China Dominates Australia’s EV Market as Sales Surge 24% in 2025

TLDRS;

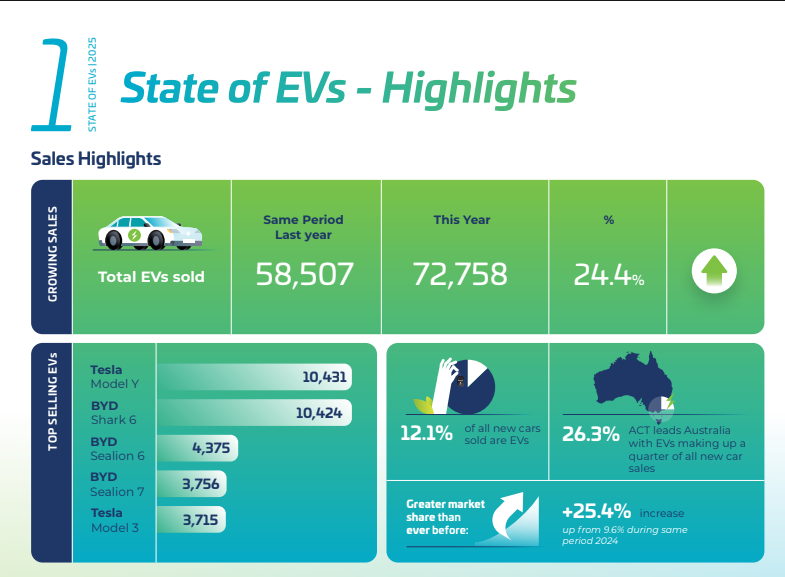

- Australia’s EV sales jumped 24.4% to 72,758 units in H1 2025, with Chinese brands leading the charge.

- China supplied 77.5% of all battery-electric vehicles sold in Australia this year, dominating the market.

- EVs now account for 12.1% of new car sales and 2% of Australia’s total vehicle fleet.

- Trade tensions may rise as Canberra weighs tariffs and supply chain diversification to curb dependence on China.

Australia’s electric vehicle (EV) market has surged to new heights in 2025, underscoring the nation’s accelerating transition toward greener mobility.

According to the latest report from the Electric Vehicle Council (EVC), EV sales in the first half of the year hit a record 72,758 units, representing a 24.4% year-on-year increase.

EVs accounted for 12.1% of all new vehicle sales in the period, marking a historic leap for the sector. June alone saw EVs capture nearly 16% of total car sales, a record monthly share driven by competitive pricing, improved battery technology, and expanding charging infrastructure.

Australia’s total EV fleet has now surpassed 410,000 vehicles, more than double the figure from two years ago. Despite this growth, EVs still represent just 2% of all vehicles on the road, signaling both the progress made and the untapped potential ahead.

China’s Dominance Raises Strategic Concerns

While the surge in adoption is a positive milestone for climate goals, it also highlights Australia’s growing dependence on Chinese automakers. Data from the Federal Chamber of Automotive Industries (FCAI) shows that China supplied 77.5% of all battery-electric vehicles sold in Australia this year.

Chinese brands such as BYD, MG, and Great Wall Motors have captured the lion’s share of the market by offering affordable models with advanced features, outpacing European, American, and Japanese rivals. However, analysts warn that this dominance brings supply-chain vulnerabilities and geopolitical exposure.

State of EVs 2025 report

State of EVs 2025 report

Europe has imposed tariffs of up to 45% on Chinese EVs, and the United States has effectively banned imports over software and hardware security concerns. Canberra, meanwhile, has joined World Trade Organization (WTO) reform talks to address oversupply issues, an indication that trade friction could soon escalate.

Trade Minister Don Farrell has reportedly prioritized addressing potential oversupply and dumping risks, which could lead to price corrections or even anti-dumping tariffs on Chinese imports. Such measures might raise EV prices domestically, potentially slowing adoption and complicating the Climate Change Authority’s target of 50% EV market share by 2035.

Charging Expansion Fuels Growth

Infrastructure development has been a key enabler of the EV boom. The EVC report cites 1,272 fast-charging locations and over 4,192 high-power public charging plugs across the country. States like New South Wales and Western Australia are leading the way with co-funding programs designed to accelerate deployment.

NSW’s $199 million destination charging initiative funds up to 80% of installation costs per site, while WA’s Charge Up Program supports businesses and local councils by covering up to 50% of expenses. The Federal DRIVEN Program, offering $40 million in rebates, is further incentivizing infrastructure expansion without requiring public access, encouraging installations at shopping centers, hotels, and fleet depots.

These initiatives not only boost adoption but also create new commercial opportunities for property owners and charging network operators.

Balancing Green Goals and Security Risks

While China’s dominance has helped make EVs more affordable and accessible, experts caution that data security, supply continuity, and technology sovereignty remain pressing challenges. Dealer associations have raised concerns about spare parts availability, technician training, and cybersecurity risks tied to connected EV systems.

Industry observers suggest that Australia’s next phase of EV policy must focus on diversification, attracting investment from other regions such as Europe, South Korea, and Japan while strengthening local assembly capacity.

The government’s balancing act will be critical: maintaining affordability to meet emissions targets while reducing reliance on a single supplier nation. As one analyst put it, “Australia’s EV revolution runs on Chinese batteries—for now. The question is, for how long?”

The post China Dominates Australia’s EV Market as Sales Surge 24% in 2025 appeared first on CoinCentral.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

White House Post Sends Solana Memecoin PENGUIN From $387K to $94M