Bitcoin Buyers Step In: Largest Accumulation Wave Emerges In the Heart of Market Fear

The entire cryptocurrency market is experiencing one of the largest bloodbaths ever, with the price of Bitcoin now dangerously trading close to the $90,000 mark, a level last seen in April 2025. Amid this sharp correction, a renewed buying pressure has been spotted in the market as investors flock in, reaching unprecedented levels.

Record Buying Activity Among Bitcoin Investors

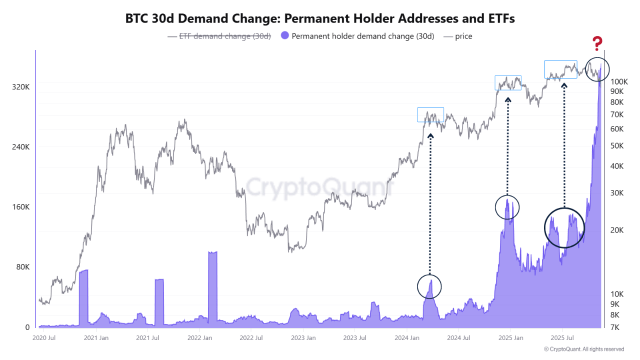

Even with Bitcoin’s price being heavily bearish, the flagship crypto asset is exhibiting an unusual shift in market dynamics that is drawing notable attention in the sector. A report shared by CryptoQuant, a leading on-chain data analytics platform, states that BTC has witnessed the largest wave of accumulation, which is unfolding in the middle of an ongoing selloff.

Prices have been declining and short-term sentiment has tipped unfavorably, but a strong undercurrent of strategic buying has formed beneath the surface. In the Quick-take post, MorenoDV, a market expert and author, highlighted that strong hands are absorbing supply at a pace that leads to price tops. However, the price of BTC is still showing bottom-like action.

Historically, Bitcoin’s price experiences a rally that leads to the formation of local tops whenever demand from wallet addresses keeping their coins, particularly long-term holders or price-insensitive owners, increases sharply. These holders seem to absorb circulating supply, create a supply squeeze in the market, and start a brief rally. It is worth noting that once their demand subsides, prices typically decline.

However, the ongoing trend is moving away from past patterns. There has been a surge in demand from these permanent holders from 159,000 BTC to 345,000 BTC since October 6, marking the largest accumulation in recent market cycles. Meanwhile, BTC’s price is declining sharply, rather than rallying.

Two highly Potential Outcomes Following The Massive Demand

Presently, strong hands are gathering an enormous amount of BTC, but the market as a whole is in a state of extreme fear and uncertainty, with billions of dollars in unrealized losses. When demand from those investors who never sell increases swiftly during a downward trend, it often paves the way for one of two high-probability outcomes.

The first scenario pointed out by the expert is a meaningful rally. This rally is set to be driven by robust supply absorption that eventually allows these investors to distribute into renewed retail adoption. A key trend to note is that smart money is buying panic-selling at a discount. Thus, a powerful rally is likely as supply dries up when retail finally capitulates.

Moving on, the second scenario is a final leg down, where prices wash out market appetite leftovers prior to the formation of a more durable trend. MorenoDV noted that the price has much more downside ahead, and this accumulation might be capturing falling knives.

If BTC’s downtrend persists, accumulation appetite could entirely be destroyed, causing even seasoned holders to reconsider. Whether the first or second scenario plays out, MorenoDV stated that the signal remains the same. Long-term capital is massively returning while short-term holders’ sentiment is capitulating.

This divergence rarely lasts long, but it usually resolves with force once it does. After the examination, MorenoDV declares that this is one of those situations where staying data-driven typically matters most, and not sentiment-driven.

You May Also Like

TELUS Digital showcases AI transformation in telecom: Unlocking value with innovative use cases at Mobile World Congress 2026

SK Telecom Stock; Declines Modestly as Company Courts European VCs