DeFi Yield Competition: Pendle and Rising Star Spectra

Author: Coinshift , Crypto KOL

Compiled by: Felix, PANews

The DeFi yield market is growing rapidly — with Pendle and Spectra serving as key players contributing to the growth of the space, each taking a different approach.

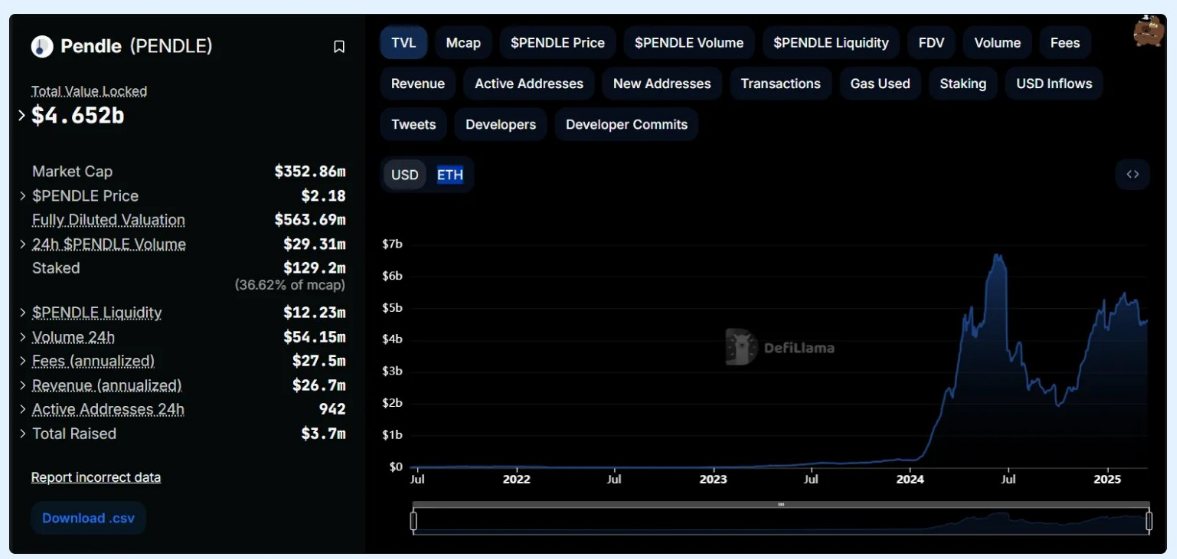

Pendle is having a breakout year in 2024. Thanks to integration with staking/re-staking ETH derivatives (LST and LRT), an active community, and strong airdrop momentum, Pendle TVL has risen from $20M to $4.6B.

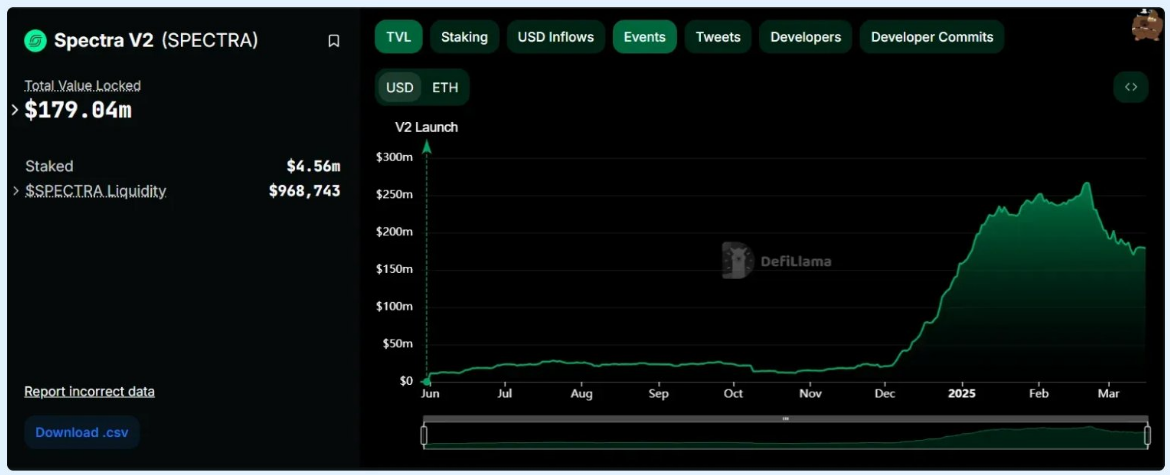

In June 2024, APWine changed its name to Spectra, focusing on permissionless pool creation and integration with stable, real-income assets such as csUSDL (Coinshift) and USR (Resolv). By early 2025, its TVL grew from $20 million to around $190 million. Although not as fast as Pendle, it has continued appeal in Base and other L2s. Spectra is also developing MetaVaults functionality to improve capital efficiency in the yield market.

This article aims to review the development history of the two protocols, explain how they differ, and how their growth strategies will affect the future returns of DeFi.

Note: This article is for reference only and does not constitute financial advice. All data related to token prices, market capitalization, and protocol TVL are based on public sources such as DeFiLlama .

Spectra and Pendle : Development trajectories

Pendle 's Explosive Growth: First-Mover Advantage

Pendle has taken a lead in the yield derivatives space by turning future yields into tradable assets. Thanks to the liquidity staking boom and early integrations with staked ETH derivatives such as Lido’s wstETH and Renzo’s ezETH, its TVL soared to $5.2 billion by mid-2024.

Key drivers of Pendle's growth include:

- Early support for popular yield tokens

- The vePENDLE model directs issuance to high-demand pools, encouraging deep liquidity

- Bribe-driven governance system to incentivize active participation and increase token utility

As TVL climbs, protocol revenue and user engagement also rise, creating a flywheel effect. Thanks to the narrative around revenue innovation and increasing fee accumulation, Pendle's native token has risen 20x in 2024.

Pendle’s TVL growth

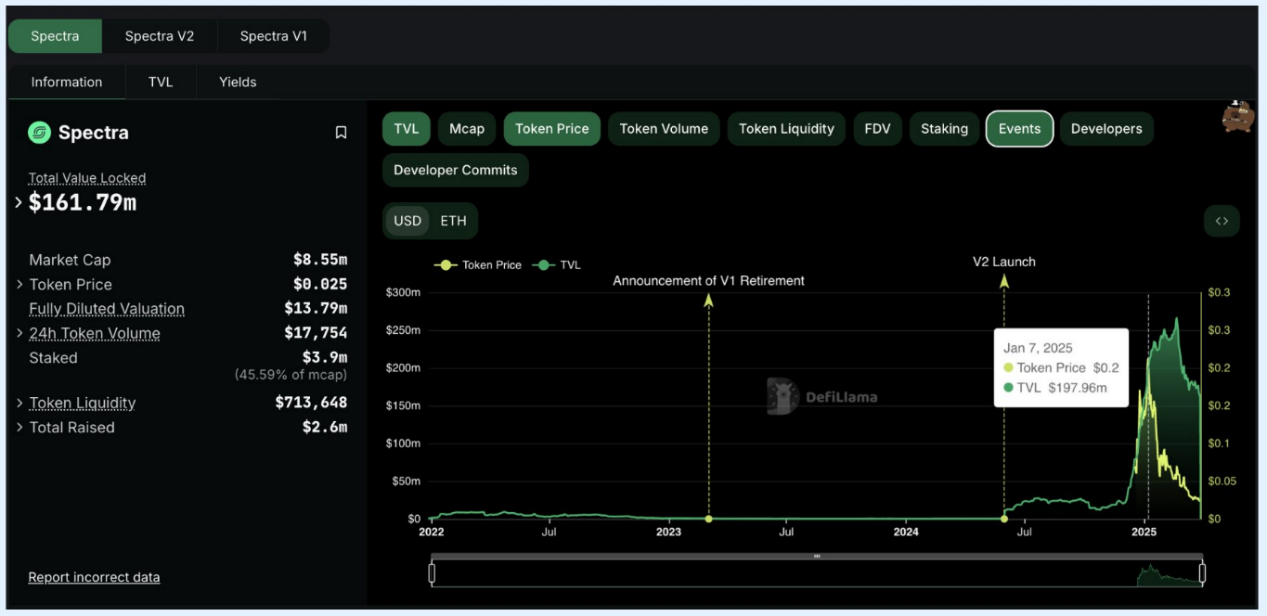

Spectra 's low-key reboot and breakout moment

Spectra took a different approach — a strategic, phased rollout rather than a high-profile launch. Initial adoption was muted after it relaunched with a planned yield market in June 2024. But that changed in December 2024, when Spectra’s TVL jumped from $20 million to over $190 million in just a few weeks.

What was the catalyst? The rapid rise of Resolv Labs’ USR, a stablecoin that has sparked a wave of demand for fixed-income options.

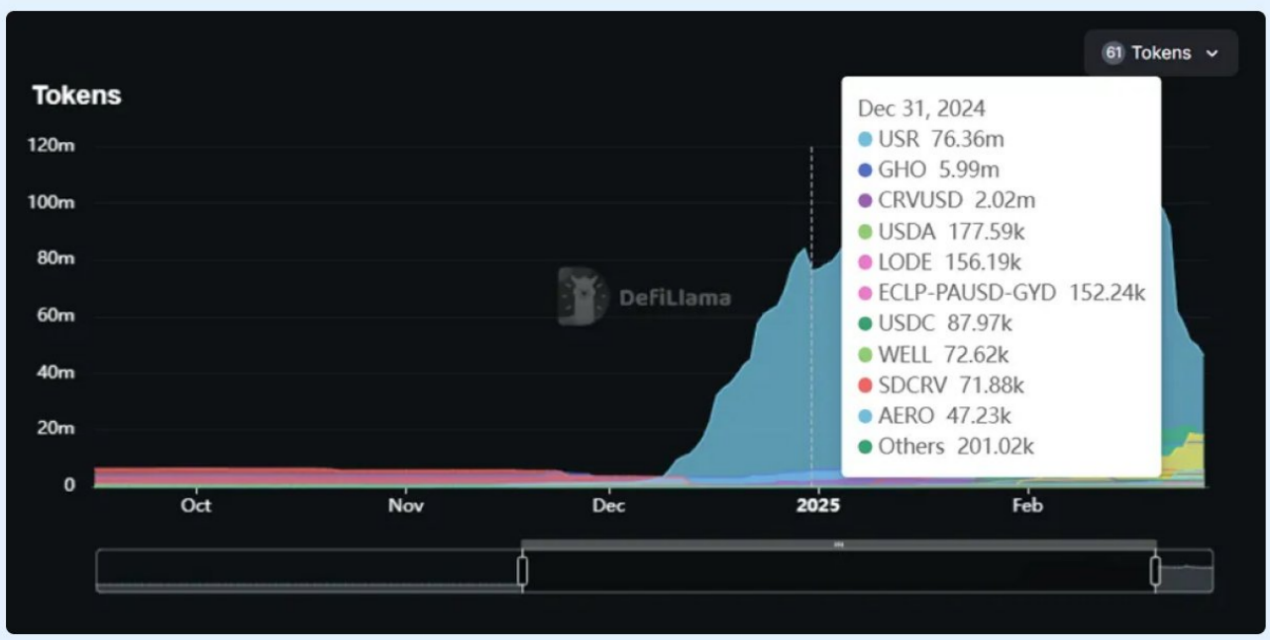

Spectra quickly became the leading venue for USR deployment, particularly for users seeking predictable fixed-rate returns. By year-end, USR accounted for more than 80% of Spectra’s TVL.

Spectra’s TVL growth

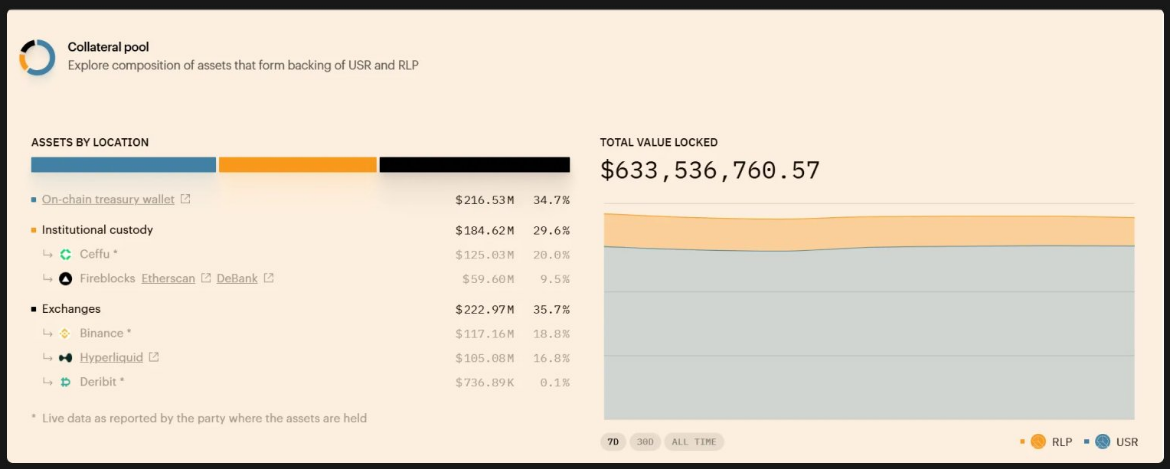

USR and Spectra : DeFi Flywheel

USR reached its breakthrough moment at the end of 2024, with TVL jumping from $36 million to nearly $400 million in less than a month. Spectra became the platform of choice for users who wanted to lock in fixed income on USR.

Several key factors kick-started the flywheel:

- Spectra is one of the first platforms to provide fixed income to USR holders

- Incentive pools funded by SPECTRA issuance and Resolv yield mechanism quickly attracted liquidity

- As liquidity flows in, more and more users turn to USR-Spectra strategies, chasing competitive fixed income and potential airdrops

Resolv’s TVL follows almost the same growth curve as Spectra. Yield miners, in particular, are attracted by Spectra’s incentives and Resolv’s stablecoin rewards.

Resolv Lab’s TVL growth trajectory

This creates a self-feeding growth loop. By December 2024, Spectra’s TVL climbs from ~$20-25M to $143M, at which point the USR pool is just over $300M. Spectra offers one of the first platforms where users can deploy USR for fixed income, so the majority of new USR supply flows directly into its marketplace.

The effect is obvious:

More USR in circulation → more demand for fixed income → more TVL flows into Spectra → growing user confidence → the cycle repeats.

Spectra’s Discord and social channels quickly followed suit. Some even described it as a “Pendle-like moment” as Spectra showed signs of catching up in terms of TVL.

As more income-generating assets are added, the composition of Spectra’s funding pool also changes

Morpho Loop : Pendle 's flywheel, Spectra 's opportunity

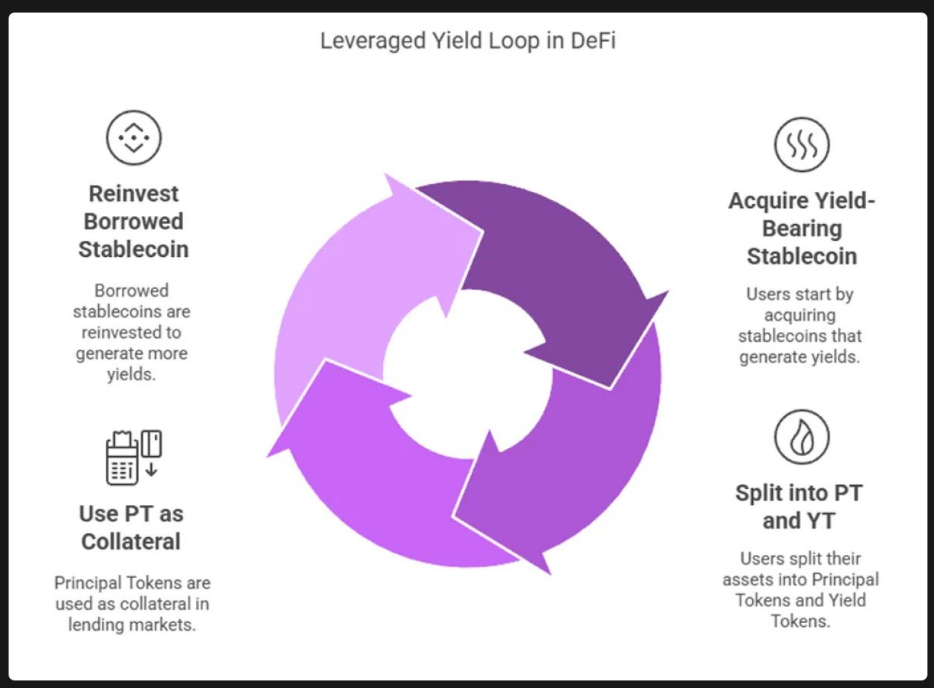

One of the strategies behind Pendle’s recent stablecoin TVL growth is the leveraged yield loop. This is a recursive strategy where users borrow and lend Principal Tokens (PT) to expand fixed income exposure.

This strategy is often referred to as the “Morpho Loop” or stablecoin arbitrage trading, and embodies the practical application of DeFi composability. Taking PT-USR on Pendle as an example, here is how it works:

(i) Obtaining a stable currency with yield

Users start with a base stablecoin like USDC or DAI and convert it into a yield-bearing token like wstUSR.

(ii) Split into PT and YT on Spectra

Users deposit wstUSR into Pendle to generate PT (principal token) and YT (yield token).

Most strategies involve holding PT because its value is relatively stable and accumulates to full par value at maturity. Users can sell YT for immediate gains or use it elsewhere.

(iii) Using PT as collateral on Morpho

Users acquire PT (e.g. PT-wstUSR) and provide it to Morpho as collateral.

For example, the PT-wstUSR/USR market on Morpho allows users to borrow USR with their PT collateral.

(iv) Reinvesting borrowed stablecoins

The borrowed USR is converted back to wstUSR, deposited into Pendle again to mint more PT and YT, and the process repeats.

The result of the Morpho loop is a leveraged fixed-rate position:

Users end up holding more PT than their original capital allows, which means that at maturity, they receive more stablecoins.

Why is this important?

The PT-USR loop is a classic example of DeFi composability — combining stablecoin issuers, yield protocols, and lending markets into a self-reinforcing flywheel.

The strategy looks like this:

Mint stablecoins → split into PT/YT → use PT as collateral → borrow → repeat.

This stablecoin yield strategy has been a key factor in Pendle’s TVL growth as it allows users to expand their fixed income exposure while putting their idle stablecoins to work.

What does this mean for Spectra ?

Currently, this loop exists on Pendle but not Spectra. However, Spectra is actively working with Morpho and ecosystem administrators to bring the Spectra-PT market to Morpho. Once live, the same strategy could open up a new round of growth for Spectra, especially given its deep focus on stablecoin native yield markets and permissionless mining pool creation.

In other words: Pendle's flywheel is spinning today. Spectra's version is still loading up -- but if its mechanics are replicated, the upside could be huge.

The leveraged income cycle strategy is working

TVL Growth and Token Price Correlation

The cases of Spectra and Pendle illustrate that protocol TVL growth is often correlated with token price performance, especially when the token captures value through fees, issuance, or governance.

Pendle

Pendle TVL exploding in 2024 directly translates into strong token performance:

- TVL jumped from $230 million to $6.7 billion, with a significant increase in market share

- PENDLE rose from around $1 to a record high of $6.67, an increase of nearly 590%.

This isn’t just speculation. Pendle’s vePENDLE model introduces fee sharing and governance weights, so more TVL means more revenue for the protocol — and more incentive to lock up PENDLE for voting power and bribes.

At its peak, Pendle had a TVL of $4.6 billion and a market cap of $644 million, giving it a TVL-to-market cap ratio of about 14%. This “undervalued” perception helped drive continued buying. Eventually, after peaking in April, the token price fell back from about $7 to the $2-4 range as some TVL fell with the expiration of popular yield pools.

Nonetheless, the general trend remains: as Pendle’s TVL grows, so does demand for the token. Strong fundamentals (TVL, revenue, and token utility) drive the narrative and investor attention.

Even in early 2025, when Pendle’s TVL fluctuated between $3.5 billion and $5 billion, the token remained within a few dollars. This suggests that the market is still pricing in future upside, not just current TVL.

PENDLE Token Price vs TVL

Spectra

Spectra’s token history is recent, but early data shows a clear correlation between TVL growth and token price movements.

In December 2024 alone, TVL grew from $20 million to $143 million, driven primarily by USR integration and demand for stablecoin yields.

In early December last year, SPECTRA was issued at a price of $0.07 and climbed to an all-time high of $0.23 within a few weeks, an increase of approximately 310%.

After peaking in early January, SPECTRA’s price began to decline, stabilizing at around $0.04-0.05 by March, while TVL remained stable at over $150 million. This suggests that the initial price surge may have outpaced usage and fee generation, and the market adjusted expectations accordingly.

At its peak price of $0.236, Spectra’s circulating market cap was around $80 million, more than 50% of its $143 million TVL — a MC/TVL ratio much higher than Pendle’s at a similar stage of growth. Once this imbalance became apparent, the premium disappeared.

By March 2025, Spectra will have a TVL of $190 million and a market cap of $14 million, which means its market cap is only about 7% of its TVL - arguably undervalued compared to Pendle, which is at a similar point in its growth curve.

If Spectra continues to scale and activates governance mechanisms like veSPECTRA, token demand could ensue. Assuming strong fee generation and continued adoption, a jump to over $1 billion in TVL could re-price the token.

SPECTRA Token Price vs TVL

Can Spectra catch up with Pendle ?

Pendle has demonstrated strong demand for tokenized yield, with billions of dollars in liquidity and clear product-market fit. Spectra is building on this foundation - focusing on stablecoin native strategies, composable lending integration via Morpho, and a permissionless design to encourage broader participation.

As the revenue landscape continues to evolve, Spectra’s path forward seems to be looking increasingly solid. If it can maintain growth, activate long-term token incentives through veSPECTRA, and continue to attract real users, it could very well become the next major player in the space.

Related reading: Interest-bearing stablecoins are booming. How can you earn income from them?

You May Also Like

‘Thinking About Buying More Bitcoin’: Michael Saylor Reacts to Bitcoin Price Collapse With Bull Statement

‘Addicted to Trump’s Circle?’ Charles Hoskinson Backs XRP Community, Slams Ripple CEO on Regulation