Bitcoin Crashes To $105,000, Sentiment Sinks Into Extreme Fear

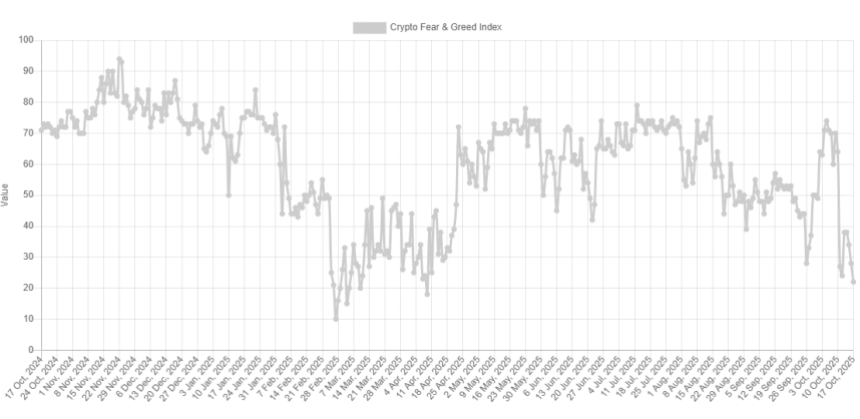

The cryptocurrency Fear & Greed Index has plummeted into the extreme fear territory following the crash in Bitcoin and other assets.

Bitcoin Fear & Greed Index Is Now Pointing At “Extreme Fear”

The “Fear & Greed Index” is an indicator created by Alternative that uses the data of several factors to determine the net sentiment present among traders in the Bitcoin and wider cryptocurrency markets. The factors in question include volatility, trading volume, market cap dominance, social media sentiment, and Google Trends.

The index makes use of a scale running from 0-100 for representing the investor mentality. All values above 53 imply the traders are greedy, while those below 47 suggest a fearful market. Values lying between the two cutoffs correspond to a net neutral sentiment.

Besides these three main sentiments, there are also two “extreme” zones called the extreme fear (below 25) and extreme greed (above 75). Currently, the market is in the former of the two.

As displayed above, the Fear & Greed Index has a value of 22 at the moment, which is just inside the extreme fear zone. This is a deterioration compared to the last few days, when the indicator held normal fear values.

The reason behind the slide into the extreme fear territory naturally lies in the bearish action that Bitcoin and other cryptocurrencies have faced recently. In particular, the market has suffered a sharp move down during the past day.

Last week also ended with a rapid drawdown in BTC and company, and then too sentiment took a large hit, with the index registering a low of 24. This previous turnaround in sentiment was also much more drastic than the latest one, as it took the metric from greed values all the way down into the extreme fear zone in a flash.

Historically, the extreme sentiments have held much importance for Bitcoin and other digital assets, as major tops and bottoms have often occurred in these regions. The relationship has been an inverse one, however, meaning that extreme fear can result in a bottom, while extreme greed can lead to a top.

The plunge into extreme fear earlier also paved the way to a bottom, although it proved to be only a temporary one. With the Fear & Greed Index back in the zone, it will be interesting to see how the Bitcoin price will develop in the coming days.

BTC Price

At the time of writing, Bitcoin is trading around $105,600, down 13% over the last week.

You May Also Like

REX Shares’ Solana staking ETF sees $10M inflows, AUM tops $289M for first time

Global Crypto Leaders to Converge in Dubai for Historic 30th Edition of HODL