Chainlink Faces Renewed Sell Pressure as Exchange Inflows Spike

According to a report shared by CryptoQuant, Chainlink is showing renewed signs of downside pressure after a short-lived recovery attempt.

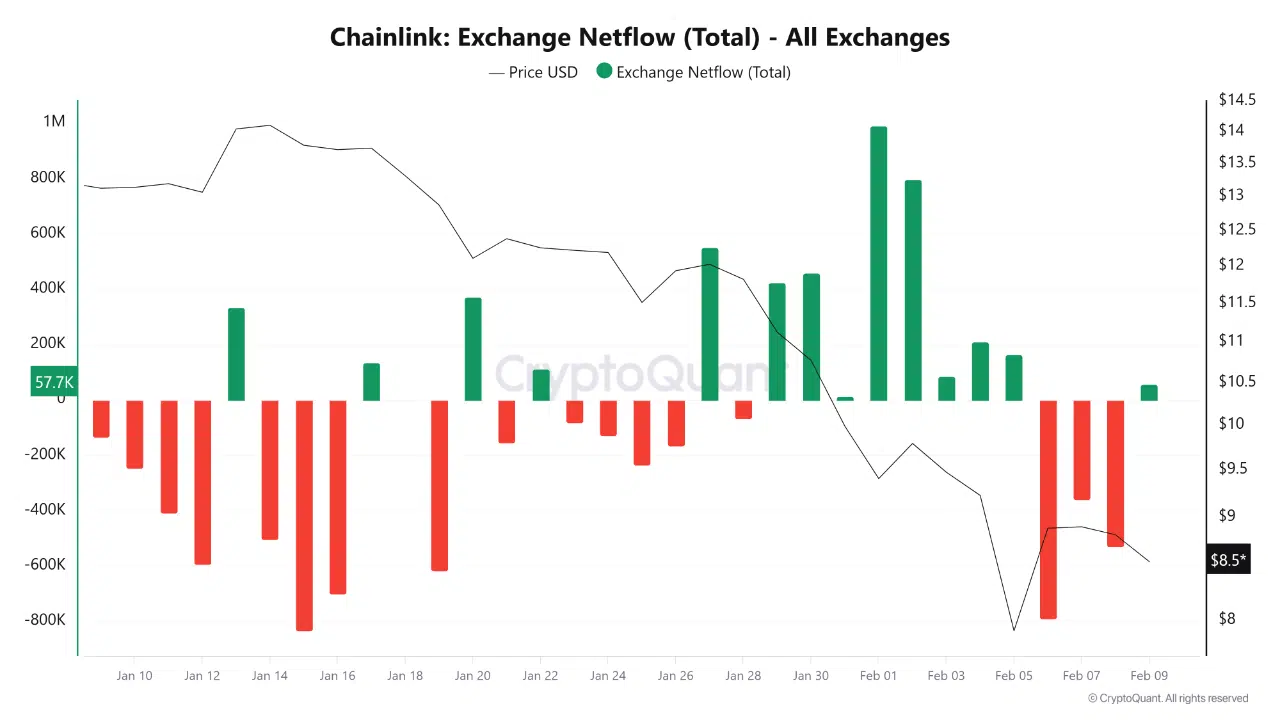

Following a bounce from the $7.19 level, exchange inflows surged sharply, signaling that selling activity has reaccelerated rather than stabilized.

The latest data shows a 19% spike in exchange inflows, a pattern that closely mirrors the sell-off observed in late January. Historically, similar inflow dynamics have coincided with periods of speculative pressure, particularly when price fails to hold nearby support levels.

Exchange Inflows Signal Heightened Risk

Exchange inflows represent tokens moving from private wallets to exchanges, often indicating preparation for selling. The sudden increase suggests that a meaningful portion of market participants are repositioning defensively rather than accumulating.

If the $7.19 area fails to hold, the report highlights a potential path toward deeper downside testing, with market structure becoming increasingly vulnerable as speculative positioning builds.

If the $7.19 area fails to hold, the report highlights a potential path toward deeper downside testing, with market structure becoming increasingly vulnerable as speculative positioning builds.

Structural Signals Beneath the Surface

Despite near-term weakness, several longer-term structural indicators outlined in the report remain intact. Since launch, the LINK ETF has recorded no days of net outflows, indicating that ETF-linked exposure has remained stable rather than contributing to selling pressure.

Separately, network-level metrics continue to show expansion. According to official data referenced in the report, Chainlink’s oracle infrastructure has facilitated $28.02 trillion in transaction value, with the cumulative total continuing to trend higher.

In addition, revenue-funded strategic reserves are reported to be increasing, reinforcing long-term network sustainability rather than contraction.

Volume Cooling Suggests Selling May Be Slowing

The report also notes early “cooling” signals in volume-based indicators. While price remains under pressure, these signals suggest that the intensity of the sell-off may be beginning to moderate rather than accelerate further.

Historically, such transitions have aligned with periods where supply continues to change hands, but panic-driven liquidation gradually gives way to more deliberate positioning.

Structural Takeaway

Chainlink’s current setup reflects a market caught between short-term distribution and longer-term structural resilience. Rising exchange inflows and weakening price action point to elevated downside risk if key levels fail, while steady ETF exposure and expanding network fundamentals suggest that broader positioning has not meaningfully deteriorated.

This configuration typically aligns with transitional phases, where price volatility remains elevated until speculative pressure subsides and demand reasserts itself.

The post Chainlink Faces Renewed Sell Pressure as Exchange Inflows Spike appeared first on ETHNews.

You May Also Like

Pi Network Enables Real Shopping with Picoin, Driving Demand and Utility

Nigeria targets 95% digital literacy by 2030 – NITDA DG, Kashifu Inuwa