Crypto Outflows Slow to $187M as CoinShares Flags Potential Turning Point

Digital asset investment products recorded a sharp deceleration in outflows last week, a development that historically aligns with potential shifts in broader market sentiment rather than simple price reactions.

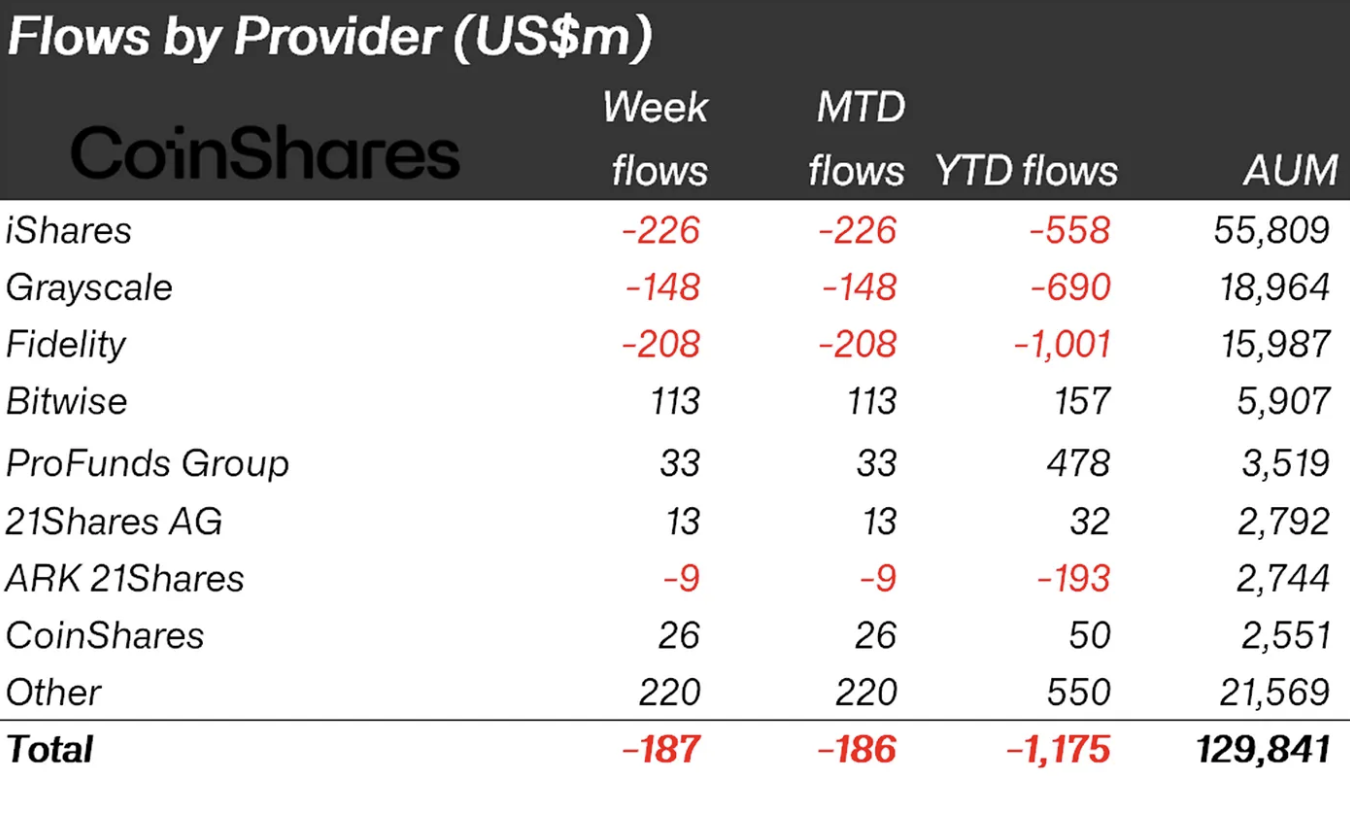

According to the latest weekly data from CoinShares, total outflows reached $187 million, a notable slowdown despite continued price pressure across major crypto assets. Assets under management declined to $129.8 billion, marking the lowest level since March 2025, while trading activity surged to a record $63.1 billion in weekly ETP volume.

Source: https://researchblog.coinshares.com/volume-272-digital-asset-fund-flows-weekly-report-1eb38ad1391a

Source: https://researchblog.coinshares.com/volume-272-digital-asset-fund-flows-weekly-report-1eb38ad1391a

Slowing Outflows Hint at Sentiment Stabilisation

The key signal in the latest report is not the direction of flows, but the pace. Historically, changes in the speed of outflows have proven more informative than price moves alone. The sharp deceleration suggests that forced selling pressure may be easing, raising the probability that markets are approaching a near-term inflection point rather than entering a new leg lower.

This dynamic mirrors conditions seen during previous local market lows, where heavy price declines were followed by stabilising flows before trend reversals emerged.

Regional Flows Show Clear Divergence

Investor behaviour varied significantly by region. European markets displayed relative strength, with Germany leading inflows at $87.1 million, followed by Switzerland at $30.1 million. Canada added $21.4 million, while Brazil recorded $16.7 million in inflows.

In contrast, the United States saw the largest weekly outflows at $214.3 million, reinforcing the current divergence between U.S. and European institutional positioning.

This dispersion suggests selective risk reallocation rather than broad-based capitulation.

Asset-Level Breakdown: Bitcoin Weakness, Altcoin Rotation

At the asset level, Bitcoin remained the primary source of negative sentiment, posting $264.4 million in weekly outflows. Ethereum, by contrast, attracted modest inflows of $5.3 million, while Solana added $8.2 million. XRP stood out as the strongest performer, recording $63.1 million in weekly inflows and maintaining its position as the top-performing digital asset year-to-date with $109 million in net inflows.

The rotation away from Bitcoin into select large-cap altcoins indicates tactical repositioning rather than wholesale risk reduction.

What the Data Suggests Going Forward

While prices remain under pressure, the slowdown in outflows combined with record trading volumes points to an environment where sellers are becoming exhausted and buyers are increasingly selective. If historical patterns hold, stabilising flows at depressed asset levels often precede structural trend shifts rather than extended declines.

For now, CoinShares data suggests that the market may be transitioning from forced liquidation to early-stage consolidation, with investor behaviour becoming more differentiated across regions and assets rather than uniformly defensive.

The post Crypto Outflows Slow to $187M as CoinShares Flags Potential Turning Point appeared first on ETHNews.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse