Stellar Stabilizes After Breakdown as Sellers Lose Momentum

Stellar (XLM) is attempting to stabilize after an extended corrective phase, with price now holding above a clearly defined long-term support zone.

The latest TradingView data from Binance shows XLM trading around $0.197, down modestly on the session but no longer accelerating to the downside, suggesting that selling pressure is beginning to fade.

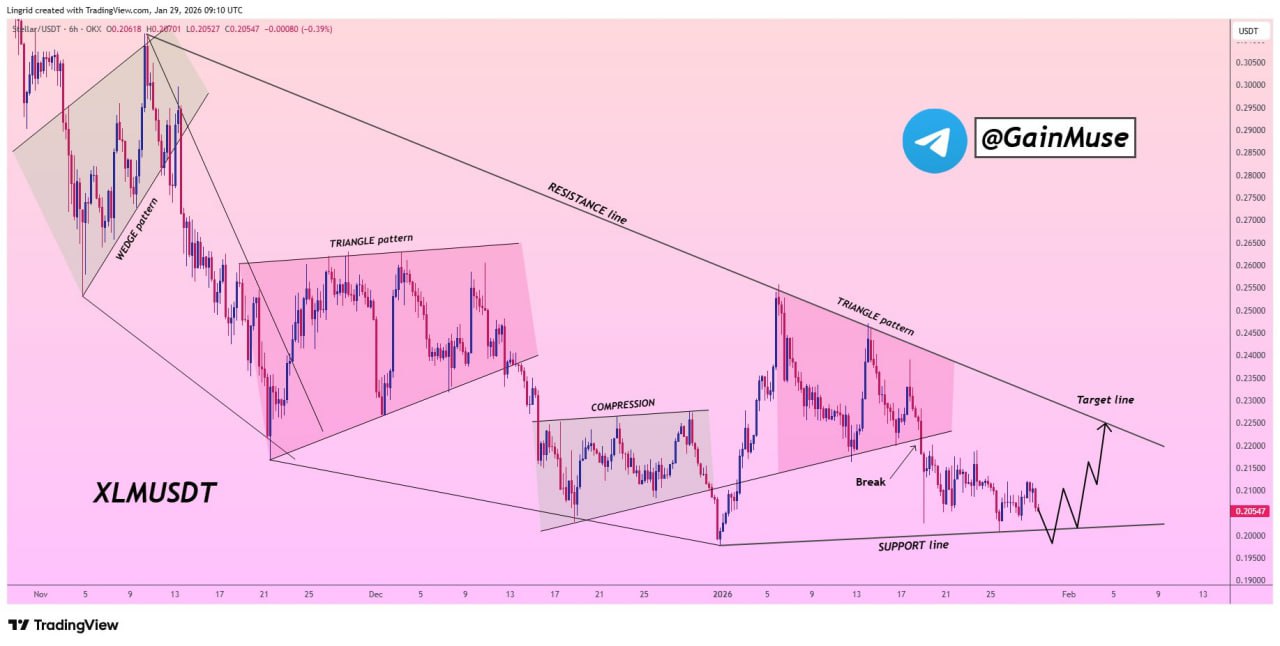

After breaking down from a descending triangle structure earlier in the move, price action has shifted from impulsive selling into compression, a common transition phase following trend exhaustion.

Breakdown Followed by Structural Support Defense

On the 2-hour chart, XLM previously lost the descending triangle that had guided price lower from the November highs near $0.26–$0.27. That breakdown initially pushed Stellar sharply lower, with price sliding through intermediate support zones before reaching the $0.20 region.

Since then, price has stopped trending and begun consolidating directly above a rising long-term support line, which has now been tested multiple times without a decisive breakdown. This behavior suggests that the recent move is corrective rather than a continuation impulse.

Importantly, sellers have failed to produce strong follow-through below $0.20, even after several rejection attempts, indicating diminishing downside momentum.

Compression Signals Potential Relief Bounce

According to crypto trader GainMuse’s technical framework, Stellar is now compressing between rising support and descending resistance. This type of structure often precedes a short-term resolution, either through a relief bounce or a delayed continuation lower.

Source: https://t.me/gainmuse/1726

Source: https://t.me/gainmuse/1726

As long as price holds above the $0.195–$0.200 support zone, the technical setup continues to allow for a rebound toward descending resistance. A first reaction target sits near the $0.215–$0.225 range, where prior breakdown levels and short-term resistance converge.

The key takeaway is that the current move lacks impulsive characteristics. Volatility has contracted, volume remains muted, and price is grinding sideways rather than cascading lower, all signs that sellers are losing control.

What Would Invalidate the Setup

While the structure favors a relief bounce while support holds, this is not yet a confirmed trend reversal. A clean break and sustained close below $0.195 would invalidate the stabilization thesis and reopen downside risk toward lower untested levels.

Until that happens, Stellar remains in a base-building phase, not an expansion phase.

Technical Outlook

Stellar is no longer in free fall. The breakdown has already occurred, and the market is now digesting that move. As long as XLM continues to defend the rising support line near $0.20, relief bounces remain technically favored, even if broader trend pressure persists.

This is a patience zone, not a momentum zone. Directional conviction will only return once price either reclaims descending resistance or loses support decisively.

The post Stellar Stabilizes After Breakdown as Sellers Lose Momentum appeared first on ETHNews.

You May Also Like

Where Is XRP Headed Next? Ripple Leaders and Community Go Live for Two Days

XRP Leaders Go Live to Unveil XRP’s Role in Financial Infrastructure