Bitcoin ETF Outflows Hit Two-Month Highs as BTC Faces Pressure

Over the past week, US Bitcoin ETFs recorded outflows of $1.22 billion, marking the largest weekly decline in the past two months since November 2025.

The data indicates waning institutional sentiment, as bullish investors have repeatedly failed to push Bitcoin BTC $88 781 24h volatility: 0.6% Market cap: $1.77 T Vol. 24h: $39.11 B above the $100,000 mark.

From a weekly high above $97,000, Bitcoin has dropped nearly 9% and is currently trading around $89,000.

Bitcoin ETF Outflows Show Lack of Institutional Interest

A net $1.22 billion flowed out of the market over the four days through January 22, including $479.7 million on January 20 and $708.7 million on January 21, according to data from Farside Investors.

The pace of outflows slowed significantly during yesterday’s trading session, with just $32 million withdrawn on January 22.

The outflows have largely offset the ETF inflows from the previous week. According to Bitcoin macro strategy platform Ecoinometrics, Bitcoin ETF flows have been in a prolonged drawdown for over 100 days.

This marks the longest period of weakness for BTC ETFs since their launch.

The research firm noted that renewed macro volatility this week disrupted a brief return of inflows from last week, highlighting the continued lack of sustained demand needed for a strong BTC price recovery.

Is BTC Price Forming a Local Bottom?

Heavy Bitcoin ETF outflows have often coincided with local price bottoms. In November, a four-day net withdrawal of $1.22 billion aligned with Bitcoin forming a low near $80,000, before rebounding above $90,000 in the following days.

A similar pattern occurred in March 2025, ahead of tariff-related market turbulence linked to President Donald Trump, when Bitcoin fell to around $76,000.

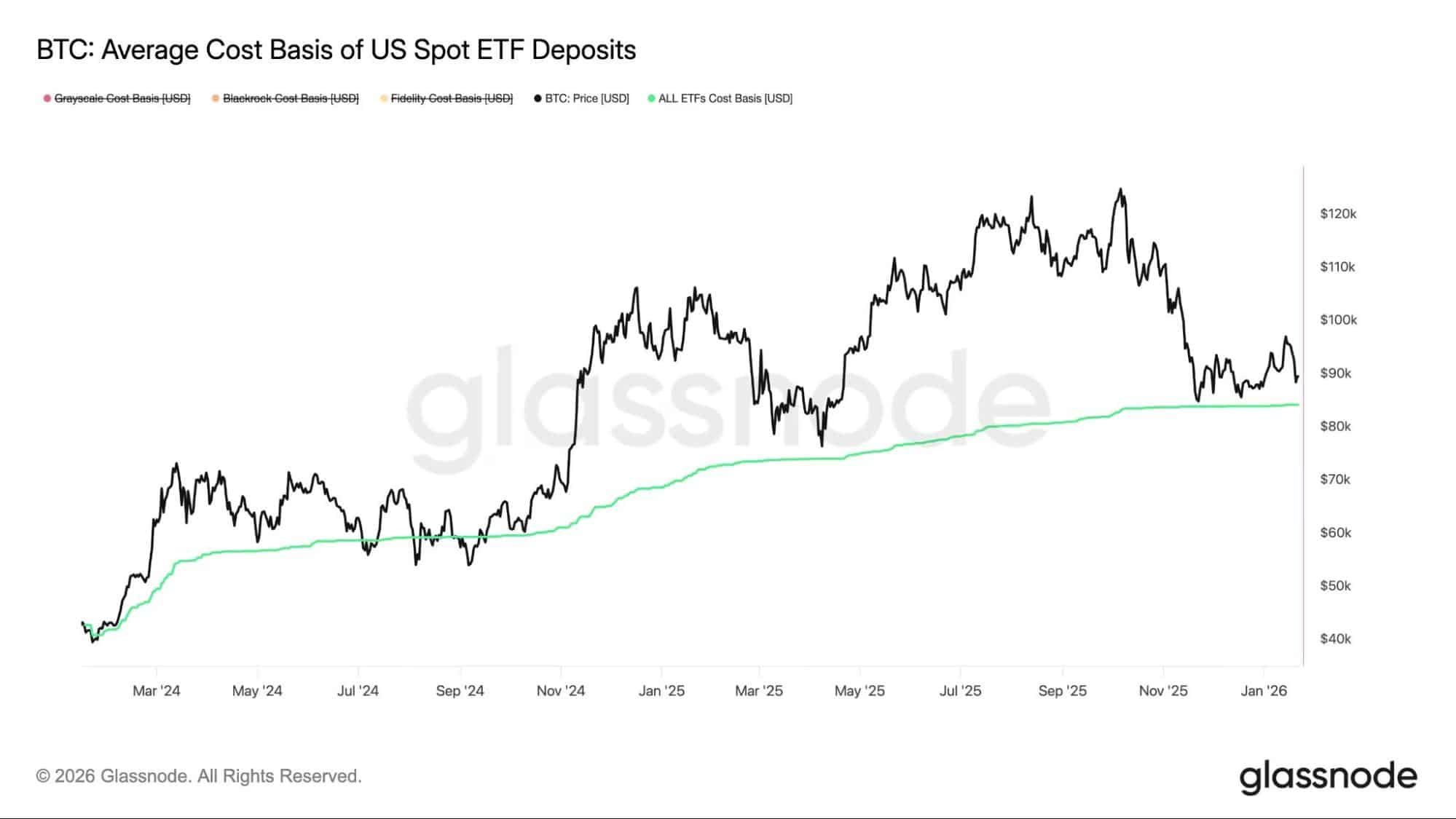

Glassnode data shows the average cost basis for ETF investors is currently $84,099, a level that has repeatedly acted as a key support zone.

Average cost basis of Bitcoin ETF deposits. | Source: Glassnode

However, the pressure on BTC investors may continue in the near term.

Crypto trader Ted Pillows noted that Bitcoin has started losing momentum after a strong start to the year.

Pillows noted that Bitcoin outperformed equities last week but has since given back most of its 2026 gains.

He added that the pullback could continue toward the $87,000-$87,500 range, which he highlighted as an important support area before any potential upside move.

nextThe post Bitcoin ETF Outflows Hit Two-Month Highs as BTC Faces Pressure appeared first on Coinspeaker.

You May Also Like

This world-class blunder has even Trump's kingmaker anguished

Gold continues to hit new highs. How to invest in gold in the crypto market?