Pipe Announces Expansion Into Australia With Partner Live Payments

Pipe, a fintech company building an embedded financial operating system for small businesses, announced its first Australian customer, Live Payments, a leading payment solutions provider serving more than 10,000 small and medium-sized businesses. This new partnership continues Pipe’s rapid global expansion, with its product now live in the US, Canada, UK, and Australia. The Australian market has been a frequent early adopter of new fintech options.

With the SMB lending space still largely dominated by big banks, Pipe anticipates strong conversion for its capital product.

Working with Pipe, Live Payments’ customers will be able to access capital offers inside its Customer Portal, which they use to manage their payments. Eligible Live Payments businesses will see capital offers from Pipe that are based on their unique revenue, cash flow, and business performance. By assessing risk through its cutting-edge underwriting engine, Pipe is able to offer personalized, pre-approved capital offers with transparent, up-front pricing.

“Pipe is at an exciting stage, with an expansion playbook that lets us enter new markets quickly and a product designed to make a real difference for small businesses everywhere,” said Luke Voiles, CEO of Pipe. “Live Payments has been a great first partner for us in Australia, helping us show what’s possible when small businesses are given the capital and tools they need to thrive.”

Live Payments is a leading Australian payment solutions provider, trusted by thousands of local businesses to simplify and manage their payments. With more than 19 years of experience, the company empowers businesses with reliable and flexible payment solutions, including online and virtual payment gateways. Live Payments stands out in the market for its innovative and rewarding offerings, designed to help Australian small businesses grow and thrive.

“We’re excited to expand access to working capital for our customers through our partnership with Pipe,” said Reuven Barukh, CEO of Live Payments. “Australian businesses have been quick to embrace new ways of accessing capital, and we’ve already seen strong demand for a solution like this. Our customers trust us with mission-critical parts of their business, and offering working capital is a natural next step in strengthening that relationship.”

Research shows that Australian small businesses face a $38 billion funding gap, with more than half of all small business capital applications unsuccessful. Pipe will help Live Payments address this significant pain point for Australian small businesses, helping them access personalized capital options inside the same platform they’re using to manage their business. Instead of relying on credit checks, personal guarantees, or lengthy documentation, capital offers are determined entirely by historical business performance and cash flow.

Pipe has a previously established Australian business entity. It expects Australia to be an attractive expansion market for existing customers, as well as local Australian companies looking to complete their stack with embedded financial solutions.

The post Pipe Announces Expansion Into Australia With Partner Live Payments appeared first on FF News | Fintech Finance.

You May Also Like

Why Following Sui Crypto News Gives Early Insight Into Cross-Chain and Interoperability Trends

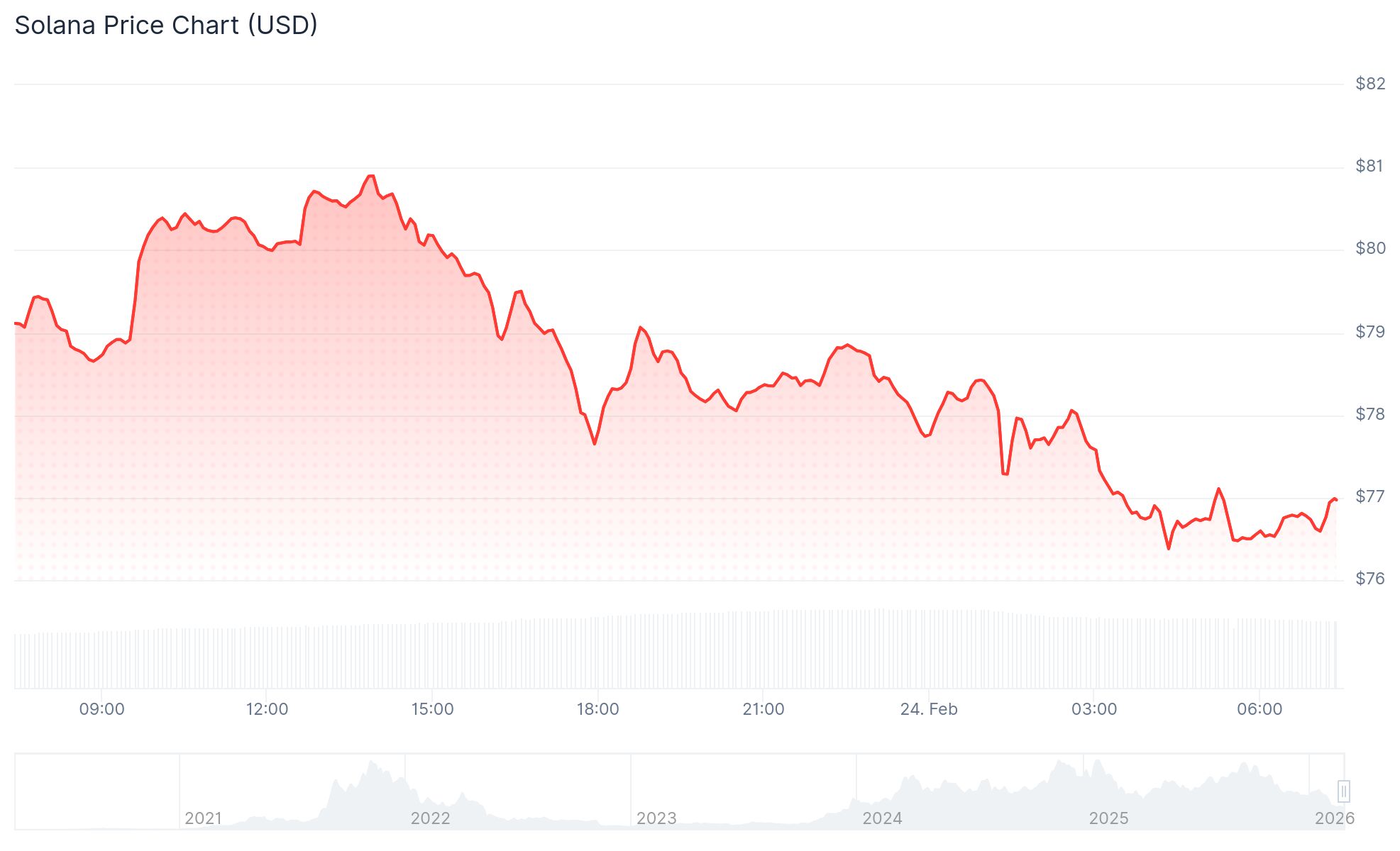

Solana (SOL) Price: Most SOL Holders Are Underwater as Token Drops to $76