U.S. Spot Dogecoin ETF Activity Remains Weak Even After 21Shares TDOG Launch

- The 21Shares Dogecoin ETF (TDOG), launched on January 22, fell in early trading, leading all Dogecoin ETFs.

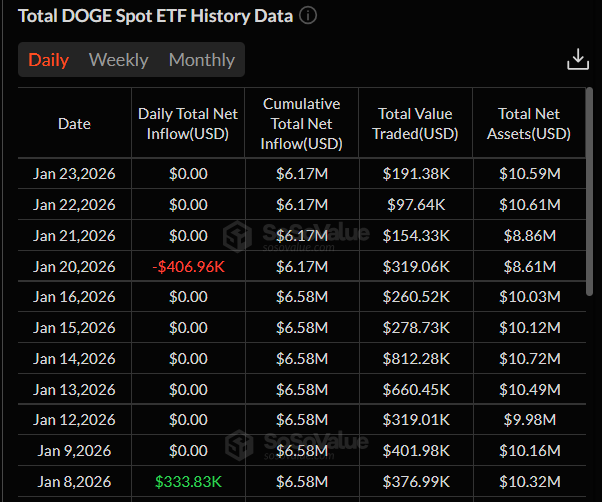

- Across U.S. spot Dogecoin ETFs, no inflows have been recorded over the past week.

The broader crypto market interest in meme coin Exchange-Traded Funds (ETFs) has remained subdued for over a week. This subdued sentiment persists even after asset manager 21Shares launched a Dogecoin exchange-traded fund. The launch adds to the growing list of crypto-linked ETFs, but has so far failed to trigger a major shift in investor interest.

21Shares Dogecoin ETF Falls in First Two Sessions

On January 22, House of Doge, the official corporate arm of the Dogecoin Foundation, along with merger partner Brag House Holdings, announced the launch of the 21shares Dogecoin ETF, under the ticker TDOG, as this is the only Dogecoin ETF provider endorsed by the Dogecoin Foundation.

As per the press release, the TDOG offers investors direct exposure to Dogecoin (DOGE) through a fully backed, transparent, and exchange-traded vehicle, and started trading on the same day of launch.

Contrary to expectations, the 21Shares Dogecoin ETF (TDOG) performed poorly on its first day of trading, signaling muted investor interest in the product. As per the SoSoValue data, TDOG saw a decline of roughly 0.07% on January 22 rather than any inflows.

Then, on January 23, the second day of trading, 21shares showed a decline of about 0.24%, which leads all three Dogecoin ETFs, with Bitwise Dogecoin ETF declining by 0.15% and Grayscale Dogecoin Trust ETF declining by 0.12%. Thus, there are still no positive or negative flows recorded across all funds of the U.S. spot Dogecoin ETF, as per the SoSoValue data.

Zero Inflows Over the Past Week

This weakened performance has been observed throughout the week. Across all U.S. spot Dogecoin ETFs, have reported zero inflows over the last week. As the last positive flow was seen in the Dogecoin ETF on January 8, around $333.9K.

Source: SoSoValue

Source: SoSoValue

With that, this week’s cumulative total Net Inflow stands at $6.17 million. Before that, on January 2, the ETF saw its largest inflows of about $2.3 million. Overall, the muted response highlights the inherently volatile nature of meme coins, even as meme-based products continue to expand in the regulated ETF market.

Highlighted Crypto News Today:

US SEC and CFTC to Discuss Crypto Harmonization Ahead of Wall Street Week

You May Also Like

Silver Breaks $100, but Selling Physical Metal Isn’t as Simple as It Sounds

Victim disarmed 'before first shot was fired' in latest agent-involved killing: report