The Daily Volume of Liquidations on Futures Contracts Exceeded $870M

- The crypto market saw a wave of liquidations for $871 million.

- These are predominantly long positions.

- According to experts, the sell-off is provoked by Trump’s statement on duties on products from the EU.

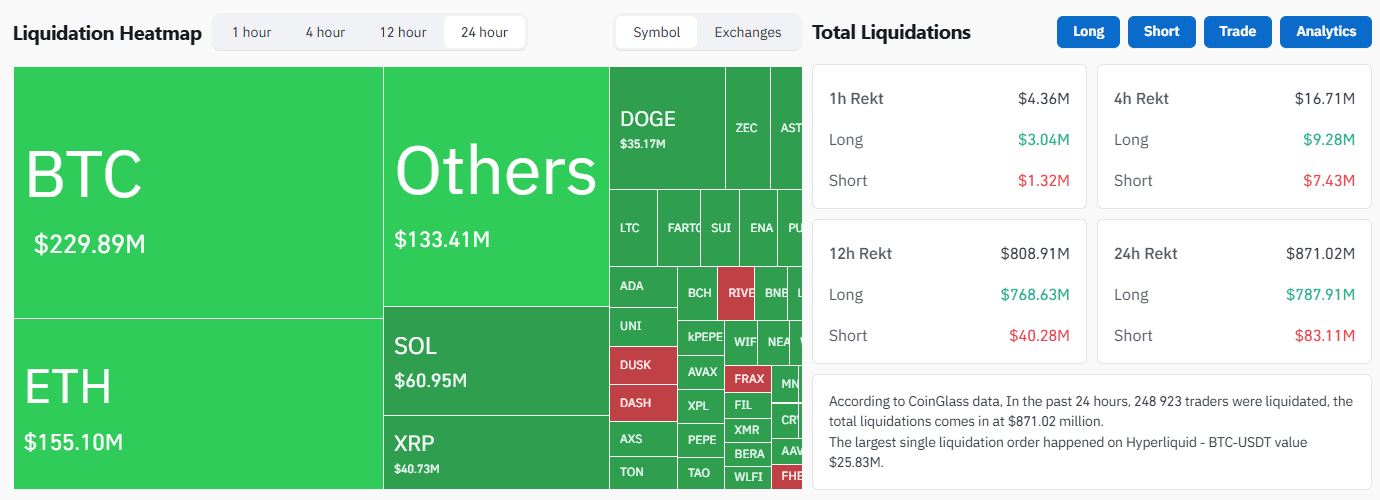

Over the past 24 hours, the volume of liquidations on crypto asset futures contracts totaled $871 million, according to CoinGlass. The wave of forced position closures was triggered by volatility, the reason for which, according to experts, is the tariff policy of US President Donald Trump’s administration.

As can be seen in the infographic below, the vast majority of losses are on long positions. In total, nearly 249,000 traders were affected by the liquidation. Bitcoin and Ethereum are at the top.

Daily liquidation volume for cryptoasset futures contracts. Source: CoinGlass.

Daily liquidation volume for cryptoasset futures contracts. Source: CoinGlass.

The largest liquidation was recorded on the Hyperliquid exchange in the BTC/USDT pair — $25.8 million. Moreover, this particular platform is the anti-leader, with Bybit in second place.

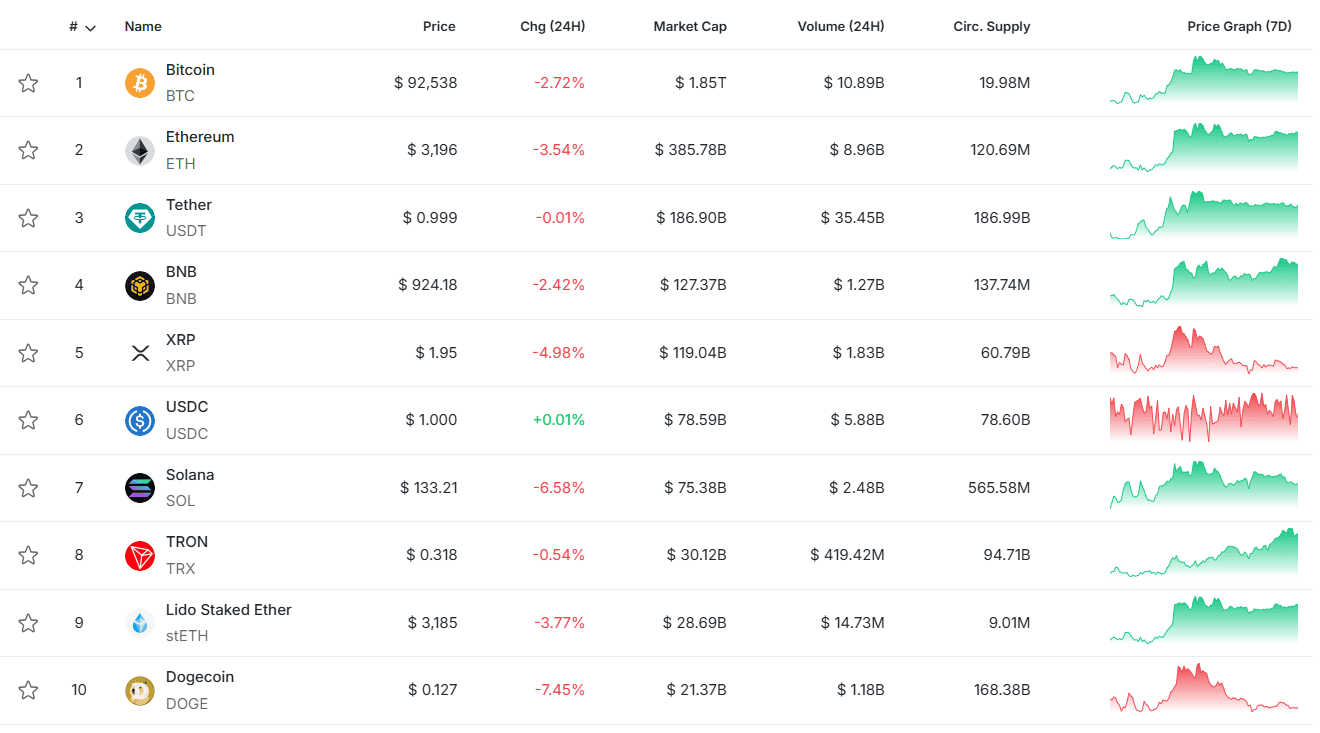

Most assets sagged on the daily chart, according to CryptoRank. Bitcoin, in particular, fell below $93,000 and Ethereum dropped below $3200.

The top 10 crypto assets by capitalization ratio. Source: CryptoRank.

The top 10 crypto assets by capitalization ratio. Source: CryptoRank.

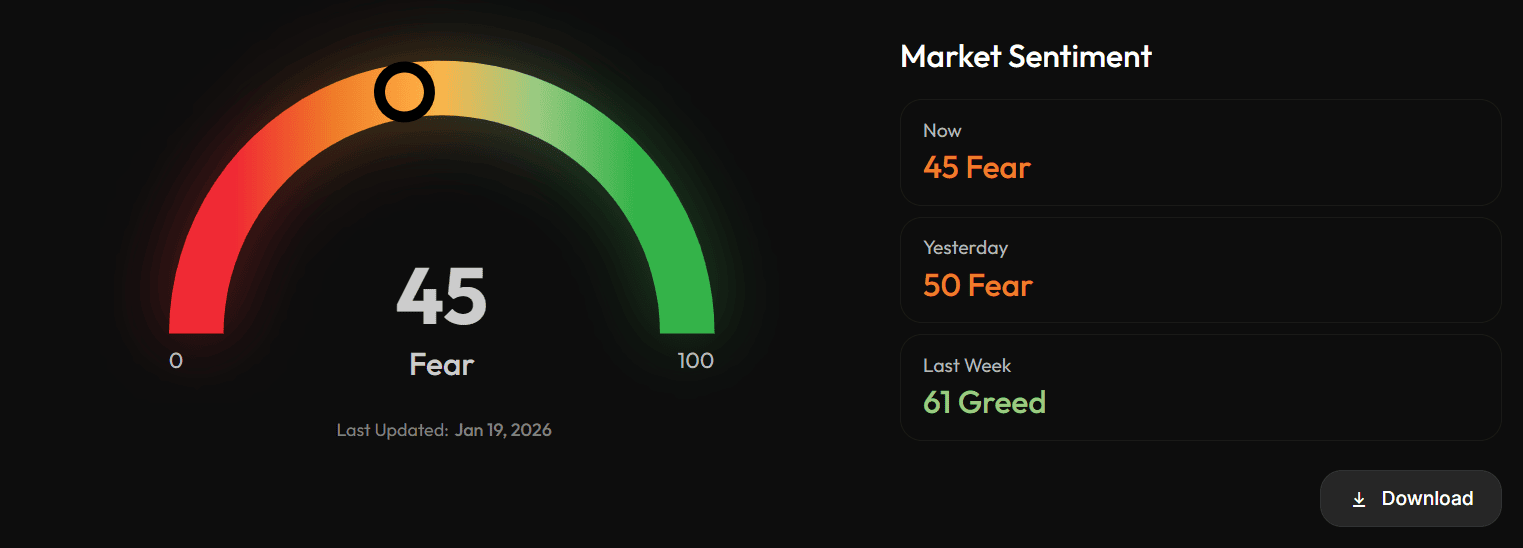

The Fear and Greed Index, which only recently hit a local high from early October 2025, has sagged 11 points relative to last week and five points in the last 24 hours.

Fear and Greed Index in the crypto market. Source: CoinStats.

Fear and Greed Index in the crypto market. Source: CoinStats.

According to experts, the sell-off is dictated by fears about the introduction of duties by the United States on imported products from a number of EU countries. Recall, Trump threatened to introduce tariffs, demanding to give America the island of Greenland.

However, specifically the cryptocurrency market remains weak relative to other high-risk assets, as the latter have shown greater resilience in the same environment, Min Jeong, a researcher at Presto Research, noted in a commentary for The Block.

You May Also Like

How Wheelchair Transportation Transforms Daily Life by Enhancing Mobility, Safety, Independence, and Social Inclusion for Individuals with Limited Mobility

CME Group to launch options on XRP and SOL futures