Memecoin Current Status Analysis: Market Sentiment is Low but Data is Good

Author: Nico , Crypto KOL

Compiled by: Felix, PANews

Recently, many people on social media have declared that Memecoin is "dead."

Memecoin is not trading as well as it has been in previous months, and Trumpcoin ($TRUMP) has definitely reached a local peak in Memecoin awareness, trading volume, and liquidity appeal.

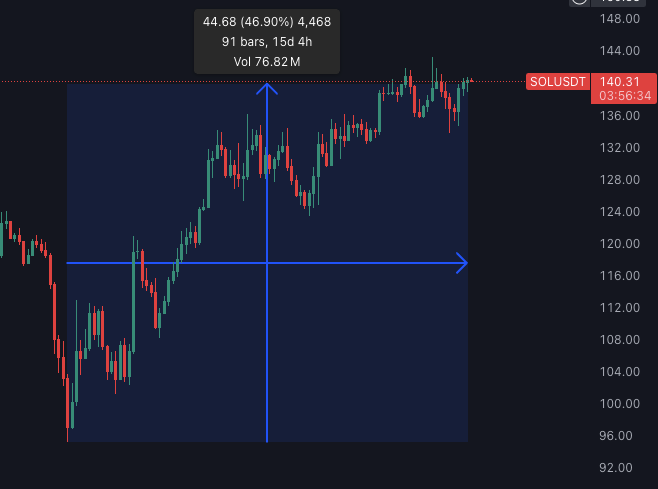

However, at the time, SOL was at a high of $290, BTC was over $100,000, and the bull market was in full swing. Since then, BTC has fallen back to $74,000-88,000, and SOL has hit a local low of $95. However, SOL has now exceeded $140 (up 46% in just 15 days), and BTC has also risen back to over $90,000. Let's reassess the current situation together.

Despite the lower SOL price, generally bearish market and low sentiment, the data tells a different story, here is the data so far in April:

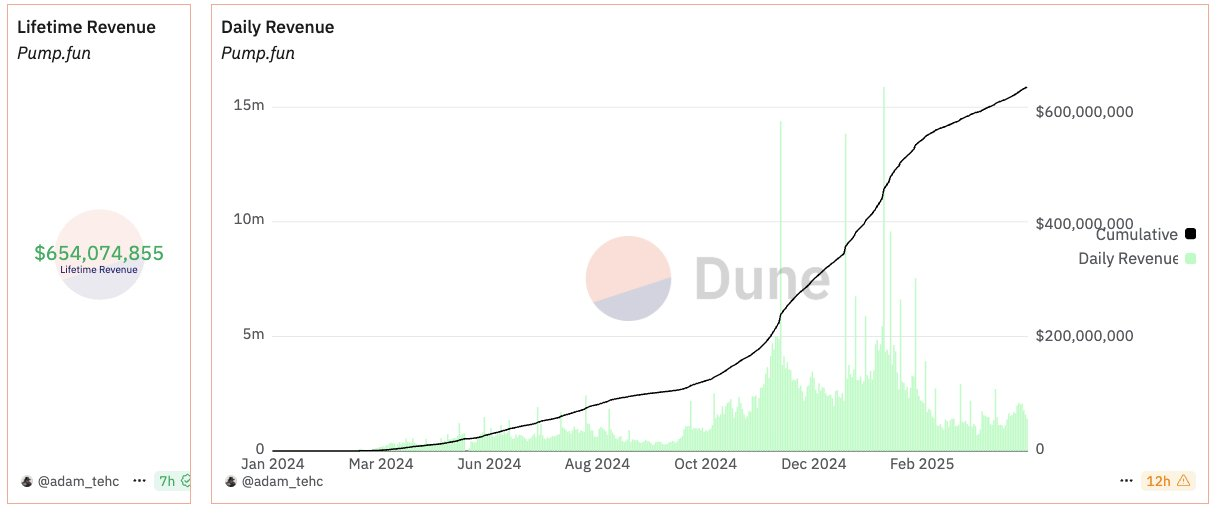

Pump.fun has generated approximately $650 million in revenue to date. Daily revenue in April was between $1 million and $2.7 million, with an average in the high range of $1.5 million to $2 million.

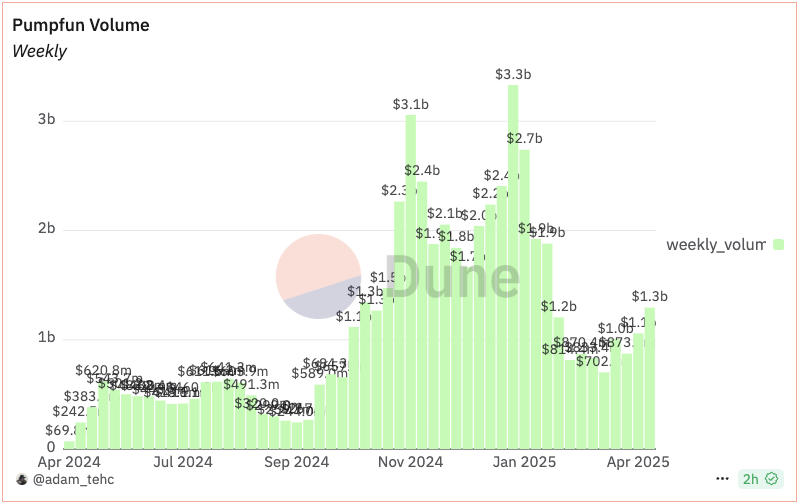

As SOL prices moved higher and trading volume dropped during the Trump incident, trading volume started to pick up significantly in April, and with the launch of Pumpswap and almost instant migration , the trading experience became smoother. This can be seen in the increase in total weekly trading volume.

Related reading: From former allies to tit-for-tat, data reveals the essence of the “civil war” between Pump.fun and Raydium

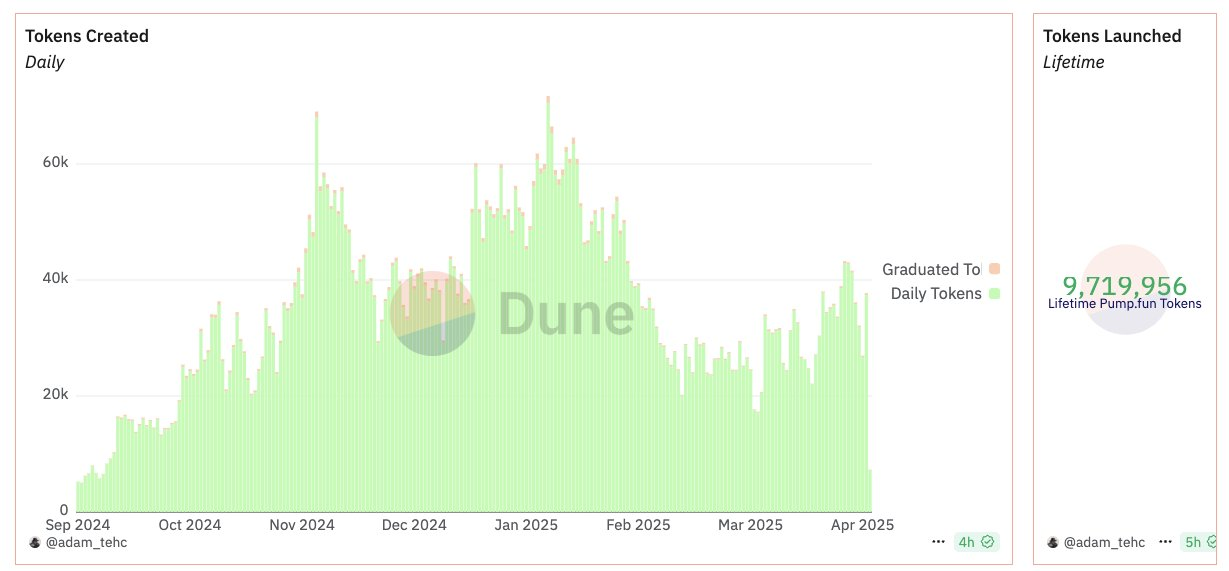

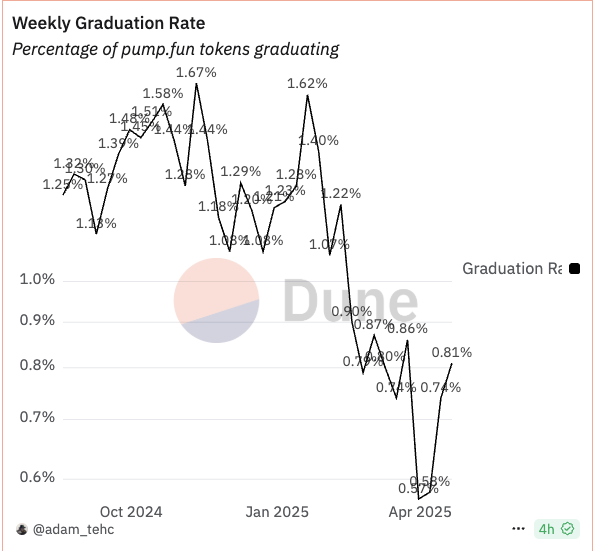

9.7 million tokens have been created to date, with 20,000 to 40,000 tokens launched per day in April and 100 to 350 tokens graduating per day (a graduation rate of 0.4% to 0.8%).

The decline in graduation rates over time correlates with a decrease in the number of users and trading volume, indicating a higher rate of PvP behavior amid intense competition. Small groups hoard supply when new projects go online, dump each other, and decide to exit early when they are unable to attract the additional liquidity required to bond tokens.

Active Users

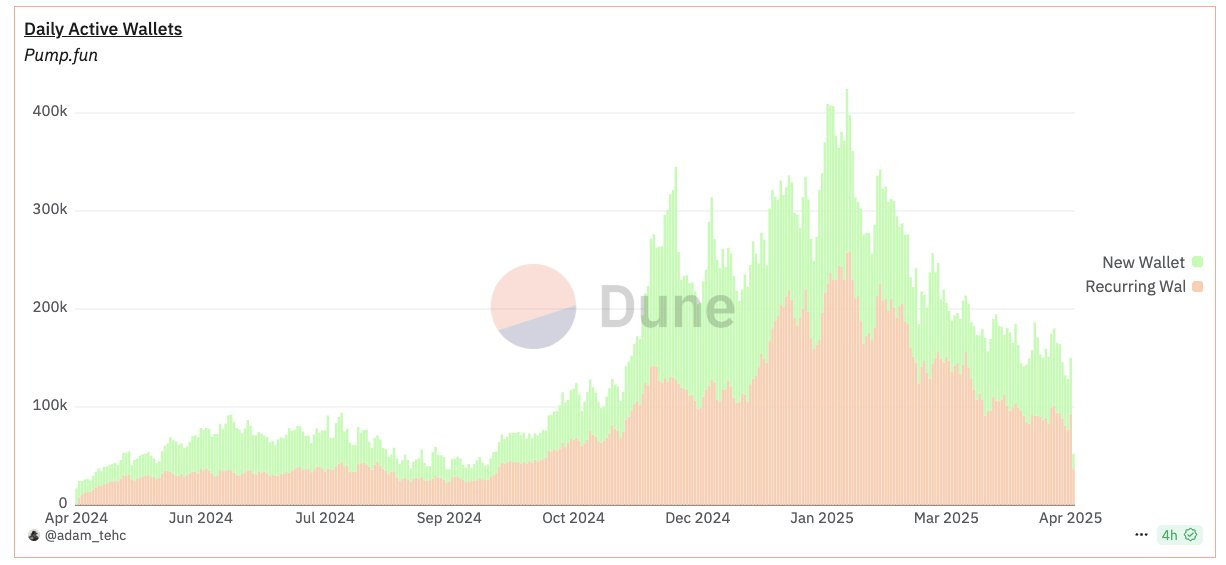

During its peak period between December 2024 and February 2025, Pump.fun Memecoins had an average of 200,000 to 400,000 daily trading users. It has been on a downward trend since then and has been below 200,000 for the past two months.

Currently, the number of daily active wallets is stable at around 150,000, with a roughly equal number of existing/reused wallets and new wallets. It is important to note that most miners conduct transactions on multiple wallets and will at least occasionally change their active wallets.

Trading robot data

As we all know, most of the Memecoin trading activities take place on the top five platforms, such as Axiom, BullX, Photon, GMGN, and Trojan. The details are as follows:

Platform | Daily Active Users (DAU) | Daily Trading Volume | Daily Trading Transaction Count

Axiom: 17,000-30,000 daily active users | $20-33 million in daily transactions | 700,000-1.5 million transactions per day

Bullx: 20,000-30,000 daily active users | $20-33 million in daily transactions | 200,000-400,000 daily transactions

Photon: 18,000-27,000 daily active users | $30-50 million in daily transactions | 250,000-350,000 daily transactions

GMGN: 10,000-18,000 daily active users | $8-20 million in daily transactions | 180,000-290,000 transactions per day

Trojan: 14,000-25,000 daily active users | $7 million-30 million in daily transactions | About 200,000 transactions per day

This is roughly in line with what we’ve seen, with an increase of around 100k+ users and $100m+ in daily volume.

Lifetime Fees and AUM ( SOL on the Platform )

Bullx: $186 million | Assets under management: 215,000 SOL, approximately $30 million

Axiom: $39 million | Assets under management: Unknown, but estimated to be similar to Bullx, possibly slightly lower

Photon: $382 million | Assets under management: 539,000 SOLs, approximately $82.6 million

GMGN: $66 million in fees | Assets under management: Unknown, but estimated to be at least half of Bullx.

The value of liquid SOL circulating in the Memecoin space on relevant platforms and others is likely to be over $200 million.

PumpSwap

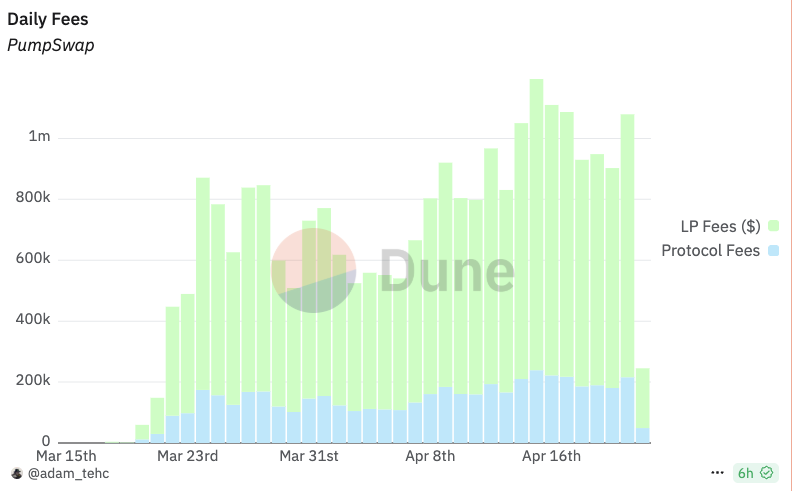

Pumpswap has daily trading volume between $300 million and $480 million, accounting for 9% to 19% of Solana’s decentralized exchange trading volume. Since all new Pump.fun tokens are issued and traded on Pumpswap, this means that a large amount of trading still occurs in early-issue tokens traded through Raydium/Meteora.

Launching Pumpswap was a smart move by the Pumpfun team, who charge a 0.25% fee, of which 0.02% goes to liquidity providers (LPs) and 0.05% goes to the protocol.

In the first month or so after going live, Pumpswap generated about $25 million in total fees ($100,000 to $240,000 per day), of which LPs received about $20 million and the remaining $5 million was allocated to the protocol.

Expect this number to continue growing as Pumpswap gains market share (which has been steadily increasing) as people tend to trade new tokens rather than old ones.

Prioritizing new coins fits in with the view of how the Memecoin space will continue to evolve. It’s no secret that the Memecoin space has become increasingly competitive lately, as the remaining active players are “battle-hardened” veterans who have held their ground during the tough times of lower SOL prices, reduced trading volumes, and fewer users.

The Memecoin space relies on new liquidity from new users, initially from more sober crypto investors/industry participants who “capitulate” as their altcoin holdings continue to lose value and seek faster gains.

As the entire market continues to grow, retail investors are also beginning to get involved.

Players are tired of DeFi tokens that require careful management and in-depth knowledge of protocol design and dynamics. Memecoin is still the preferred tool for speculation, while Solana is like a casino/banker. They are easy to understand, have a low barrier to entry, and have higher returns for new traders due to their highly asymmetric upside. New things happen every day, and everything can be tokenized, with infinite content: people, content, events, memes, etc.

It has just begun.

Related reading: Local frenzy or full recovery? Data analysis of Solana chain MEME whale movements and market differentiation

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise