Shiba Inu crypto: Fear, rotation into Bitcoin, and what it means for SHIBUSDT now

Right now Shiba Inu (SHIBUSDT) is trading in a market that is clearly risk-off, and this backdrop shapes the immediate prospects for Shiba Inu crypto in a meaningful way.

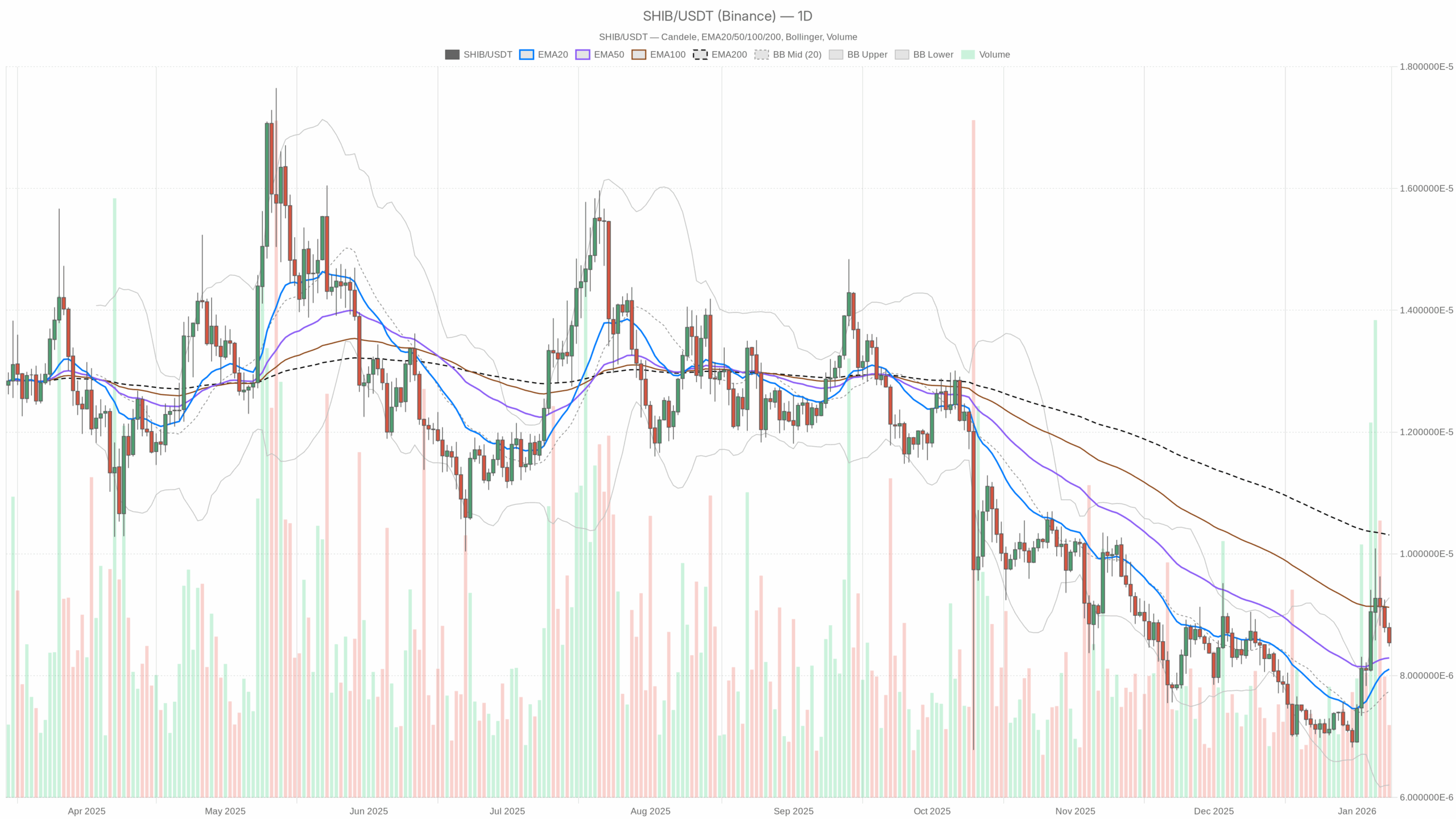

SHIB/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

SHIB/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Daily chart (D1): Shiba Inu crypto caught in the middle

The daily timeframe is what sets the macro bias for SHIBUSDT. Here the system flags the regime as neutral, and the few usable indicators back that up.

RSI (D1)

RSI 14 (daily): 56.73

Daily RSI is sitting just above the midline. That is typical of a market that recently had some upside pressure but has not entered a true trend phase. It is neither overbought nor oversold, which fits a consolidation or early balancing phase rather than a blow-off top or deep discount. For Shiba Inu crypto, this means buyers have not lost control completely, but they are not dictating the tape either.

MACD (D1)

MACD line / signal / histogram: effectively flat in the data

With MACD reading as flat, we are not seeing a strong, confirmed trend on the daily. That matches the neutral regime tag: Shiba Inu coin is not in a clean bullish expansion or a sustained bearish slide on this timeframe. The market is waiting for a catalyst, either renewed inflows into meme coins or a broader de-risking leg that drags SHIB lower.

EMAs (D1)

EMA 20 / 50 / 200 (daily): no usable values in the feed

We do not have reliable numeric levels here, so we cannot talk exact trend structure across those EMAs. Given RSI near 57 and a neutral regime, the most realistic assumption is that price is not aggressively extended away from its short- and medium-term moving averages. In practice, that often means SHIB is chopping around a value area where both bulls and bears can make a case.

Bollinger Bands & ATR (D1)

Bollinger Bands (mid/up/low) and ATR14: not populated

Without band and volatility levels, we cannot talk about exact squeeze or expansion conditions. However, from the macro environment (shrinking market volume, fear, and a dominance spike in BTC) we can infer that realized volatility in meme coins like Shiba Inu crypto tends to come in sharp clusters. There are periods of quiet churn followed by sudden, news- or liquidity-driven spikes. We are currently in a broader risk-off mood, which usually compresses speculative volatility before the next big move.

Pivot levels (D1)

Daily pivots (PP / R1 / S1): not usable from the feed

Even without exact levels, the concept still matters. In a neutral regime, price tends to oscillate around daily pivot and previous session highs and lows. For SHIBUSDT that means day traders will focus more on intraday ranges than on clean breakouts until volatility and volume return.

Daily takeaway for Shiba Inu crypto: the higher timeframe is not screaming trend in either direction. RSI slightly favors the bulls, but the absence of strong MACD momentum and the neutral regime tell us this is a balance zone. SHIB is vulnerable to macro flows: if risk comes back, there is room for a rally; if fear persists, the path of least resistance tilts lower.

1-hour chart (H1): Early signs of pressure on Shiba Inu coin

The 1-hour chart is where we start to see the risk-off mood bite and short-term pressure build.

RSI (H1)

RSI 14 (H1): 33.76

Hourly RSI is pressing down toward the oversold zone. That is the signature of short-term selling pressure: intraday traders are hitting bids, and buyers are stepping back, but it is not a capitulation flush yet. For Shiba Inu crypto this is exactly the kind of action you see when capital rotates into BTC dominance spikes, as the more speculative names get leaned on first.

MACD, EMAs, Bollinger Bands, ATR, pivots (H1)

The H1 MACD is flat in the data, and there are no usable EMA, Bollinger Band, ATR, or pivot figures. Taken together with a neutral regime label on H1, the picture is of a market drifting lower rather than trending in a clean waterfall. Shorts are comfortable pressing, but they do not have total control. Short-covering bounces can appear quickly if sentiment stabilizes.

Hourly takeaway: the 1-hour RSI is leaning bearish versus the daily neutrality. That is our first timeframe conflict: the macro is not broken, but intraday flow is clearly on the sell side.

15-minute chart (M15): Execution layer, skewed bearish

On the execution timeframe, the system already flags the regime as bearish and confirms the short-term pressure.

RSI (M15)

RSI 14 (M15): 37.59

Short-term RSI is weak but not oversold. This tends to match a grinding pullback rather than a panic. Locally, Shiba Inu crypto is trading on the back foot: rallies are being sold, and the path intraday is a slow bleed unless a sharp liquidity event, such as short covering or news, interrupts it.

Other indicators (M15)

With MACD flat and no usable EMAs, Bands, ATR or pivots on M15, we rely mainly on structure and RSI. The regime points down, momentum is soft, but there is still room for both another leg lower and a snap-back bounce. This is a trader’s tape, not an investor’s setup.

15-minute takeaway: the lowest timeframe is in a bearish regime with weak momentum. It confirms that short-term execution favors fading bounces rather than chasing upside, unless and until the intraday momentum picture flips.

Market context: why this moment matters for Shiba Inu crypto

A few macro elements are critical for understanding SHIB here and framing expectations.

- Bitcoin dominance ~56.8%: Capital is concentrating in BTC, which usually starves meme coins of flows. Historically, Shiba Inu price rallies struggle to sustain when BTC dominance pushes higher.

- Total market cap -2.8% in 24h, volume -15.9%: This is classic risk-off, not a one-coin story. Reduced turnover means breakouts, up or down, are more likely to be illiquid spikes than well-supported trends.

- Fear & Greed at 28 (Fear): Investors are defensive. In this mood, narratives like “Shiba Inu could reach $0.0001” or “will Shiba Inu coin reach 1 cent” attract more skepticism than capital, unless backed by fresh catalysts.

- Regulatory and security overhang: Headlines on tax crackdowns and physical attacks on crypto holders reinforce caution. That usually pushes flows into majors and stables instead of speculative meme assets.

Put simply, the environment is not friendly for a sustained Shiba Inu price rally right now. That does not prevent sharp short squeezes, but it makes them harder to sustain without a broad shift back to risk-on.

Shiba Inu coin: bullish scenario

Despite the heavier tone intraday, a constructive path for Shiba Inu crypto is still on the table, but it is conditional on several factors.

What a bullish path looks like:

- Daily momentum stabilizes and grinds higher: RSI on D1 holds above 50 and starts working toward the 60–65 area, signalling that buyers are gradually absorbing dips instead of just reacting to bounces.

- Intraday momentum flips: On H1 and M15, RSI would need to reclaim the 45–55 zone and hold there, showing that selling pressure has stopped dominating every bounce.

- Market context improves: Total market cap stops bleeding and stabilizes, while BTC dominance pauses or pulls back a bit. That would indicate altcoin risk is becoming more acceptable again.

In that environment, SHIBUSDT could first stage a mean-reversion move back toward its recent value area, roughly where the 20 and 50 EMAs sit on D1. If breadth in altcoins improves, it could then push toward a more extended leg higher. That is where narratives like a Shiba Inu price rally or breakout potential become realistic rather than purely speculative.

What invalidates the bullish scenario:

- Daily RSI losing the midline decisively and living below 45 for several sessions.

- H1 RSI staying pinned in the low 30s or dipping into the 20s without strong bounces, a sign of trend-like selling rather than a dip.

- A continued grind higher in BTC dominance alongside falling total market cap, the classic environment where Shiba Inu crypto tends to underperform badly.

If those conditions persist, the idea of an imminent sustained Shiba Inu price rally becomes weak. At that point, any spikes are more likely to be short squeezes than the start of a broader uptrend.

Shiba Inu coin: bearish scenario

The short-term data leans in this direction, because intraday momentum is soft and risk appetite is poor across the board.

What a bearish path looks like:

- Hourly and 15-minute momentum stay heavy: RSI on H1 hangs in the low 30s, M15 ranges in the 30–40 band, with bounces quickly sold.

- Daily regime turns from neutral to bearish: Even without explicit EMA data, you would see this through multiple red daily candles, failed rallies, and RSI sliding from the high 50s down toward 40.

- Macro risk-off deepens: Total market cap continues to lose ground and volume remains depressed, while BTC dominance either holds or climbs. That is the classic environment where traders systematically derisk altcoins.

In that case, Shiba Inu crypto drifts lower, respect for support levels weakens, and the market starts to ask once again whether “is Shiba Inu coin dead?” To be clear, death narratives are usually exaggerated for volatile meme assets, but under that scenario SHIB becomes a liquidity source, not a destination.

What invalidates the bearish scenario:

- H1 RSI snapping back above 45–50 and staying there, showing that dip buyers are finally stepping in.

- Daily RSI defending the mid-50s or quickly reclaiming it after any pullback.

- A visible improvement in total crypto market cap and breadth, with altcoins catching a bid instead of just following BTC’s lead.

If those shifts appear, aggressive shorts in SHIBUSDT become vulnerable to a squeeze, especially given how quickly sentiment can flip in meme coins and similar assets.

Positioning around Shiba Inu crypto: how to think about risk

Across timeframes, here is the core tension that defines current positioning.

- Daily (macro) bias: neutral – the higher timeframe is not broken; SHIB is not in a confirmed downtrend or uptrend.

- Hourly and 15-minute: leaning bearish – intraday flow is defensive, with sellers in control of short-term direction.

That gives traders a classic setup conflict and forces a choice of style.

- Momentum traders may look to sell bounces on the low timeframes as long as H1 and M15 momentum stay weak and the market backdrop is fearful.

- Mean-reversion traders will be watching for signs of exhaustion on intraday charts, especially if H1 RSI dips into oversold territory while daily RSI remains robust near the mid-50s.

Volatility and uncertainty deserve respect here. With volumes down and fear present, Shiba Inu price moves can be gappy and news-sensitive. Sharp wicks both up and down are likely, especially around broader market headlines or sudden moves in Bitcoin.

None of this is a guarantee in either direction. The data right now says: macro balance, micro pressure. If the market mood improves, Shiba Inu crypto has room to mean-revert higher. However, if fear persists and BTC keeps absorbing liquidity, SHIBUSDT remains vulnerable to a deeper grind lower before any talk of sustained recovery becomes plausible.

If you want to monitor markets with professional charting tools and real-time data, you can open an account on Investing using our partner link:

Open your Investing.com account

This section contains a sponsored affiliate link. We may earn a commission at no additional cost to you.

This analysis is an informational market commentary, not investment, tax, or legal advice. Cryptoassets are highly volatile and can result in total loss. Always conduct your own research and consider your risk tolerance before making trading decisions.

You May Also Like

UK FCA Plans to Waive Some Rules for Crypto Companies: FT

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy