Buy Now, Pay Later Statistics 2026: Market on Fire

The concept of Buy Now, Pay Later (BNPL) has revolutionized the way consumers approach their shopping experiences. Imagine being able to purchase high-ticket items instantly, without emptying your wallet at checkout. This trend has rapidly gained traction, particularly among younger consumers, offering a convenient solution for splitting payments into manageable portions. With no interest charged in most cases, it’s no wonder that BNPL platforms are surging in popularity.

However, the BNPL ecosystem is not just a passing trend. It’s a seismic shift in the retail finance industry, reshaping how we think about spending and budgeting. BNPL continues to experience explosive growth, attracting millions of users globally and significantly impacting the retail and financial sectors.

Editor’s Choice

- BNPL results in an 85% higher average order value than when customers use other payment methods.

- The US is projected to reach 96.3 million BNPL users by late 2026.

- On average, BNPL users have borrowed $2,085 across all their BNPL purchases.

- 59% of Gen Z consumers are forecast to make a BNPL payment.

- BNPL holds about 6% of the US market share.

- Holiday shoppers spent a record $20 billion through BNPL in the recent season.

- 10% of consumers with incomes over $100,000+ used BNPL, with higher usage among lower incomes.

Recent Developments

- Affirm reported Q3 CY2025 revenue of $933.3 million, up 33.6% YoY, with EPS of $0.23.

- 96% of Afterpay US customers repaid Black Friday/Cyber Monday 2025 BNPL purchases on time or early.

- Global BNPL market expected to grow 18.9% to $509.2 billion in 2026.

- US projected to reach 96.3 million BNPL users by late 2026.

- Affirm’s US payment volume expected to hit $23.27 billion in 2025, up 15.4% YoY.

- 72% of Americans planned to use BNPL in 2026, per a 2025 survey.

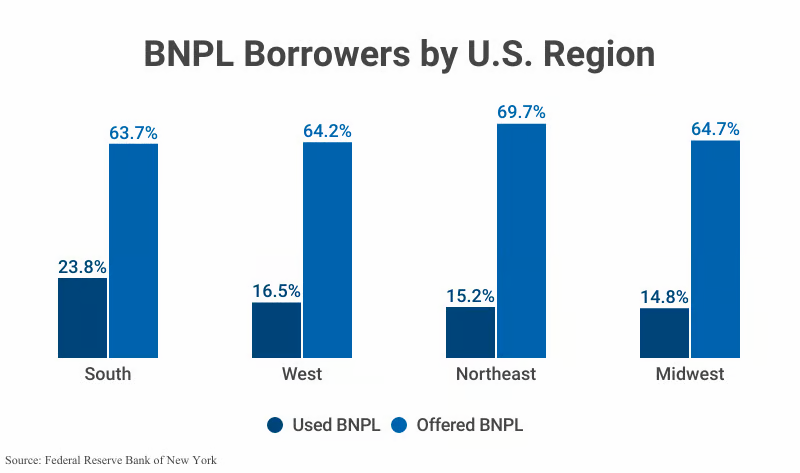

BNPL Borrowers by U.S. Region

- The South reports the highest BNPL usage, with 23.8% of consumers having used Buy Now, Pay Later, while 63.7% were offered BNPL options.

- In the West, 16.5% of consumers have used BNPL, even though 64.2% had access to BNPL services, highlighting a sizable adoption gap.

- The Northeast shows the widest gap between access and usage, where 69.7% of consumers were offered BNPL, but only 15.2% actually used it.

- The Midwest records the lowest BNPL usage rate, with just 14.8% of consumers using BNPL, despite 64.7% being offered BNPL financing.

- Across all U.S. regions, BNPL availability consistently exceeds 60%, while actual usage remains below 25%, indicating significant untapped adoption potential nationwide.

(Reference: Capital One Shopping)

(Reference: Capital One Shopping)

Market Share of Payment Methods for E-commerce Transactions

- Digital wallets dominate with a 54% share of e-commerce transactions.

- Credit cards account for 16% of online payments.

- Debit cards represent 10% of the e-commerce market share.

- Account-to-account (A2A) transfers capture 10% market share.

- Buy now, pay later (BNPL) services hold a 6% share.

- Other methods, including cryptocurrency and prepaid accounts, account for 2%.

- PrePay methods are used for 1% of e-commerce transactions.

- Cash on delivery remains at 1% share.

- Digital wallets projected to exceed 50% global e-commerce share.

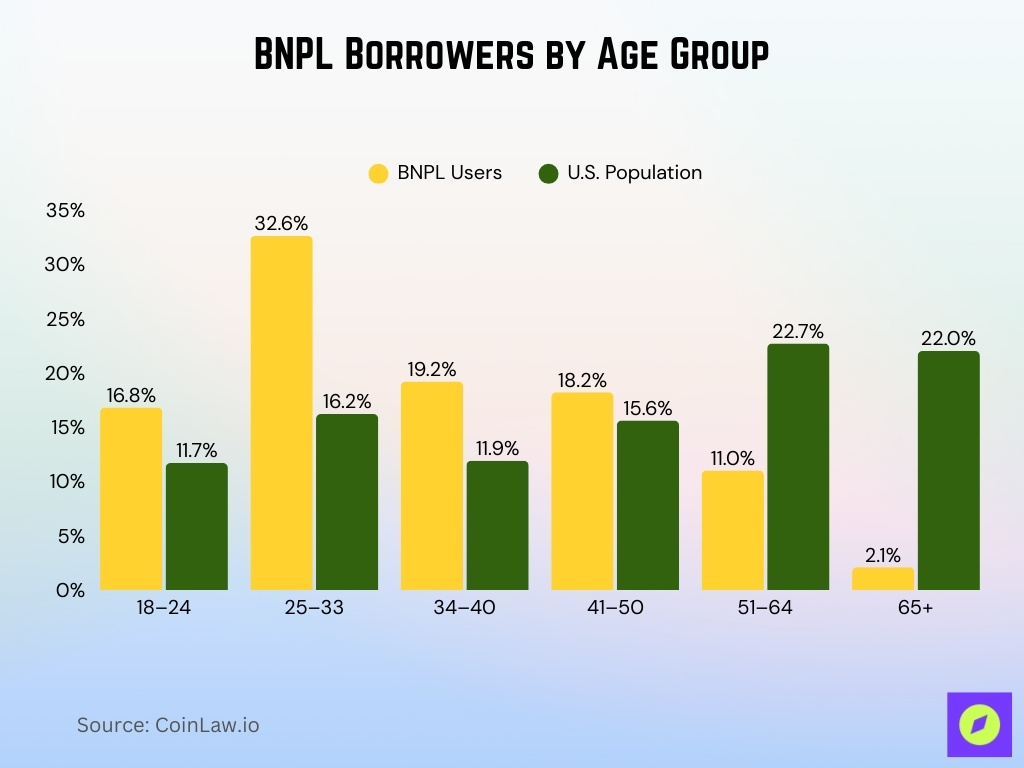

BNPL Borrowers by Age Group

- Young adults aged 25–33 dominate BNPL usage, accounting for 32.6% of all BNPL users, despite representing only 16.2% of the U.S. population.

- Consumers aged 18–24 make up 16.8% of BNPL borrowers, exceeding their 11.7% share of the overall population, signaling early adoption among younger shoppers.

- The 34–40 age group represents 19.2% of BNPL users, compared with 11.9% of the U.S. population, showing strong mid-career BNPL engagement.

- Adults aged 41–50 account for 18.2% of BNPL borrowers, slightly above their 15.6% share of the population, indicating steady mainstream adoption.

- Older consumers aged 51–64 are underrepresented, with only 11.0% of BNPL users despite making up 22.7% of the U.S. population.

- Older people aged 65 and above show minimal BNPL usage, representing just 2.1% of users while comprising 22.0% of the population, highlighting a significant age-based adoption gap.

- Overall, BNPL usage skews heavily toward younger age groups, while older demographics remain largely untapped, reinforcing BNPL’s appeal among digitally native consumers.

(Reference: Capital One Shopping)

(Reference: Capital One Shopping)

BNPL Provider Market Share and Popularity of Apps

- Klarna dominates European BNPL with a leading market position as the sector grows 19.5% to $217.7 billion.

- Afterpay is significant in the US BNPL market, part of the top 5 providers holding over 95% market share.

- Affirm expanded its active user base to 21 million, marking 23% increase.

- PayPal leads BNPL usage with 56% of users choosing Pay in 4.

- Sezzle is among the top 5 US BNPL providers, accounting for over 95% combined market share.

- Clearpay positions itself as the dominant BNPL in the UK retail sector.

- Zip is part of major US BNPL firms with over 95% market share alongside Affirm, Klarna, Afterpay, and Sezzle.

Reasons for Using Buy Now Pay Later (BNPL) and Credit Cards

- 57% of BNPL users choose it to spread payments for cash flow management.

- 58% find BNPL more convenient at checkout than credit cards.

- 36% prefer BNPL for better budgeting over credit cards.

- 32% use BNPL to avoid interest charges, unlike credit cards.

- 53% avoid credit cards, preferring BNPL simplicity.

- 45% cite easier payments with BNPL vs credit cards.

- 44% prefer BNPL flexibility over credit cards.

- 36% choose BNPL for lower interest rates.

- 33% drawn to BNPL easy approval, unlike credit cards.

- 72% of low-income BNPL users said it was the only way to afford a purchase.

Frequently Asked Questions (FAQs)

There are about 380 million BNPL users worldwide reported.

The global BNPL market is estimated at about $509.2 billion in 2026, rising toward ~$1 trillion by 2031.

The U.S. BNPL user base is on track to reach approximately 100 million users by 2027.

Conclusion

Buy Now, Pay Later (BNPL) has shifted from a niche payment option to a global financial phenomenon. BNPL continues to grow in market size, user adoption, and geographic reach, driven by demand for flexible, interest-free payment options. With younger generations embracing these services, businesses that integrate BNPL into their payment systems will see significant benefits.

However, as the sector expands, so too does the need for regulatory oversight and innovation. The emergence of new players, increasing regional adoption, and the integration of AI and sustainable finance models will shape the future of BNPL and beyond. Consumers and businesses alike will need to adapt to this evolving financial landscape.

The post Buy Now, Pay Later Statistics 2026: Market on Fire appeared first on CoinLaw.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models