Stablecoin Payments Hit $9 Trillion in 2025, Rivaling Global Giants Like PayPal and Visa: A16z

Stablecoins have quietly become one of the biggest payment networks in the world, moving trillions of dollars on-chain and cementing their role in global finance.

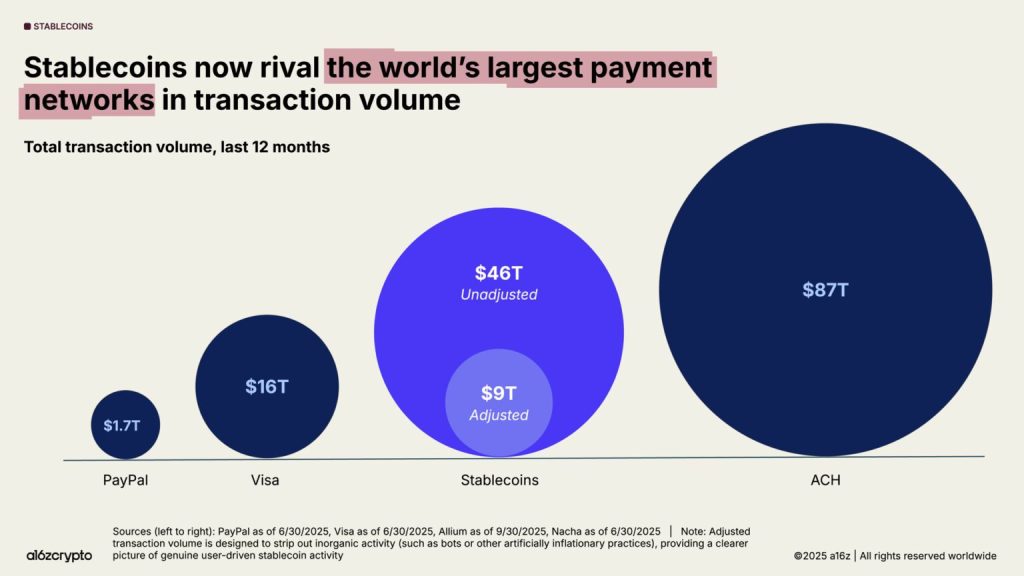

According to Andreessen Horowitz’s State of Crypto 2025 report released Wednesday, these digital tokens processed $46 trillion in total transaction volume over the past year, a 106% increase from the previous year.

The report described stablecoins as the clearest signal of crypto’s maturity this year. While total volumes include high-frequency financial flows rather than retail payments, the numbers are still staggering.

A16z Says Stablecoins Are Closing In On ACH Network Volumes

Stablecoin transaction activity now approaches that of the US Automated Clearing House, or ACH, the electronic backbone of the US banking system.

ACH processes most direct deposits, payroll and bill payments across American banks, making this milestone a sign that stablecoins are beginning to operate at the same scale as the infrastructure that powers traditional finance.

On an adjusted basis that filters out bot-driven or artificial activity, stablecoins processed about $9 trillion in the past 12 months, up 87% from a year earlier. That level represents more than half of Visa’s payment volume and more than five times PayPal’s.

Organic Growth Signals Shift From Speculation To Everyday Use Across Global Markets

In earlier years, stablecoins were mainly used for crypto trading settlements. Now, they have become one of the fastest, cheapest and most borderless ways to send US dollars.

Transfers often settle in less than a second and cost less than a cent. The report calls them the “backbone of the on-chain economy” as they power remittances, cross-border payments and decentralized financial services.

Usage continues to rise sharply. Monthly adjusted transaction volume hit an all-time high of $1.25 trillion in Sept. 2025 alone, showing momentum that remains uncorrelated with speculative crypto trading. This trend, A16z said, points to strong organic demand and growing real-world utility.

Stablecoin supply has also surged to record levels, surpassing $300b. The two largest issuers, Tether (USDT) and USD Coin (USDC), account for roughly 87% of all circulating supply.

Ethereum and Tron remain the main blockchains for settlement, processing about $772b in adjusted stablecoin transactions in September, or nearly two-thirds of global volume.

Although dominated by these incumbents, new issuers and networks are gaining traction. Developers are building stablecoins tied to local currencies and region-specific rails, expanding the market beyond US-denominated assets.

A16z’s data shows stablecoins are now a meaningful macroeconomic force. More than 1% of all US dollars in circulation now exist in tokenized form on public blockchains.

Stablecoins Now The 17th Largest Holder Of Treasuries, Up From 20th Place Last Year

Stablecoin reserves collectively hold over $150b in US Treasuries, making them the 17th largest holder, ahead of many sovereign countries and up from 20th place last year.

This comes as foreign central banks reduce exposure to US government debt and increase gold holdings for the first time in three decades. Even as global demand for Treasuries weakens, stablecoins are driving renewed appetite for dollar-denominated assets.

Nearly all stablecoins are pegged to the US dollar, which reinforces its position as the world’s reserve currency. A16z projects the total stablecoin market could grow tenfold, surpassing $3 trillion by 2030.

The report concludes that stablecoins, once a niche trading tool, are now a pillar of digital finance. They bridge the worlds of traditional money and blockchain networks, and for the first time, they are beginning to rival the payment giants that shaped the modern financial era.

You May Also Like

CryptoQuant: Bitcoin short-term holders are panic selling, and key support levels are facing a test

GALA Technical Analysis Jan 25