From First BTC Donation to Bitcoin Fund: Save the Children Expands Crypto Strategy

The international NGO, Save the Children, has introduced a Bitcoin Fund designed to hold bitcoin BTC $91 402 24h volatility: 2.4% Market cap: $1.82 T Vol. 24h: $50.80 B donations for multiple years, test blockchain-based payment tools, and speed up how money reaches families in crises where traditional finance fails. The announcement was made on December 11.

Built in partnership with digital asset firm Fortris, the fund departs from the usual practice of converting crypto donations to fiat instantly. Instead, it allows the charity to time conversions and use BTC directly within pilot programs, according to their blog.

How the Bitcoin Fund Will Operate

The fund is pitched as a “bitcoin-powered humanitarian solution” aimed at cutting delays common in cross-border aid transfers and enabling new models such as digital wallets, vouchers, and stablecoin distributions.

The NGO has time to test operational uses of bitcoin beyond fundraising. A collaboration with Fedi in 2024 began piloting community wallets and low-fee bitcoin transfers as part of cash assistance programs, aiming to give participants more control over how they receive and spend aid.

The new Bitcoin Fund is expected to connect with such pilots and could later be used in domestic emergencies, such as US hurricanes or wildfires, to move value to families faster than traditional banking channels.

Save the Children Has a Long History With Bitcoin

This latest step follows a long track record with crypto. Save the Children US accepted its first bitcoin donation in 2013 during the Typhoon Haiyan response, becoming the first international NGO to do so. Since then, the organization has expanded its crypto rails through partners like The Giving Block, accepting donations in dozens of cryptocurrencies and, by early 2024, raising nearly $8 million in crypto to fund projects in more than 100 countries.

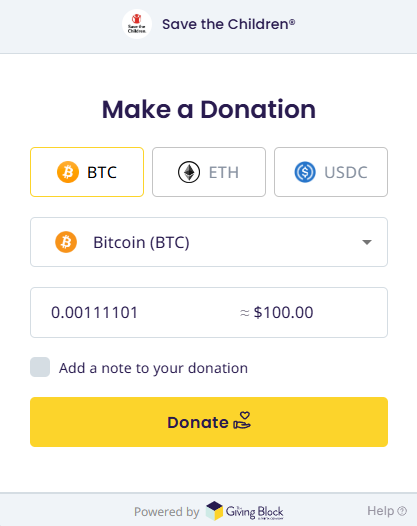

Currently the NGO accepts donations in almost any crypto | Source: Save the Children

Save the Children’s appetite for bitcoin comes from a position of scale. The global movement, through 30 member offices and Save the Children International, supported around 66.1 million people in 113 countries in 2024, including 41.2 million children, according to their 2024 annual report.

With operations spanning conflict zones, climate disasters and protracted crises, the group has become one of the most visible child-focused NGOs worldwide and is increasingly cited as a pioneer in crypto philanthropy among large charities.

nextThe post From First BTC Donation to Bitcoin Fund: Save the Children Expands Crypto Strategy appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip