Crypto Market Under Pressure—Why Bitcoin and Ethereum Plunge While Gold and S&P Mark ATH

The post Crypto Market Under Pressure—Why Bitcoin and Ethereum Plunge While Gold and S&P Mark ATH appeared first on Coinpedia Fintech News

The crypto market has come under pressure today, with Bitcoin, Ethereum, and major altcoins like XRP experiencing bearish pressure. While the price action may look concerning, this decline is not being driven by panic or bad news. Instead, market data points to a technical reset driven by leverage, liquidity conditions, and short-term positioning. The pullback comes at a time when Gold made a remarkable rise to $4500 while the S&P 500 closed above 9000 for the first time in history.

Understanding these factors is crucial in determining whether this move signals a deeper weakness or a temporary pullback.

Leverage Unwind Is Driving the Sell-Off

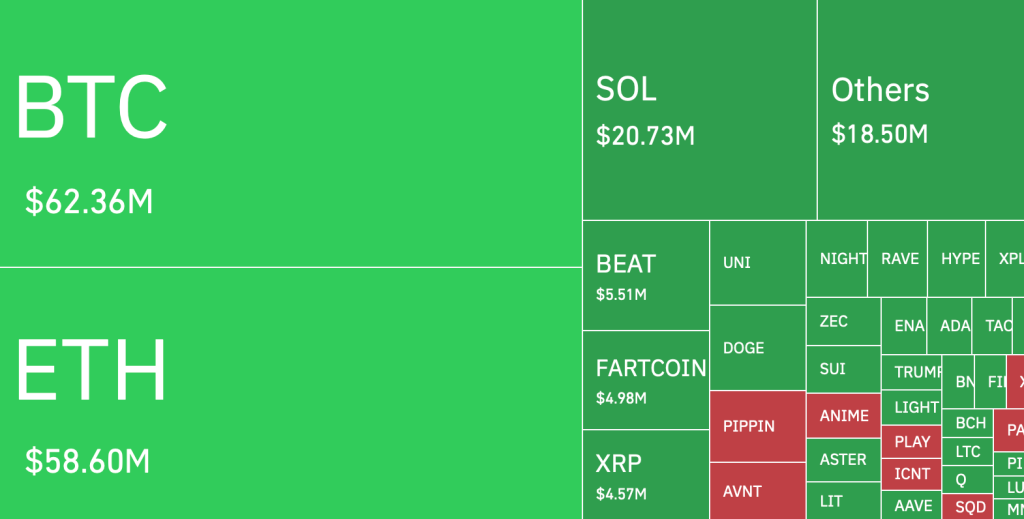

Over the last 24 hours, more than $180–$220 million in leveraged positions were liquidated across the crypto market, with Bitcoin and Ethereum accounting for over 60% of the total. BTC alone saw roughly $65–75 million in liquidations as the price slipped below short-term support. Funding rates, which were holding +0.015% to +0.02% on perpetuals earlier, have started compressing toward neutral. This confirms the move is driven by crowded long positioning getting flushed, not aggressive new short selling.

Spot Buying Has Slowed Down

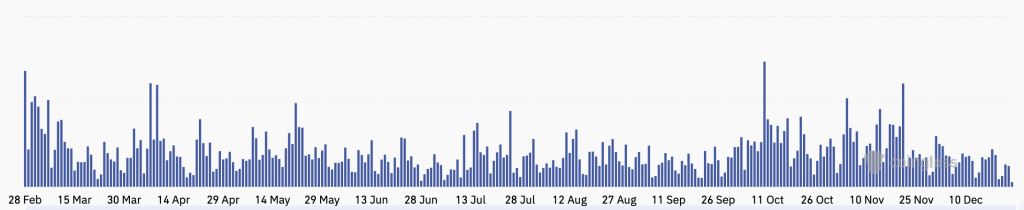

Spot market data shows declining follow-through. Bitcoin spot volumes are down roughly 25–30% week-on-week, while exchange net flows remain neutral rather than strongly positive or negative. ETF-related inflows have slowed compared to last week, reducing passive bid support. This means the derivatives selling pressure is not being absorbed quickly by spot buyers. When leverage dominates volume and spot participation fades, price typically drifts lower until forced selling exhausts itself.

What’s Next for the Bitcoin Price & Crypto Markets?

Crypto markets are pulling back at a time when Gold and the S&P 500 are printing or holding near all-time highs, and that contrast matters. Traditional markets are pricing in macro stability and controlled easing, while crypto is still digesting excess leverage from the recent rally. In other words, risk is being rewarded in slower-moving assets, while high-beta crypto is forced to reset positioning first.

With U.S. initial jobless claims due in the next few hours, traders are reducing exposure rather than pressing fresh longs. Any upside surprise in claims could reinforce recession fears and tighten risk appetite further, keeping crypto under pressure. Until macro data removes uncertainty and leverage fully resets, crypto remains in consolidation mode, not trend acceleration.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Liquidity Boost Stabilizes Solana-Based Stablecoin USX After Market Drop