BTC Price Holds Firm as Altcoins Bleed—Is the Capital Rotating Back to Bitcoin?

The post BTC Price Holds Firm as Altcoins Bleed—Is the Capital Rotating Back to Bitcoin? appeared first on Coinpedia Fintech News

December has been a hopeful month for the crypto markets, as the trend tends to turn bullish, which further transforms into a strong ascending trend or bull run too. Unfortunately, the cycle seems to have changed this time, as Bitcoin recorded one of the worst Q4 since 2018, which is raising concern for the upcoming price action. However, the BTC price seems to be stuck within a tight range, displaying some strength, while the altcoins, like Ethereum, are stuck below $3000, XRP flashes the possibility of heading to $1.5, and Chainlink is losing support.

With this, it becomes quite evident that the Bitcoin price is absorbing the selling pressure while the altcoins are failing to hold ground. Does this suggest traders have shifted their focus back to Bitcoin?

Bitcoin Is Absorbing Selling Pressure While Altcoins Underperform

Over the past 48 hours, Bitcoin has declined roughly 3–4%, while many large-cap altcoins have fallen 8–15% over the same period. This divergence reflects capital rotation rather than broad risk exit. Bitcoin continues to capture defensive flows due to its deeper liquidity and stronger spot participation. BTC spot volumes remain 20–25% higher than the combined volume of the top alt pairs, helping absorb derivatives-led selling.

The market cap gap between Bitcoin and the altcoins substantiates the claim, as both levels have diverged from each other in the past few days. Besides, altcoins lack this buffer. Order-book depth in major alts is down 30%+ compared to last week, meaning smaller sell orders are pushing prices lower. With many altcoins trading below key resistance and failing to reclaim structure, traders are selling rallies instead of adding exposure. This imbalance explains why Bitcoin is stabilising while altcoins continue to bleed.

BTC Dominance Is Quietly Rising

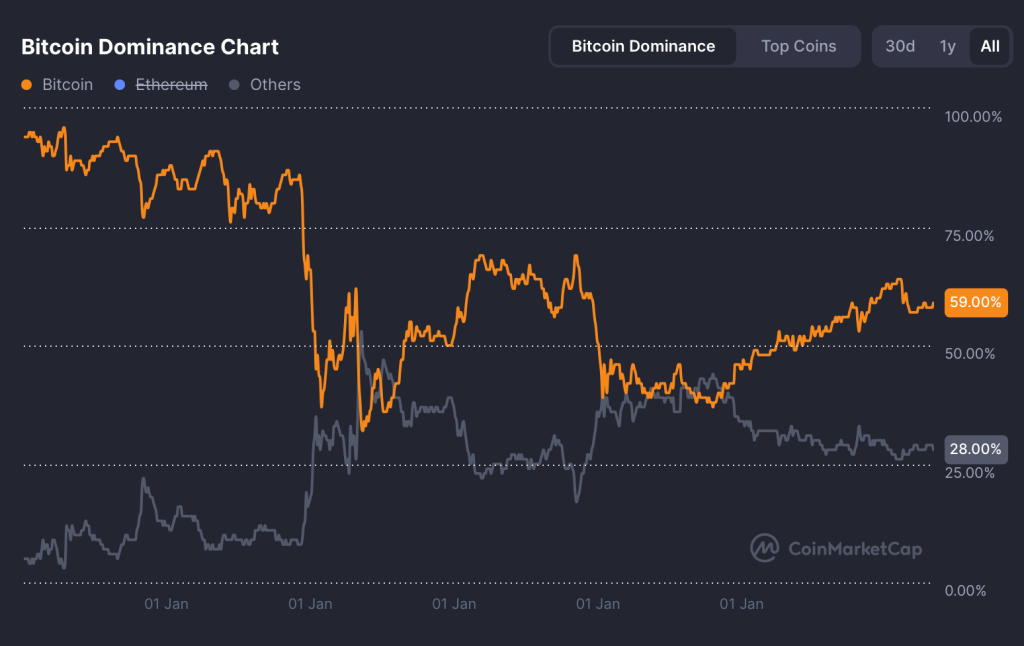

The Bitcoin dominance chart shows BTC dominance climbing toward 59%, marking a clear series of higher lows and higher highs over recent months. This confirms a sustained rotation into Bitcoin rather than a short-term spike. Importantly, dominance is holding above the 55% breakout zone, which previously acted as resistance and has now flipped into support.

From a technical perspective, this structure signals trend continuation. As long as BTC dominance remains above 56–57%, capital flow favors Bitcoin over altcoins. The declining share of “Others,” or altcoins, is now near 28%, which reinforces that altcoins are losing relative market share faster than Bitcoin during pullbacks.

Historically, phases where BTC dominance grinds higher like this coincide with altcoin underperformance and selective risk-taking, not broad market expansion. Until dominance shows rejection near the 60–62% zone, the path of least resistance remains skewed toward Bitcoin relative strength, keeping pressure on the altcoin complex.

What This Means for Traders

Rising Bitcoin dominance near 59% signals that capital is prioritising liquidity and safety over beta. In this phase, Bitcoin tends to absorb selling pressure while altcoins continue to underperform, making selective exposure more important than broad participation. Traders should expect rallies in altcoins to face supply unless BTC dominance stalls or reverses below the 56–57% zone. Until that happens, trading Bitcoin or staying defensive offers a better risk-reward than chasing oversold alt setups.

You May Also Like

CME Group to launch options on XRP and SOL futures

The Rise of the Heli-Trek: How Fly-Out Adventures Are Redefining Everest Travel