Chainlink Recovery Incoming? Key Levels Identified for LINK’s Next Rally

- Technical indicators point to possible Chainlink price upside as liquidity clusters sit above the current price, and LINK has bounced from the key $12.67 support zone.

- A new Grayscale report emphasizes Chainlink’s expanding role in tokenization and traditional finance integrations, calling LINK a strong candidate for diversified crypto portfolios.

Amid the broader crypto market recovery, Chainlink (LINK) is also showing signs of a bounce back, raising hopes of a rally ahead after a 25% drop over the past month. Investors have begun reaccumulating Chainlink (LINK), though the renewed buying interest has yet to translate into a price upside.

Data shows Binance users are driving the uptick in accumulation, with analysts eyeing a potential shift in momentum.

Binance Whales Step In To Buy Chainlink

Chainlink (LINK) is seeing a fresh wave of whale inflows, with large holders increasing their positions over the past 24 hours, as mentioned in our previous story. The top 10 wallets drove the latest accumulation, lifting the monthly average inflow to 3,150 LINK, valued at roughly $42,000 at current prices, as per data from CryptoQuant.

Source: CryptoQuant

Source: CryptoQuant

The renewed interest comes as LINK trades 53% below its August peak, prompting investors to view the pullback as a re-entry opportunity. Derivatives data also reflects strengthening sentiment, with liquidity improving as traders position for potential upside.

On Binance, the Taker Buy Sell Volume has risen to 2.21, indicating that taker buyers are gaining control of the market.

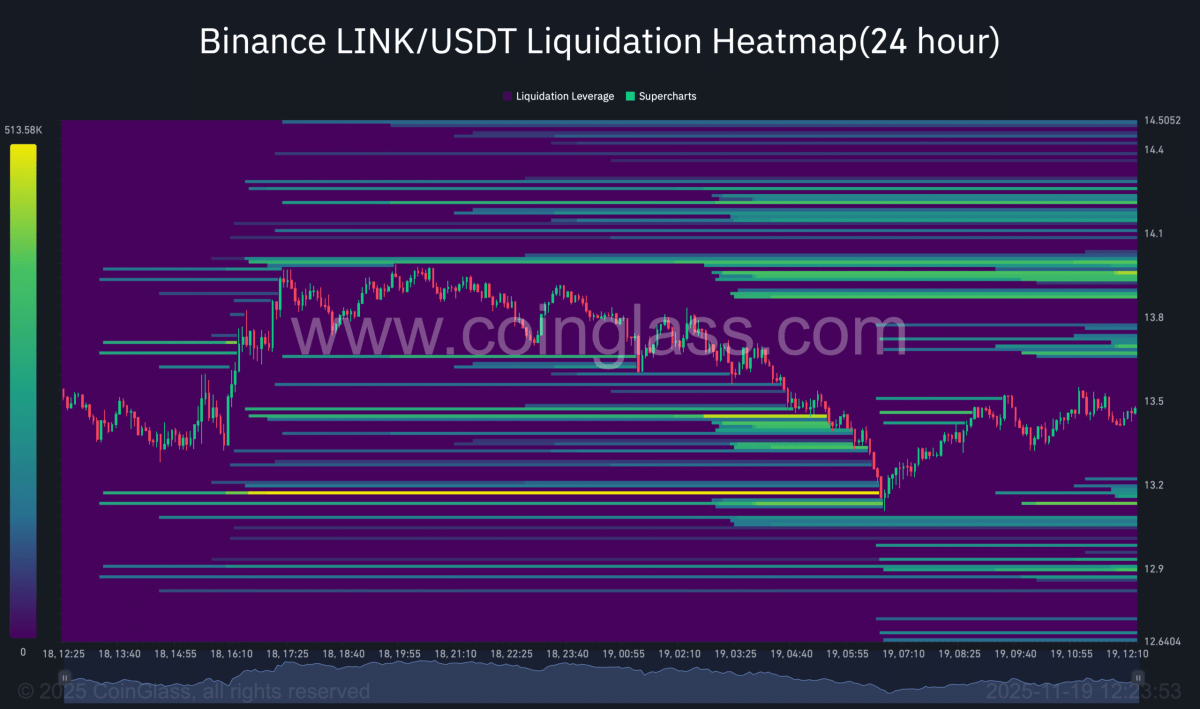

Furthermore, the Chainlink liquidity clusters show a clear path for the LINK price rally. CoinGlass data shows that liquidity is more heavily concentrated above LINK’s current price than below it. Since price typically moves toward areas of higher liquidity, the setup suggests a potential upward pull if momentum continues.

Source: Coinglass

Source: Coinglass

Still, whether LINK can confirm an upside move will depend on coordinated behavior across whales, retail traders, and derivatives market participants.

Additionally, the LINK price has just bounced off the crucial support at $12.67, as per the CNF report. It has served as a key reaction zone in previous market cycles, and the latest chart shows LINK once again bouncing back from the same area.

This bounce can push the LINK price to $17 ahead, and further to $20 if strong bullish momentum builds.

Grayscale Releases Link Adoption Report

Crypto asset manager Grayscale has shared a detailed report on the growing adoption of Chainlink. The asset manager noted that Chainlink serves as the critical bridge between crypto and traditional finance. Its technology is seen as essential infrastructure for blockchain-based finance, and its growing adoption makes it a key player in the tokenization process. Grayscale noted:

Moreover, Chainlink’s suite of technologies helps register ownership of off-chain assets, such as securities, real estate, and commodities, on the blockchain, offering benefits like more efficient settlements and lower costs. With partnerships including S&P Global and FTSE/Russell, Chainlink’s role in the future of finance continues to expand, making its native token, LINK, a compelling asset for crypto portfolios.

]]>You May Also Like

How Wheelchair Transportation Transforms Daily Life by Enhancing Mobility, Safety, Independence, and Social Inclusion for Individuals with Limited Mobility

CME Group to launch options on XRP and SOL futures