Japanese Banks Hint at Bitcoin Adoption as Saylor Eyes More Buys and Bitcoin Hyper Becomes the Next to Explode

KEY POINTS: The Financial Services Agency (FSA) aims to allow Japanese banks to register as crypto asset exchange companies and offer crypto services

The Financial Services Agency (FSA) aims to allow Japanese banks to register as crypto asset exchange companies and offer crypto services Strategy’s Michael Saylor hints at new future Bitcoin buys to fuel the company’s $74B-strong Bitcoin treasury

Strategy’s Michael Saylor hints at new future Bitcoin buys to fuel the company’s $74B-strong Bitcoin treasury Bitcoin is seeing historically-low volatility as adoption increases, with over 4M $BTC already trapped in treasuries

Bitcoin is seeing historically-low volatility as adoption increases, with over 4M $BTC already trapped in treasuries Bitcoin Hyper’s ($HYPER) presale reaches $24.3M

Bitcoin Hyper’s ($HYPER) presale reaches $24.3M

According to the initial Livedoor news article, banks that receive the green light would also need to register as ‘crypto asset exchange companies’ to qualify for their new position.

The move follows a surge in crypto support and adoption throughout the country, with 12M registered crypto accounts and over $34B in crypto assets reported in February 2025.

Bitcoin penetrating Asian markets at the banking level could represent a massive catalyst for 2025’s Q4 and beyond, especially with Bitcoin Hyper ($HYPER) also targeting a Q1 2026 release.

Michael Saylor Hints at New Bitcoin Purchases

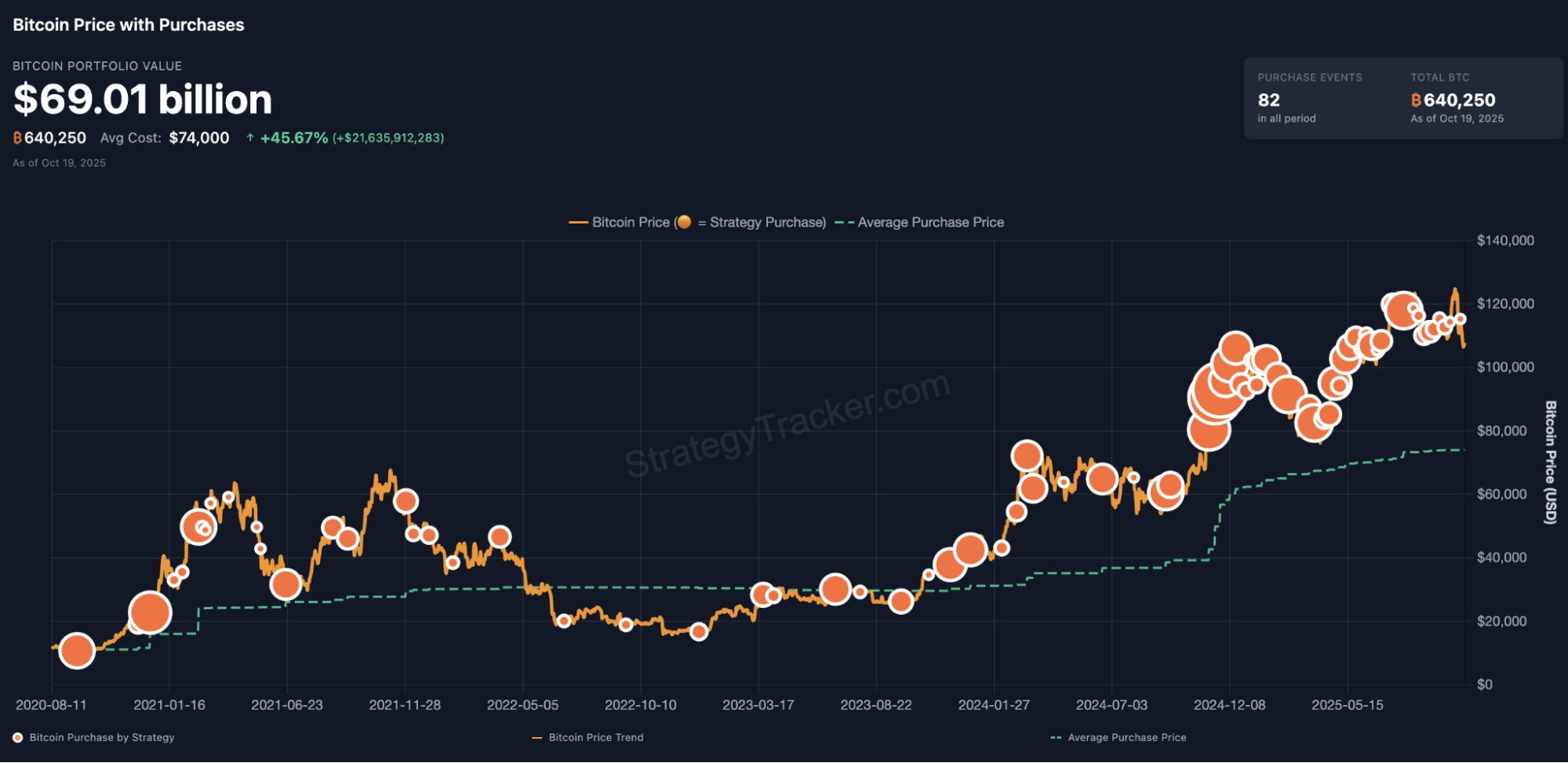

Michael Saylor just hinted at new Bitcoin purchases with a short but suggestive ‘The most important orange dot is always the next.”

The X post also featured Strategy’s $BTC purchase history, sprinkled with multiple orange dots of different sizes over the last five years.

Michael Saylor is a long-term proponent of Bitcoin, and Strategy’s hoarding plan showcases just that. It’s been less than a month since Saylor’s interview with Mark Moss, where Saylor called Bitcoin ‘inevitable’ and explained how its refinery model could spark the next industrial revolution.

During that same interview, he also made the case that governments and corporates will eventually find themselves forced to invest in Bitcoin, and we’re already seeing that today.

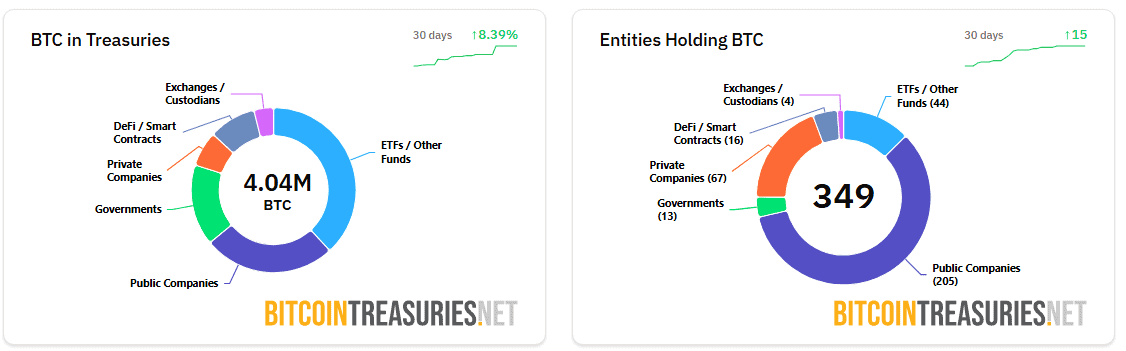

According to data from Bitcoin Treasuries, 4.04M $BTC is already trapped in treasuries, between entities like governments, public and private companies, ETFs, and exchanges. 205 of them are public companies which, together, hold 1,048,269 bitcoins.

As expected, Michael Saylor’s Strategy is leading the adoption race, with a 640,250 Bitcoin-strong treasury, worth $74B.

But this is just the beginning, as the adoption rate increases by the day, primarily thanks to Bitcoin’s lower volatility and stronger financial presence.

Deribit’s Volatility Index shows a volatility pattern below the 46.27 critical indicator for the June-October 2025 window. This is the lowest and most stable Bitcoin’s volatility has been over the last two years.

Part of that is thanks to Trump’s GENIUS Act, which establishes a clearer and safer regulatory ecosystem for issuers and investors alike.

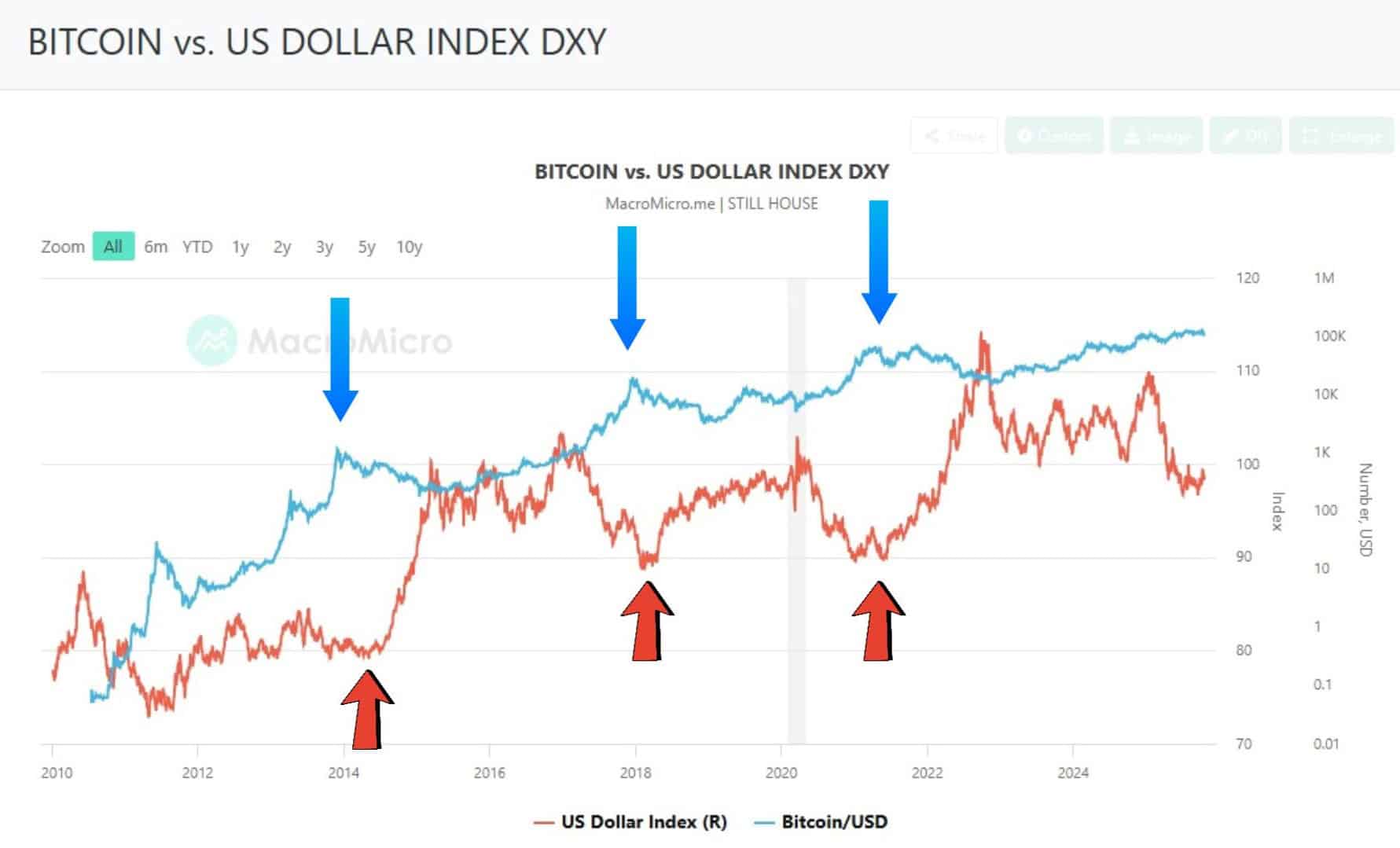

MacroMicro’s Bitcoin vs. Dollar Index speaks volumes to that, seeing how every time the US dollar dipped, Bitcoin went the opposite way.

The conclusion is clear: the market trusts Bitcoin more by the day, and Bitcoin Hyper ($HYPER) will contribute to that in 2026 and beyond.

How Bitcoin Hyper Promises to Change Bitcoin

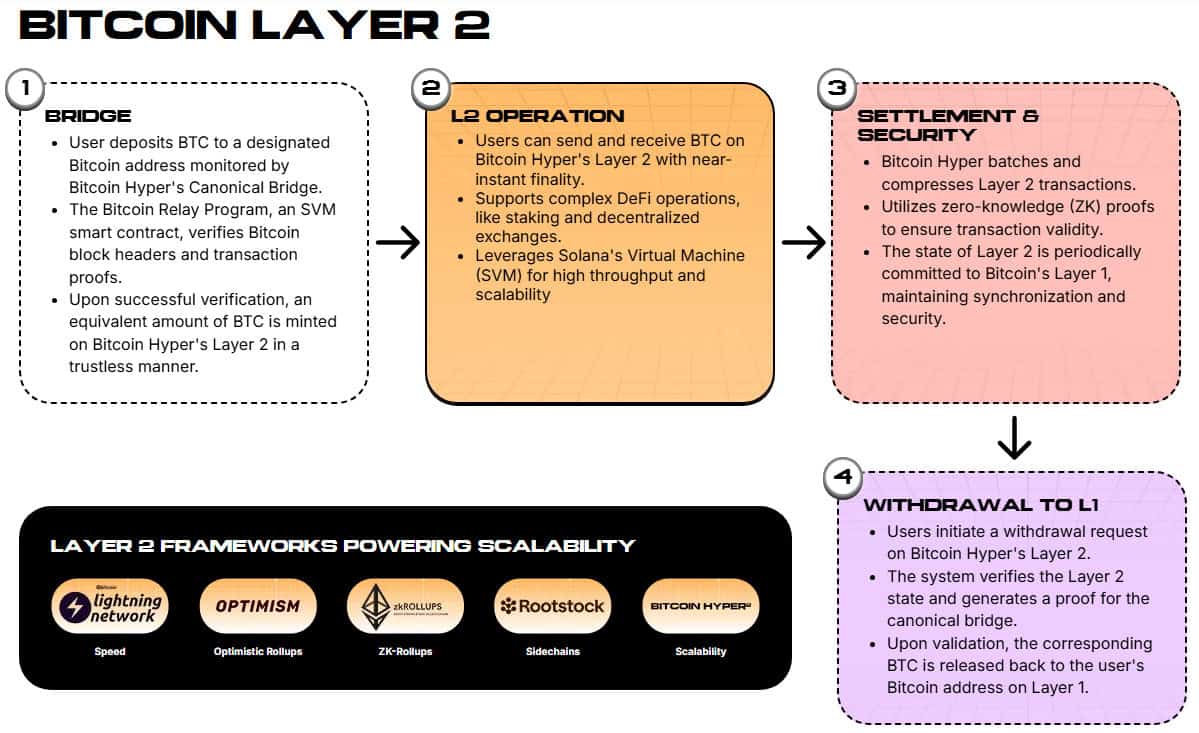

Bitcoin Hyper ($HYPER) is a Layer 2 solution that promises to enhance the Bitcoin ecosystem by making it faster, cheaper, and more scalable, thereby increasing its institutional and retail appeal.

The project targets Bitcoin’s most pressing issue: its performance limitation.

Hyper seeks to change that with the help of tools like the Solana Virtual Machine (SVM) and the Canonical Bridge.

SVM is responsible for increasing the network’s responsiveness and throughput, allowing for the ultra-fast execution of DeFi apps and smart contracts. The Canonical Bridge, however, addresses the network’s finality times directly.

Once the Bitcoin Relay Program has confirmed the incoming transaction, which happens in seconds, the Canonical Bridge mints the tokens into the Hyper layer. You can then use your $HYPERs within Hyper’s Layer 2 or withdraw them to the native layer at will.

Hyper remains synchronized to Bitcoin’s Layer 1 constantly, as well, to ensure optimal feedback and security.

In the long term, Hyper plans to enhance the scalability and performance of the Bitcoin ecosystem, offering near-instant finality and lower fees. This would make the network more feasible for institutional investors with a high TPS throughput.

The presale garnered $24.3M so far, making it one of the best presales of 2025. Now sitting at its presale price of $0.013145, $HYPER stands as the next crypto to explode in 2026, given the release date estimated for Q1.

If you want to invest, check $HYPER’s official presale page and buy your stack today.

This isn’t financial advice. Do your own research (DYOR) and invest wisely.

You May Also Like

This world-class blunder has even Trump's kingmaker anguished

Gold continues to hit new highs. How to invest in gold in the crypto market?