“Trump Insider Whale” Turns Bearish, Closes BTC, ETH Long Positions at $10M Losses

An alleged insider trader—known as “Trump Insider Whale” or BitcoinOG (1011short)—has just capitulated from Bitcoin BTC $87 707 24h volatility: 1.8% Market cap: $1.75 T Vol. 24h: $53.92 B and Ethereum ETH $2 911 24h volatility: 4.2% Market cap: $351.53 B Vol. 24h: $33.10 B long positions. Closing these longs resulted in nearly $10 million in losses, signaling a now bearish or more cautious stance.

Onchain data reported by Lookonchain shows the address 0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae closed positions sized at 427.29 BTC, worth $37.5 million, and 30,588 ETH, worth $88.63 million, taking $9.73 million (0.77%) in losses. The report also noted a 20 million USDC withdrawal from Hyperliquid, deposited to a Binance account. Everything happened on Jan. 26, 2026.

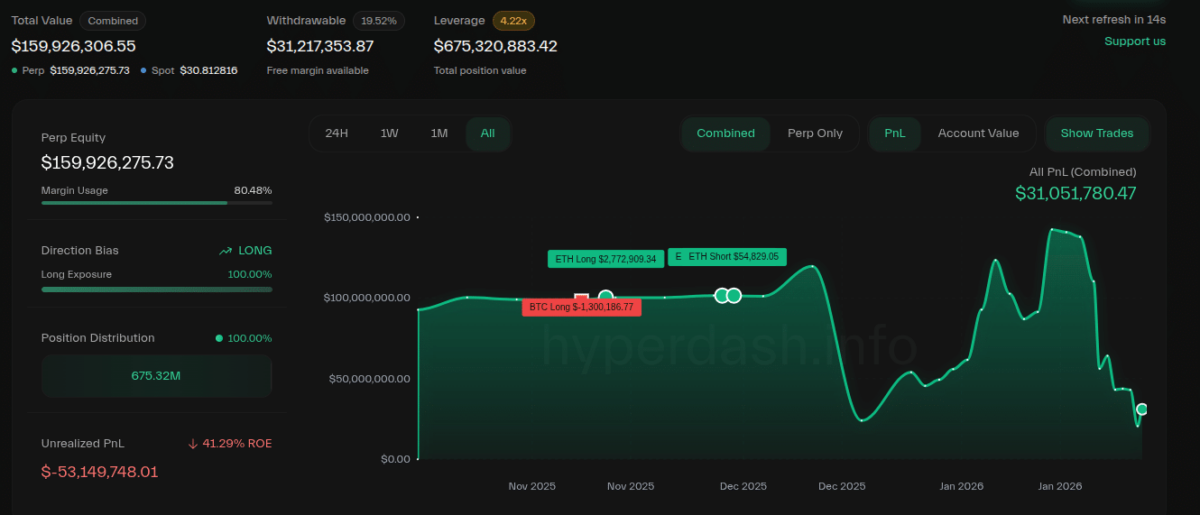

Interestingly, however, the account still has open positions of nearly $160 million in “perp equity” at unrealized losses superior to $50 million, according to onchain data Coinspeaker retrieved from HyperDash. The realized PnL of the so-called BitcoinOG sums to $31 million.

0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae (BitcoinOG) position on Hyperliquid as of Jan. 26, 2026 | Source: HyperDash

BitcoinOG, the “Trump Insider Whale”

The address entered onchain analysts’ radar following the Oct. 10-11 unprecedented liquidation event. Notably, the mysterious entity behind this account demonstrated excellent timing accuracy while shorting Bitcoin moments before the crash, raising suspicions of insider trading activity.

Arkham Intelligence called the entity “Trump Insider Whale,” as Coinspeaker reported a few days past the incident.

Later in October, the also-called “BitcoinOG” added more size to a BTC short, reportedly of $140 million. The whale then flipped to a bullish stance opening large-size long positions on the two leading cryptocurrencies and has most of these positions still open despite closing part of it on Jan. 26, 2026.

Thus, the recent capitulation sends a message of a more cautionary risk-management strategy, instead of a full shift to bearish. Nevertheless, the market and copy traders remain monitoring the address’s activity on Hyperliquid, looking for insights on the next direction both Bitcoin and Ethereum could take in the following days.

nextThe post “Trump Insider Whale” Turns Bearish, Closes BTC, ETH Long Positions at $10M Losses appeared first on Coinspeaker.

You May Also Like

XRP Holders Brace for a Critical Move

Fed Decides On Interest Rates Today—Here’s What To Watch For