Bitcoin (BTC) Drops Below $108K, Aster (ASTER) Tumbles by Double Digits: Market Watch

The cryptocurrency market reversed its trajectory today (October 21), with numerous leading digital assets charting significant declines.

BTC slipped to approximately $107,500, while altcoins like ASTER experienced much more painful losses.

Red Day for BTC

The primary cryptocurrency started the new business week on the right foot, with its valuation climbing to as high as $111,500. However, the uptick was short-lived, and the bears regained control once again.

Over the past several hours, BTC charted a substantial red candle and dipped to roughly $107,500, representing a 3% plunge on a daily scale and a 13% crash on a two-week basis.

BTC Price, Source: TradingView

BTC Price, Source: TradingView

The renewed downtrend of the asset caused some analysts to envision dark scenarios and even the potential end of the bull run. X user Dr Profit, for instance, claimed that a drop below the critical level of $101,700 may confirm a bear market. On the other hand, different factors like the reduced amount of BTC stored on exchanges hint that it’s not all doom and gloom.

Following BTC’s price retreat, its market capitalization has shrunk to around $2.14 trillion, while its dominance over altcoins stands at approximately 58%.

The Alts Head South, too

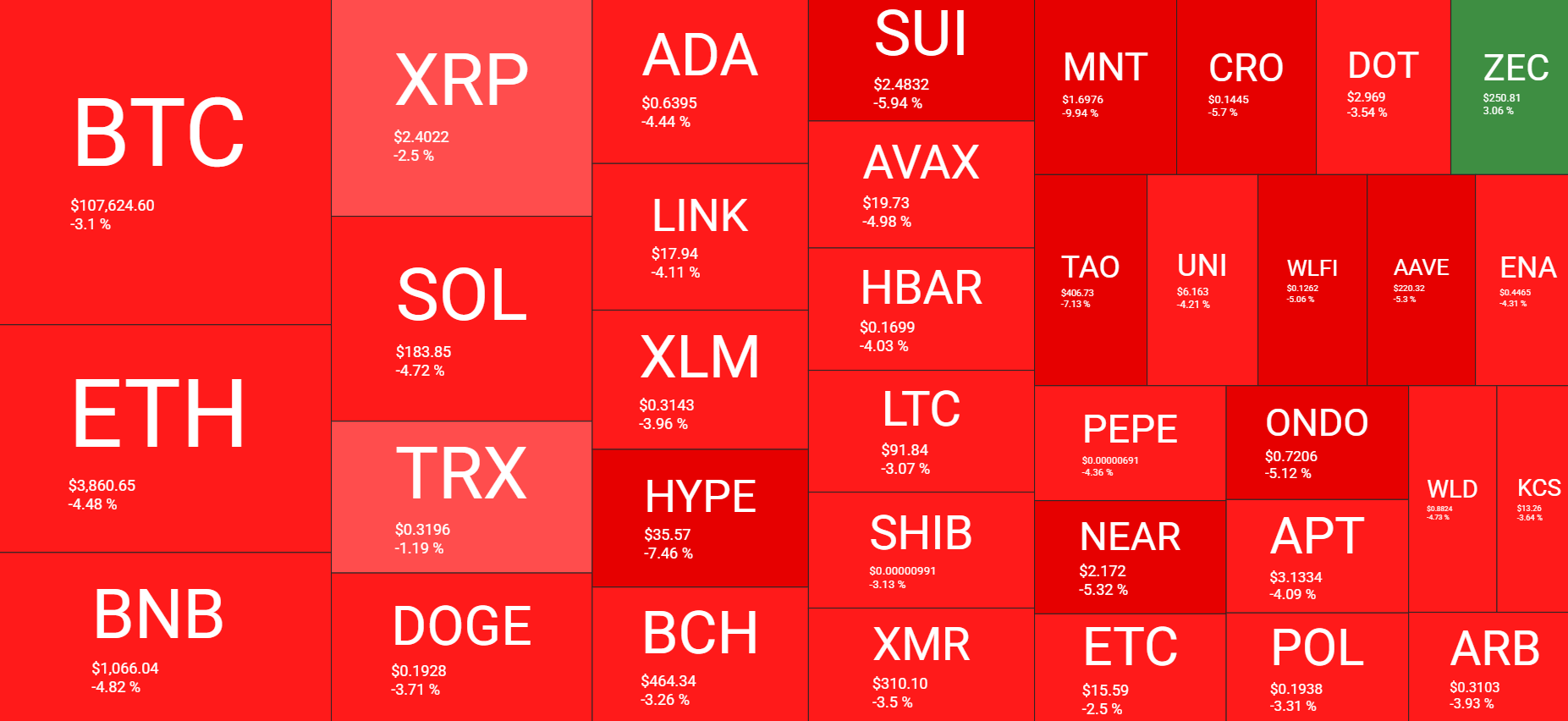

The leading alternative coins have followed BTC’s example and witnessed even greater declines. Ethereum (ETH) plunged by 4.5% to the current $3,860, Ripple’s XRP dipped well below $2.50, while Solana (SOL) tumbled by 5% to $184.

Aster (ASTER) is the biggest loser from crypto’s top 100 club, collapsing by 12% on a 24-hour scale. Mantle (MNT) and Hyperliquid (HYPE) follow next with drops of 10% and 8%, respectively.

Among the very few altcoins in green territory today are ChainOpera AI (COAI), Provenance Blockchain (HASH), and Zcash (ZEC). The total cryptocurrency market capitalization has slipped to roughly $3.73 trillion, meaning a 3.2% decrease for the day.

Cryptocurrency Market Overview, Source: QuantifyCrypto

Cryptocurrency Market Overview, Source: QuantifyCrypto

The post Bitcoin (BTC) Drops Below $108K, Aster (ASTER) Tumbles by Double Digits: Market Watch appeared first on CryptoPotato.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Trading Psychology After a Losing or Winning Streak