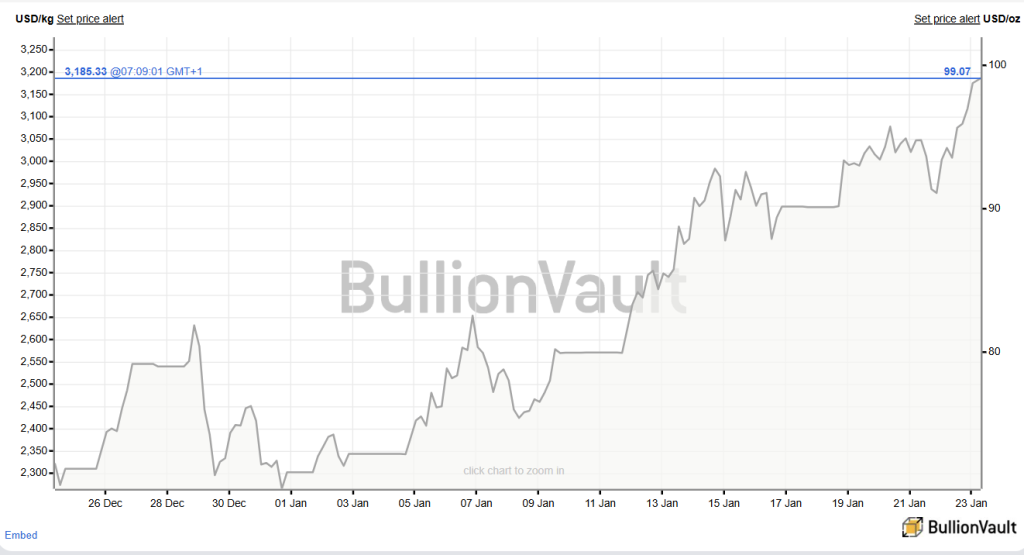

Silver Price Hits $99 as Industrial Demand Hits Record Levels

The silver price is trading near $99 per ounce, so it’s now within reach of the long-discussed $100 milestone. The move got the attention of a lot of investors, including crypto ones too. With that in mind, analysts say the rally is being driven by real supply stress.

Market analyst Ripster outlined several forces behind the surge; structural shortages, rising industrial demand, and growing pressure in the physical silver market. Together, these factors are affecting how silver is priced and traded.

A Market Running on Empty

One of Ripster’s key points is that silver has now entered its fifth straight year of supply deficit. In simple terms, the world is using more silver than it produces.

Mining output has failed to keep up with demand, partly because most silver is mined as a byproduct of other metals such as copper and zinc. That limits how quickly supply can respond, even when prices rise sharply.

On top of that, China has imposed export curbs on silver. China controls an estimated 60% to 70% of global silver processing and refining capacity. In past years, Western markets relied on Chinese exports as a form of emergency supply when inventories ran low.

That safety valve is now largely closed.

With less silver flowing out of China and global production stuck, inventories across major exchanges and vaults have been steadily drained.

Investors Treating Silver as Real Money

Ripster also links the silver rally to growing concerns about currency value and government debt.

Global debt levels continue to rise, while the Federal Reserve has signaled a shift toward lower interest rates. That combination weakens confidence in fiat currencies, especially the U.S. dollar.

In that environment, investors are returning to hard assets. Silver is being treated as monetary metal again, not just an industrial commodity.

Unlike gold, silver still trades at a fraction of its inflation-adjusted highs. That makes it more attractive to smaller investors and funds looking for a hedge that still has upside.

This renewed demand from investors is adding to pressure already coming from industrial buyers.

Physical Silver Is Becoming Hard to Get

One of the strongest signals Ripster highlights is what is happening in the physical market.

Buyers are paying large premiums to receive silver immediately rather than waiting for future delivery. That tells traders the spot market is tight and inventories are thin.

More importantly, large players in the futures market are no longer settling contracts in cash. They are demanding physical delivery instead.

That behavior creates serious stress for exchanges. When too many traders ask for real metal at the same time, exchanges are forced to source bars at almost any price.

In one reported case, a Canadian mining company received offers of $10 above market price just to deliver silver immediately.

This is not normal behavior in a healthy commodity market.

Read also: Silver Tops the List: Best Metals to Buy for the 2026 Bull Cycle

Industrial Demand Is Forcing Buyers In

Unlike gold, silver is not optional for many industries.

Source: bullionvault.com/silver-price-chart

Source: bullionvault.com/silver-price-chart

Ripster points out that silver is now a critical input for:

• Solar panels

• Electric vehicles

• Power grids

• Semiconductors

• AI data centers

Each solar panel and EV requires a fixed amount of silver. Data centers use it for high-speed connectivity and power management.

As AI infrastructure expands, demand from this sector alone is rising fast.

Manufacturers cannot wait for prices to cool down. They must buy silver at whatever price the market sets or shut down production.

That creates what analysts call forced buying.

Even as prices climb, demand does not fall. That breaks the normal supply-and-demand feedback loop that usually caps rallies.

Why Analysts Are Talking About $100 and Beyond

Major banks such as Citi and Goldman Sachs have started floating price targets between $100 and $110 per ounce.

These forecasts are not based on hype cycles or retail speculation. They are based on inventory data, industrial demand trends, and physical market stress.

With silver already trading near $99, those targets no longer look extreme.

If physical shortages worsen or futures delivery pressure intensifies, price spikes can accelerate very quickly.

Silver is a small market compared to gold. That makes it far more sensitive to supply shocks.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Silver Price Hits $99 as Industrial Demand Hits Record Levels appeared first on CaptainAltcoin.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Trump's border chief insists Americans support ICE – and is shut down by host: 'Come on!'