UAE Stablecoin USDU Approved as First USD Token Under PTSR

This article was first published on The Bit Journal.

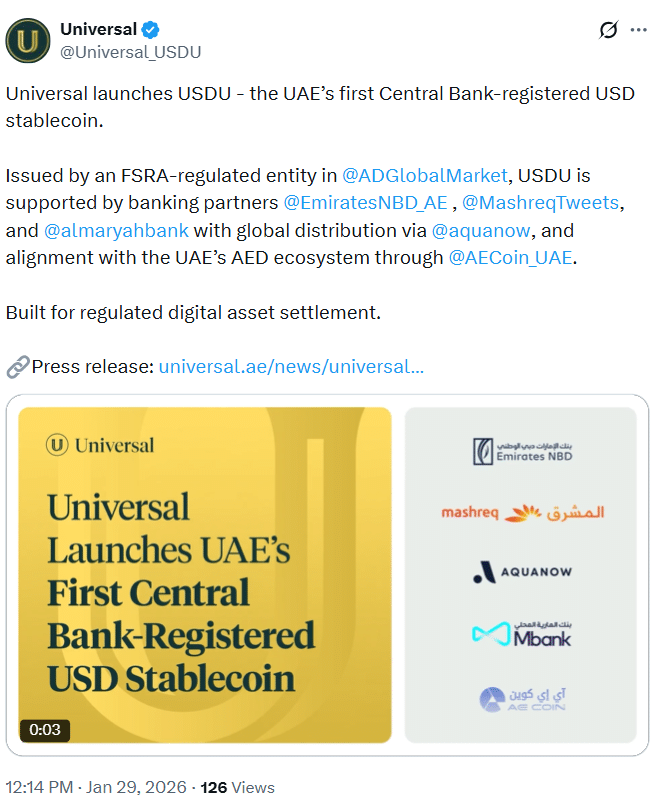

The UAE stablecoin landscape reached a milestone after the Central Bank of the United Arab Emirates approved the country’s first USD-backed digital token under its Payment Token Services Regulation.

The approval confirms the launch of USDU by Universal Digital. It establishes a regulated structure for issuance, custody, and reserve management. The decision reflects the UAE’s move toward supervised digital payment instruments.

CBUAE Approves USDU as Foreign Payment Token

The Central Bank confirmed that USDU has been approved as a foreign payment token. The authorization was issued under the Payment Token Services Regulation framework.

This places the token directly under national oversight. The move strengthens regulatory clarity for the UAE stablecoin market.

Universal Digital will issue and manage the token. The firm operates under the supervision of the Financial Services Regulatory Authority at Abu Dhabi Global Market. This ensures compliance with existing financial rules and reporting standards.

Source: X

Source: X

Issuer and Regulatory Oversight

Universal Digital is licensed within ADGM. The company follows FSRA requirements on governance, risk controls, and disclosures. This regulatory setup integrates the UAE stablecoin into the country’s established financial supervision system.

Also Read: Stablecoin Liquidity Falls Below $258B at Multi-Month Lows as Capital Exits Crypto

The structure aligns with how digital assets are supervised in regulated financial zones. Authorities confirmed that the token meets eligibility criteria under the central bank framework.

Reserve Structure and Transparency

USDU is fully backed by U.S. dollar reserves. The reserves are held on a one-to-one basis. Funds are stored in safeguarded onshore accounts at Emirates NBD and Mashreq.

Mbank supports Universal Digital as a strategic banking partner. Independent monthly attestations are conducted by a global accounting firm. This reserve model supports transparency standards applied to the UAE stablecoin regime.

Banking and Institutional Support

Local banks play a direct role in reserve custody. This links the digital token to the domestic banking system. Officials said this design reduces settlement risk.

Executives at Mashreq confirmed growing institutional interest in regulated digital value instruments. They noted that the approval supports market maturity within the UAE stablecoin segment.

Distribution and Infrastructure Partnerships

Digital asset infrastructure firm Aquanow has been appointed as a global distribution partner. The firm will support institutional access to USDU outside the UAE, where permitted by local law.

Within the UAE, Aquanow operates under Dubai’s Virtual Assets Regulatory Authority. This coordination allows compliant integration into the digital asset ecosystem. It strengthens operational reach for the UAE stablecoin without bypassing regulation.

Domestic and Cross-Border Use Cases

Universal Digital is also collaborating with AECoin. AECoin is the first licensed AED-backed stablecoin in the country. The partnership aims to enable future USDU and AECoin conversions for domestic settlement.

Source: Universal

Source: Universal

Beyond national borders, USDU is designed to connect with international platforms. The supervised structure allows regulated transfers where local rules permit. This expands the functional scope of the UAE stablecoin.

Market Context and Regulatory Timing

The approval comes amid rising digital asset activity in the UAE. Several banks are already testing stablecoin-based solutions. Preparations are underway for broader adoption.

S&P Global Ratings has noted that regulated USD-backed tokens may attract foreign businesses. Analysts link this interest to faster settlement and lower transaction costs tied to the UAE stablecoin framework.

Conclusion

The approval of USDU marks a concrete step in regulated digital finance. It shows how central bank oversight, licensed issuers, and local banks can operate together. The UAE stablecoin model now moves from policy to execution.

Also Read: Why Banks Want Stablecoin Yield Banned Under US Law

Appendix: Glossary of Key Terms

USDU: A USD stablecoin permitted by the Central Bank of the UAE.

UAE stablecoin: A regulated digital token for the Middle East that is being circulated under the UAE’s payment and digital asset guidelines.

CBUAE: Central Bank of the United Arab Emirates – regulates payment tokens.

Payment Token Services Regulation (PTSR): Regulations on the issuance and operations of payment tokens in the United Arab Emirates.

Issuing organization of USDUThe Issuer and Operator of the USDU Payment Token.

ADGM: Abu Dhabi Global Market, which is a financial free zone with its own regulator.

FSRA – The regulator that monitors companies under the jurisdiction of ADGM.

VARA: The Dubai authority overseeing virtual asset activities and service providers.

Frequently Asked Questions About UAE stablecoin

1- What is the UAE stablecoin USDU?

The UAE stablecoin USDU is a USD-backed digital payment token approved by the Central Bank of the UAE.

2- Who issues USDU?

USDU is issued and managed by Universal Digital. The company is regulated by the Financial Services Regulatory Authority at Abu Dhabi Global Market.

3- How are USDU reserves managed?

Reserves are held on a 1:1 basis in U.S. dollars. Funds are kept in safeguarded onshore accounts at Emirates NBD and Mashreq.

4- Is USDU permitted for international use?

USDU may be distributed outside the UAE where local regulations allow. Institutional access is supported through regulated infrastructure partners.

References

CoinDesk

TechAfricaNews

Read More: UAE Stablecoin USDU Approved as First USD Token Under PTSR">UAE Stablecoin USDU Approved as First USD Token Under PTSR

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip