on “wholesale payment use cases across both domestic and cross-border transactions.”

The projects will involve the use of stablecoins pegged to Malaysia’s ringgit fiat currency and tokenised deposits. Malaysia is a Muslim-majority country and some of the use-cases will also explore “Sharia-related considerations.”

The three specific use cases listed on the BNM’s website are:

- The use of ringgit stablecoins for business-to-business payments involving Standard Chartered Bank and Capital A;

- The use of tokenised deposits for payments involving Malayan Banking (Maybank); and

- Using tokenised deposits for payments, this time involving CIMB Group Holdings (CIMB).

It hasn’t been disclosed which network will be used in the initiatives. However, similar central bank trials of digital asset–based technology, such as Australia’s Project Acacia, have involved multiple networks.

These initiatives will be conducted in a controlled environment and involve collaboration with ecosystem partners, including corporate clients of financial institutions and other regulators.

Bank Negara Malaysia

Bank Negara Malaysia

BNM said the results of the initiatives could be used to inform the eventual implementation of a Malaysian wholesale central bank digital currency (wCBDC).

The primary purpose in the medium-term is to allow the bank to assess the implications of stablecoins and tokenised deposits for Malaysia’s “monetary and financial stability,” and to guide further policy development. BNM noted that it intends to provide more information about plans to use ringgit stablecoins and tokenised deposits before the end of 2026.

Malaysia’s DAIH was launched less than a year ago, in June 2025. At the time of its launch, the BNM described the innovation hub’s purpose as being to “stimulate financial innovation in a controlled environment,” with a view to supporting “the development of digital assets and the application of leading-edge financial technology in Malaysia.”

Related: UK Lawmakers Hear Skepticism on Stablecoins as Lords Launch Regulation Inquiry

Malaysian Central Bank Lays Out 3-Year Tokenisation Road Map

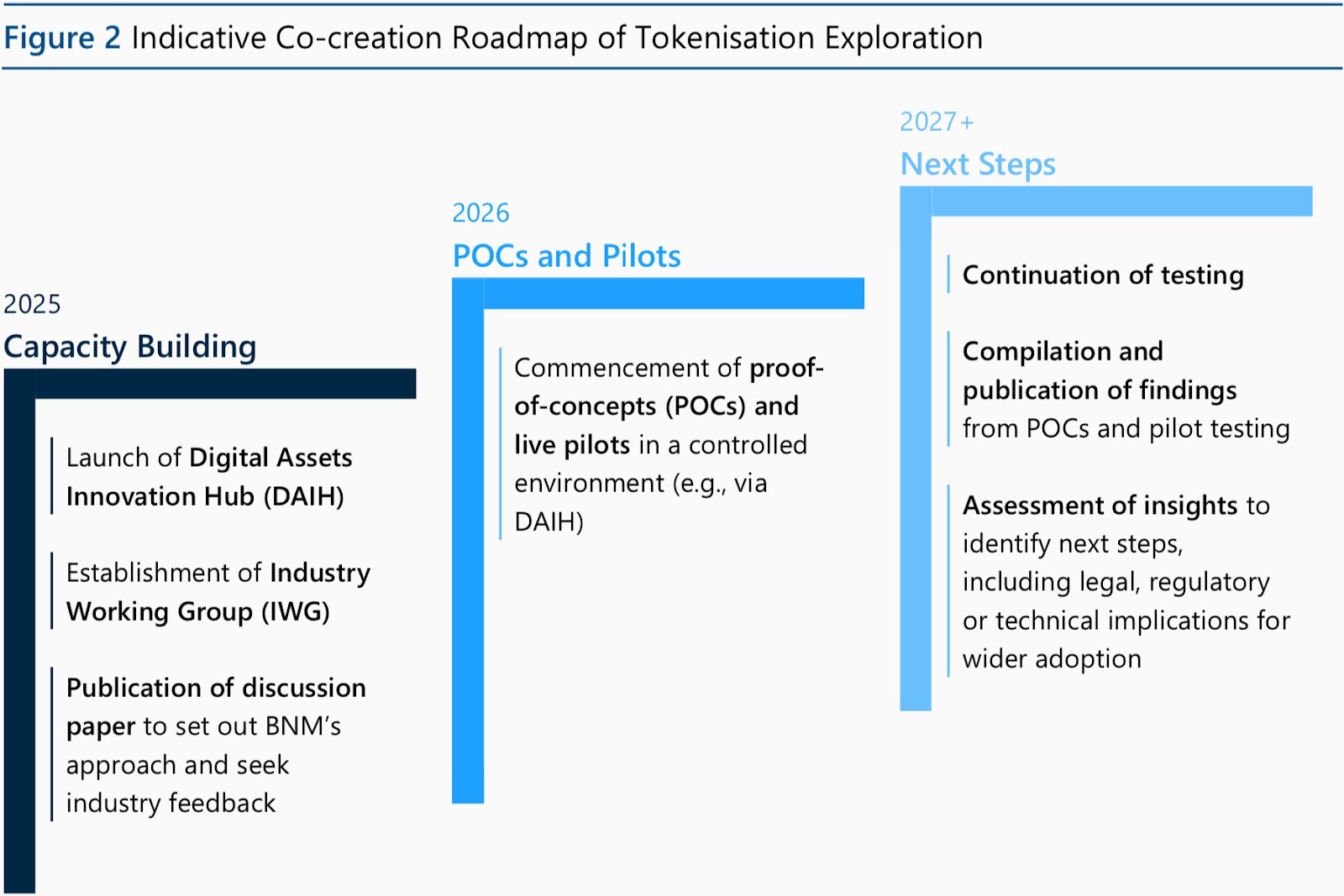

In October of last year, the BNM released a discussion paper titled Asset Tokenisation in the Malaysian Financial Sector, which laid out a 3-year roadmap for the development of digital assets with a particular focus on tokenisation.

The discussion paper laid out what it calls a “co-creation roadmap,” involving co-operation between “regulators, industry participants and other stakeholders,” to explore and shape the implementation of tokenisation in the Malaysian economy.

Outline of Malaysia’s co-creation roadmap for tokenisation. Source: BNM discussion paper (pdf)

Outline of Malaysia’s co-creation roadmap for tokenisation. Source: BNM discussion paper (pdf)

The launch of the BNM’s stablecoin and tokenisation initiatives constitutes part of stage 2 of this road map. According to the roadmap, following the completion of the pilot initiatives by the end of 2026, any insights gained will be used to guide further regulatory, legal and technical progress in stage 3, starting in 2027.

There have been several notable recent developments around digital assets in Malaysia, including the announcement in December by Capital A (the operator of the airline Air Asia) that it had signed a letter of intent to develop and test a new ringgit-pegged stablecoin in partnership with Standard Chartered Bank through the DAIH.

Under this plan, Standard Chartered would be the issuer of the stablecoin while Capital A and its broader ecosystem would look to develop, test and pilot “real-world wholesale use cases.”

Related: Visa, Mastercard Play Down Stablecoins for Payments as Consumer Demand Falls Short

Also in December, the current King’s eldest son, Ismail Ibrahim, launched a ringgit-pegged stablecoin, RMJDT, to be issued by telecommunication company, Bullish Aim — which is also owned by Ibrahim.

While currently still undergoing testing in the regulatory sandbox, a statement from Zetrix, the privately-owned blockchain on which RMJDT will run, said that the stablecoin’s purpose is to “strengthen the international use of the Malaysian Ringgit in cross-border trade settlements and to act as a catalyst for attracting increased foreign direct investment (FDI) into Malaysia.”

The post Malaysia’s Central Bank Launches Stablecoin, Tokenised Deposit Pilots appeared first on Crypto News Australia.

You May Also Like

Avalanche and Hyperliquid Lead Crypto Rally Post-Fed Rate Cut

Pi Network Accelerates Real World Adoption as Picoin Transitions from Digital Asset to Everyday Payment

The Pi Network ecosystem is once again demonstrating significant progress. While the community initially focused on mining ac