Sui (SUI) Soars by 11% Daily: Major Bull Run Incoming?

The cryptocurrency market has shown signs of revival over the past 24 hours, with SUI among the top performers.

Its price has climbed by double digits within the timeframe, currently trading at roughly $1.53. According to some analysts, the rally might be just starting.

What’s Next?

One of the well-known market observers to touch upon SUI’s performance as of late is the X user Ali Martinez. He claimed the asset has reached a key support trendline that has held since 2023. He noted that the previous two tests of that zone triggered massive pumps of 450% and 750%, suggesting that if history repeats, the valuation could soon skyrocket above $4.

Michael van de Poppe also chipped in. He predicted that SUI will outperform many cryptocurrencies in the near future, “as people tend to go back to the ones that have been performing over the past few years.”

He pointed out the recent launch of Grayscale’s Sui Trust, arguing that the current condition could be “an ultimate opportunity” for investors to increase their exposure to the asset.

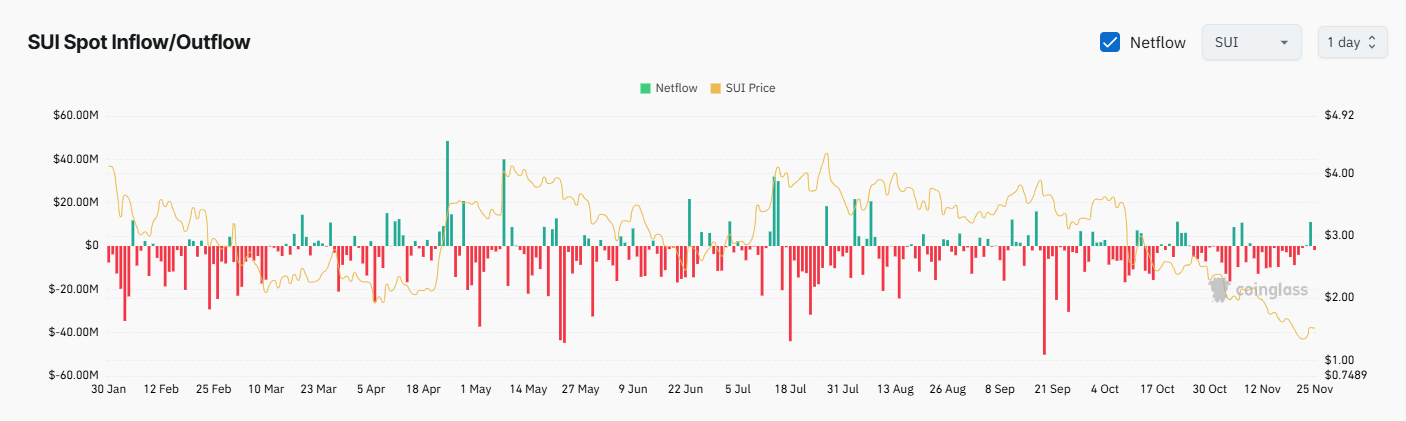

SUI’s exchange netflow supports the bullish theory. In the last few weeks, outflows have dominated over inflows, meaning some investors have moved their holdings from centralized platforms to self-custody solutions. This, in turn, reduces the immediate selling pressure.

SUI Exchange Netflow, Source: CoinGlass

SUI Exchange Netflow, Source: CoinGlass

Jump Above $2?

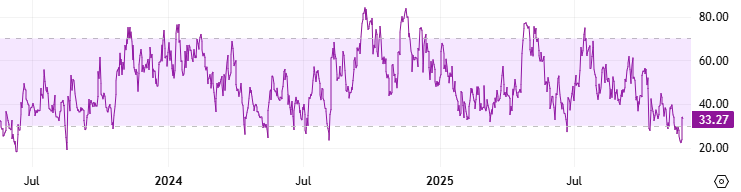

X user CryptoBullet infused additional optimism by claiming that SUI has recently reached its most oversold level on the 3-day and 1-day charts since 2023. The analyst thinks this could be a precursor of a bounce to the $1.90-$2.20 range.

According to CryptoWaves, SUI’s Relative Strength Index (RSI) is hovering around 30 on a daily scale, which aligns with the aforementioned analysis.

The metric measures the speed and magnitude of the latest price movements to give traders an idea of whether the asset is about to have a reversal moment. Ratios below 30 signal that SUI is oversold and could be due for a rally, whereas anything above 70 is interpreted as bearish territory.

SUI RSI, Source: CryptoWaves

SUI RSI, Source: CryptoWaves

The post Sui (SUI) Soars by 11% Daily: Major Bull Run Incoming? appeared first on CryptoPotato.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Your Crypto Companion: Navigating the Fast-Paced Digital Market