ETFs Rotate Amid U.S.-China Tension — Bitcoin See $20M Inflows While Ethereum Bleeds $127 M

Bitcoin spot exchange-traded funds (ETFs) saw modest inflows on Wednesday, while Ethereum products recorded heavy losses, as global markets reacted to renewed U.S.–China trade tensions and investors braced for fresh U.S. inflation data.

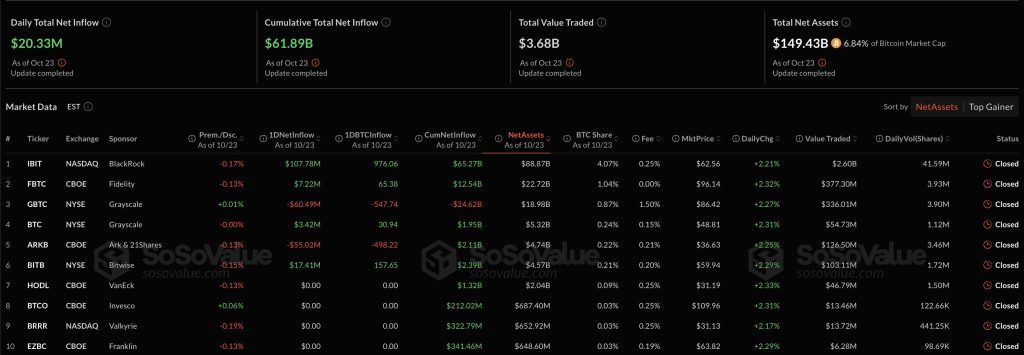

According to data from SoSoValue, Bitcoin spot ETFs recorded a total net inflow of $20.33 million on October 23, while Ether spot ETFs recorded combined net outflows of $127.47 million.

Capital Rotates From Ethereum to Bitcoin ETFs Amid Market Uncertainty

Bitcoin ETF outflow was led by BlackRock’s iShares Bitcoin Trust (IBIT), which pulled in $107.78 million.

Bitwise’s BITB followed with $17.41 million in inflows, while Fidelity’s FBTC added $7.22 million. Grayscale’s GBTC, however, saw a significant outflow of $60.49 million, marking the largest daily withdrawal among Bitcoin funds.

Source: SoSoValue

Source: SoSoValue

The total net asset value of all U.S.-listed Bitcoin spot ETFs now stands at $149.43 billion, representing 6.84% of Bitcoin’s total market capitalization. Cumulative net inflows since their approval have reached $61.89 billion.

BlackRock continues to dominate the sector with $88.87 billion in net assets under management, followed by Fidelity with $22.72 billion and Grayscale’s GBTC with $18.98 billion.

Despite GBTC’s outflows, Bitcoin ETFs overall saw a weekly net inflow of $355.76 million, highlighting investor interest in the asset even amid volatile macroeconomic conditions.

Ethereum ETFs, in contrast, extended their losing streak, extending the loss from the previous day.

Fidelity’s FETH led the withdrawals with $77.04 million in outflows, followed by BlackRock’s ETHA with $23.31 million.

Bitwise’s ETHW and VanEck’s ETHV lost $8.85 million and $5.65 million, respectively, while Grayscale’s ETHE and mini ETH funds saw $5.71 million and $6.91 million in redemptions.

As of Thursday, the total net assets of all Ethereum spot ETFs stood at $26.02 billion, about 5.63% of the asset’s total market value.

Cumulative inflows remain positive at $14.45 billion, but weekly data show net outflows of $150.31 million.

The rotation between Bitcoin and Ethereum ETFs comes amid heightened geopolitical risk and uncertainty over U.S. monetary policy.

Trump Warns of 155% Tariffs on Chinese Goods; Global Markets React

On Monday, President Donald Trump reignited trade tensions with China, threatening to impose tariffs of up to 155% on Chinese goods starting November 1 unless a new trade agreement is reached.

The comments, made during a meeting with Australian Prime Minister Anthony Albanese, shook financial markets and pushed investors toward safer assets, including Bitcoin.

Trump accused China of exploiting the U.S. “for years,” adding that “China’s paying 55 percent and a potential 155 percent come November 1 unless we make a deal.”

The White House later confirmed that Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will meet Chinese Vice Premier He Lifeng in Kuala Lumpur this weekend in an attempt to avert escalation ahead of Trump’s expected meeting with President Xi Jinping during the upcoming APEC summit in South Korea.

The renewed trade tensions follow months of tit-for-tat measures between Washington and Beijing, including new export restrictions and 100% tariffs on advanced technology components.

Also, markets are now awaiting Friday’s delayed U.S. Consumer Price Index (CPI) report for September, expected to show inflation rising to 3.1% annually, the first time above 3% this year.

Economists expect a 0.4% monthly increase in CPI. A higher-than-expected reading may dampen expectations of an imminent rate cut, but analysts say the central bank remains focused on signs of labor market weakness rather than inflation alone.

Analysts say the standoff has fueled uncertainty across global markets, with risk assets, including cryptocurrencies, responding sharply to shifts in sentiment.

Ethereum Accumulates as Bitcoin Struggles to Extend ‘Uptober’ Gains

Bitcoin traded around $111,300 at press time, holding steady near the upper end of its weekly range between $107,000 and $111,500.

The flagship cryptocurrency remains 2.3% below its monthly open, leaving the possibility of a negative “Uptober” performance if prices fail to recover before month’s end.

Data from CoinGlass shows that Bitcoin typically gains around 20% in October during bull market years, which would place the target near $130,000.

Ethereum, meanwhile, traded around $3,957 after falling 6.5% since the start of the month. Despite the ETF outflows, on-chain and technical indicators point to a potential price rebound.

Charts show Ether forming a “triple bottom” pattern around the $3,750–$3,800 zone, suggesting strong buying support.

A decisive break above $4,000 could validate the reversal setup, with potential upside toward $4,280 in the near term.

On-chain data from Glassnode also indicates accumulation among large holders.

You May Also Like

What does COIN Global do?

DeFi Development Corp. expands Solana treasury accelerator