Bitcoin Flat After Trump Rolls out Reciprocal Tariffs

Just minutes before midnight on Thursday, U.S. President Donald Trump ushered in his updated tariff policy, gleefully proclaiming, “IT’S MIDNIGHT!!! BILLIONS OF DOLLARS IN TARIFFS ARE NOW FLOWING INTO THE UNITED STATES OF AMERICA!”

Bitcoin Shows Little Reaction to Trump’s New Trade Tariffs

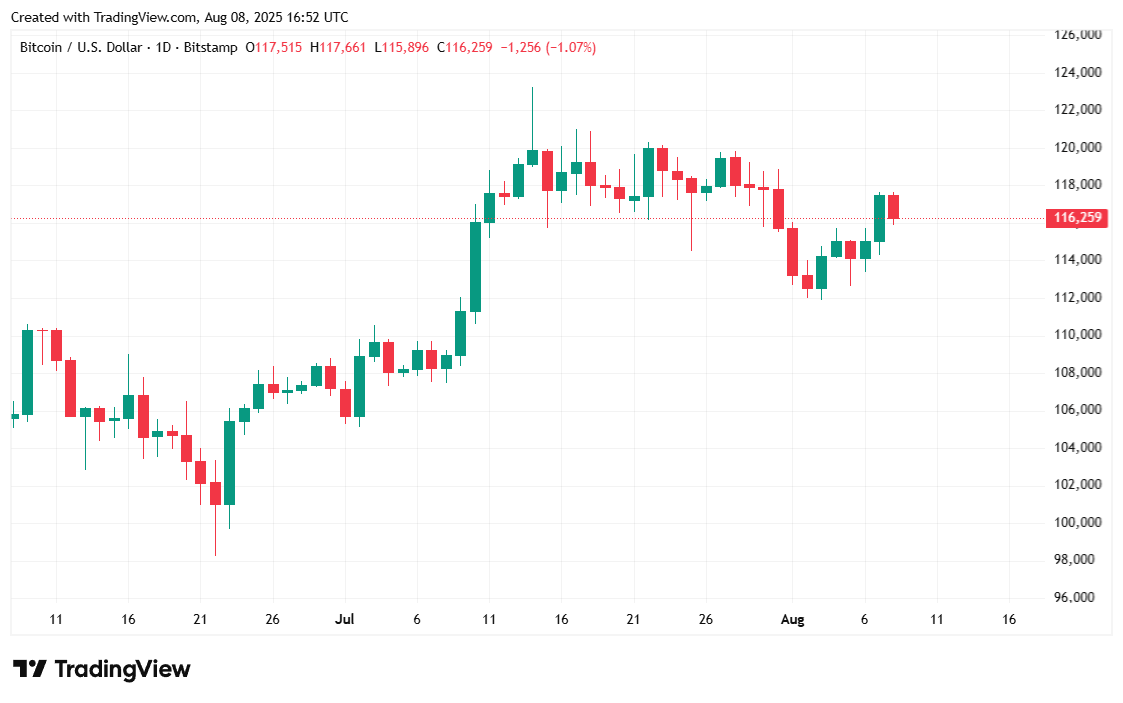

Call it tariff fatigue, but even after the Trump administration’s contentious trade policy took effect at midnight on Thursday, bitcoin’s price has changed very little, continuing to hover around the $116K mark for the past 24 hours.

U.S. President Donald Trump has characterized his controversial taxes on imports into the country as retaliatory, alleging that other countries “have taken advantage of the United States for many years.” Thursday’s tariffs left countries like Switzerland scrambling to strike a deal with the administration after Trump slapped the European country with a 39% tax on its incoming goods. The US’s largest trading partner, longtime ally, and neighbor to the north, Canada, received a 35% tariff, and when Canadian Prime Minister Mark Carney attempted to negotiate, Trump snubbed him.

“We haven’t really had a lot of luck with Canada,” Trump said last month while speaking with reporters at the White House. “I think Canada could be one where they’ll just pay tariffs. It’s not really a negotiation.”

Yet despite all the tariff controversy, stock and crypto markets are up and bitcoin is flat. The S&P 500, Nasdaq, and Dow all climbed 0.77%, 0.90%, and 0.52% respectively on Friday. The broader crypto market edged 0.76% higher, even as the dominant digital asset treaded water.

Overview of Market Metrics

Much like yesterday, bitcoin was trading at $116,188.20, up slightly by 0.41% in the last 24 hours, and also up 0.82% for the week, according to Coinmarketcap at the time of reporting. The cryptocurrency’s price has swung between $115,696.49 and $117,689.20 since Thursday.

( BTC price / Trading View)

( BTC price / Trading View)

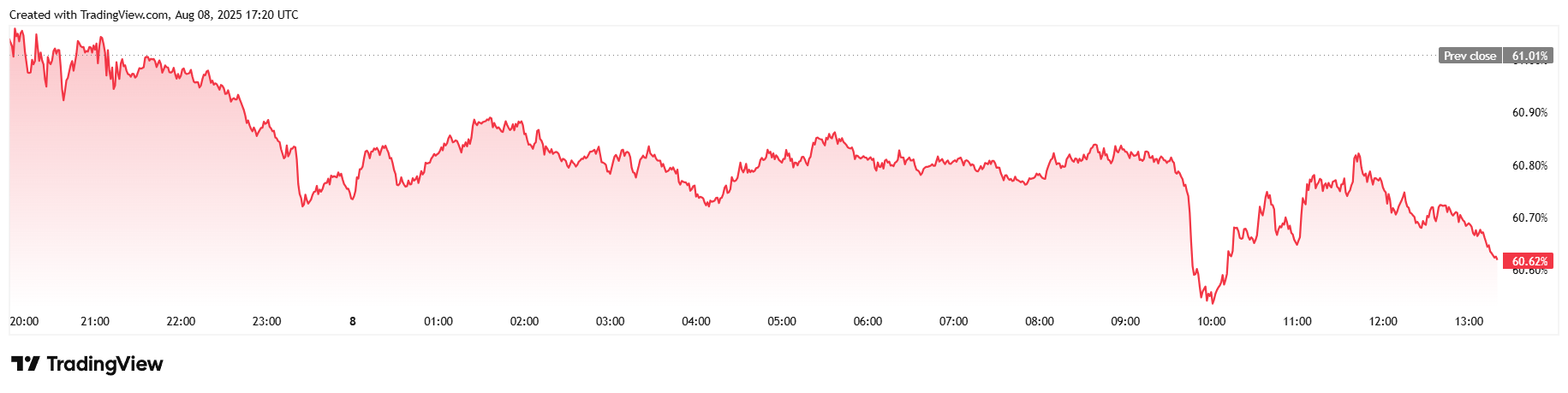

Trading volume over the last 24 hours rose 8.07% to $63.26 billion while market capitalization stayed flat at $2.31 trillion. Bitcoin dominance tumbled by 0.64% to 60.62% as various altcoins such as ether ( ETH) outperformed the flagship cryptocurrency.

( BTC dominance / Trading View)

( BTC dominance / Trading View)

Bitcoin futures open interest totaled $80.43 billion, a meager 0.19% increase. Total bitcoin liquidations were also flat over 24 hours, coming in at $32.86 million. Short liquidations once again dominated that overall figure, making up $23.47 million of all liquidations. The rest were long liquidations, which stood at $9.39 million.

You May Also Like

Telos Advisers Welcomes Stephen Gardner as a Strategic Advisory Board Member

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon