Educational Byte: How Fake CAPTCHAs Can Steal Your Crypto

We all know CAPTCHAs: those “I’m not a robot” boxes or image grids you click when logging in or browsing. They’re meant to block bots and make websites safer. But cybercriminals have started using deceptive versions. They’re fake CAPTCHAs that trick users into installing malware or giving away private data.

What begins as a harmless-looking verification ends up being a gateway for crypto theft, credential harvesting, or system compromise. So, we’ll explore how those fake CAPTCHAs work, the risks they pose to your crypto, and most importantly, steps you can take to defend yourself.

How the Fake Captcha Scam Works

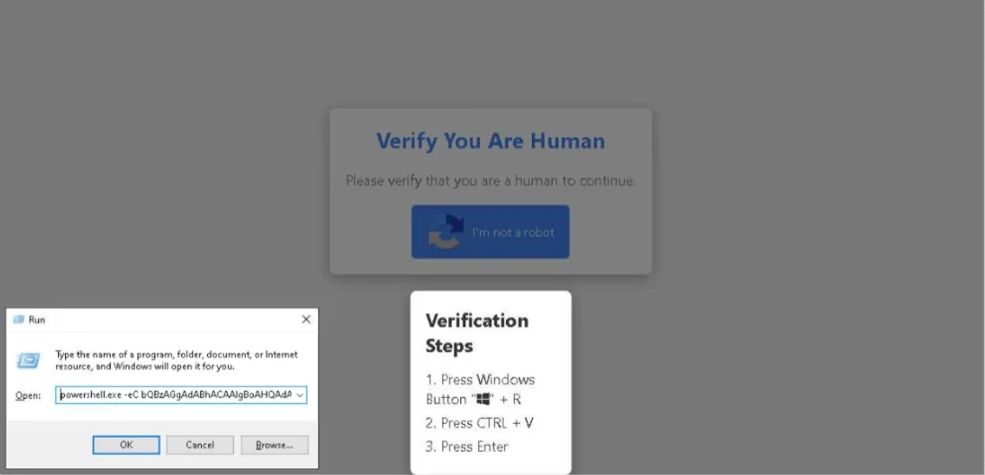

A fake CAPTCHA is crafted to look like a normal verification step, but behind the scenes, the attackers are executing a malicious plan. You click “I’m not a robot,” and the page quietly copies a command into your clipboard. Then it prompts you to paste it somewhere (often the Windows Run box) and press Enter. That simple command executes malware like Lumma Stealer or the Amadey Trojan, which harvest passwords, browser cookies, crypto wallet keys, and more. Not even a proper download is needed.

\

\ Researchers have observed this tactic being embedded into compromised websites across different industries, sometimes via ads or via third-party scripts on otherwise legitimate domains. The attack often uses fileless execution, which means the malware doesn’t leave a noticeable trace on disk, making detection trickier.

Once inside, the malware scans for browser-saved credentials, cookie data, two-factor tokens, and wallet files, and can quietly exfiltrate what it finds. The Amadey Trojan, in particular, also acts as a clipper: it detects crypto addresses already copied on the clipboard, and then replaces them with ones controlled by the hackers. This way, when you paste the address to send funds, it may not be your intended destination.

It might sound technical, but the key is that the CAPTCHA prompt acts as a lure: you believe you’re just verifying you’re human, and don’t see what’s really happening behind. Analysts saw that in some tests, 17% of users exposed to a fake CAPTCHA campaign ended up following the instructions that triggered malware. \n

Why the “I’m Not a Robot” Trick is So Effective

Fake CAPTCHAs work so well because they exploit a ritual we’ve all learned to trust. Clicking a box or selecting traffic lights feels routine, something safe and familiar. That habit makes users lower their guard. Attackers count on this automatic behavior. They mimic Google’s design style and use the same fonts and layouts.

In a way, fake CAPTCHAs are the perfect social engineering tool: they blend technical deception with psychological manipulation. People tend to associate CAPTCHAs with extra safety, just a filter that keeps bots out. That’s what makes them ideal for smuggling in the very threats they’re supposed to block. We could call this “trust hijacking”: turning a symbol of security into bait.

When the malware behind these scams targets crypto users, it’s not random. Criminals follow where the money flows, and crypto wallets are pure digital gold. Stealing one recovery phrase can be worth more than months of low-level phishing attempts. The trick’s elegance lies in its simplicity: a single click that feels harmless, leading straight into the attacker’s control.

\

How to Protect Yourself from Fake Captcha Attacks

We must be careful not to assume every CAPTCHA is safe. Here are strategies to reduce risk and keep your crypto secure:

\

-

Start by checking whether the website is known and trustworthy. If a CAPTCHA appears on an already suspicious site or seems oddly intrusive, exit immediately.

-

Always verify the URL. Misspellings, extra characters, or odd domains are warning signs.

-

Never paste commands into your system based on web prompts. No legitimate CAPTCHA ever asks you to run something manually.

-

To avoid incidents when pasting complex crypto addresses, you can use easier shortcodes, usernames, and textcoins in Obyte to send and receive funds.

-

You can also use textcoins in Obyte to keep most of your funds offline, safe from any kind of hacking attempt.

\

- Use up-to-date antivirus or endpoint protection that can block or detect malicious scripts or PowerShell executions.

- Consider browser extensions or tools that block scripts or clipboard manipulation on untrusted pages.

- Enable strong security habits: keep your software patched, distribute your funds across different wallets, and avoid storing private keys in digital form.

Fake CAPTCHAs are a cunning twist in the ongoing battle between cybercriminals and everyday users. For those holding or handling crypto, the stakes are high. Stay alert, follow the protective steps above, and treat any CAPTCHA prompt outside normal activity with skepticism.

:::info Featured Vector Image by pikisuperstar / Freepik

:::

\n

\

You May Also Like

Astonishing Kevin Durant Bitcoin Fortune: A Decade-Long Hold Yields 195-Fold Return

Vitalik Buterin Supports Native Rollup Integration on Ethereum