ASTER Plunges by Double Digits, Bitcoin Slides Toward $110K: Market Watch

Bitcoin’s recovery attempts have come to a halt as the asset has declined below the $111,000 level once again on Thursday morning.

The altcoins are also in the red, with ETH slipping to $4,000 and XRP dropping back down to $2.40. There are a few double-digit price losers as well.

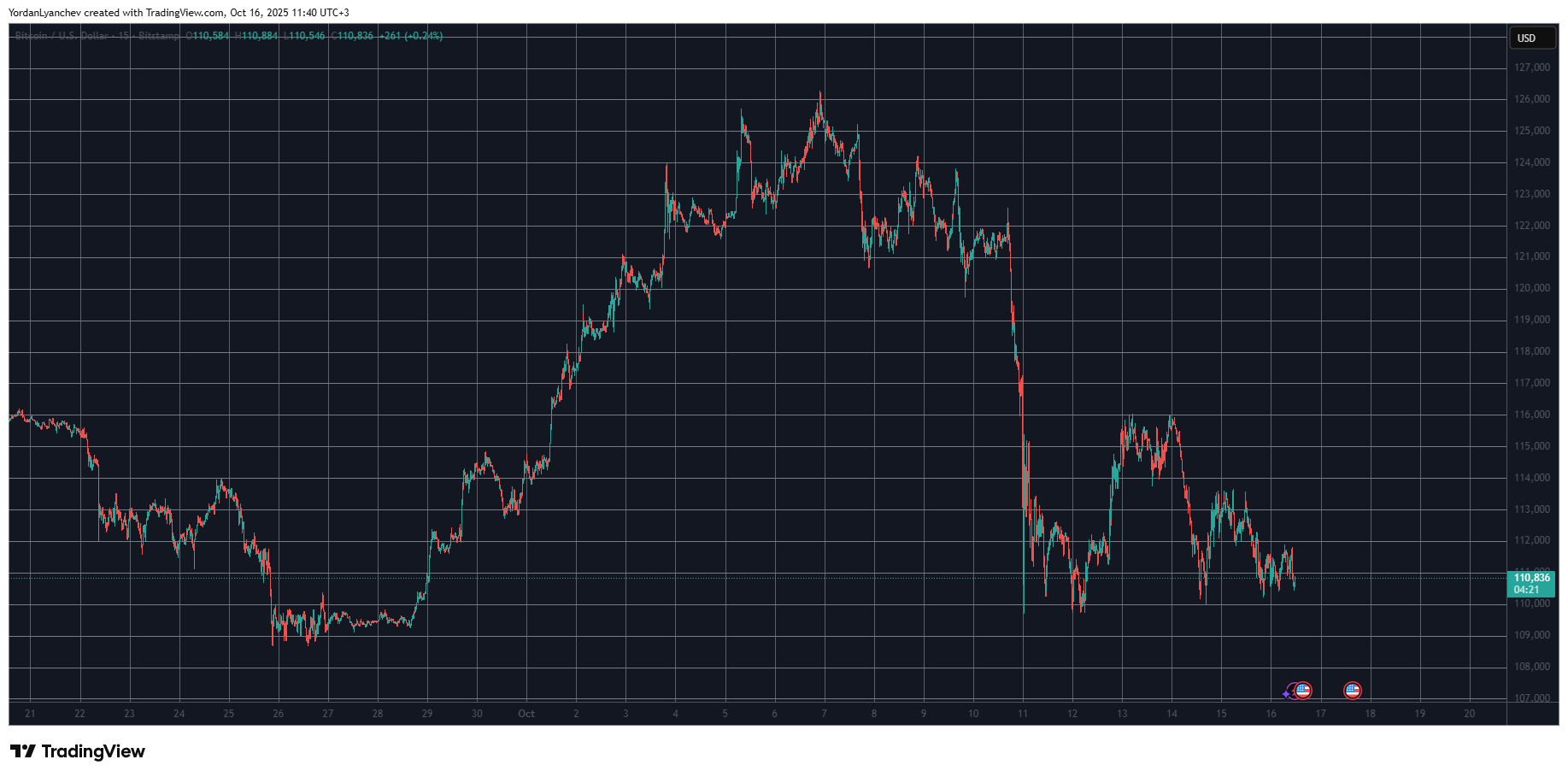

BTC Slides Below $111K

Bitcoin and the rest of the cryptocurrency market experienced massive turbulence at the end of the previous week, when the largest of the bunch plunged by over $20,000 on some exchanges and bottomed at a multi-month low of $101,000. This crash wiped out over $19 billion in leveraged positions from more than 1.6 million traders.

BTC tried to recover in the following days after immediately surging back to $110,000. It kept climbing at the start of the new business week and hit $116,000 on Tuesday.

However, that was as far as it could go as the bears stepped up once again. They pushed the asset south to $113,000 yesterday and below $111,000 as of press time today. This means that its market capitalization has fallen once again and is close to breaking below $2.2 trillion on CG.

Its dominance over the altcoins, though, has bounced since yesterday and is up to $57.2%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Alts in Retrace Mode

Most altcoins have produced even more painful declines over the past 24 hours. Ethereum leads the pack with a 4.4% drop that has pushed it to under $4,000. XRP has dipped to $2.39 after a 5% nosedive. SOL, ADA, LINK, DOGE, XLM, HYPE, SUI, AVAX, HBAR, and MNT have charted losses of up to 8%.

There are four double-digit price losers, led by TAO’s 15% daily plunge. ASTER (13%), ZEC (12%), and IP (10%) follow suit.

In contrast, COAI continues to steal the show with a massive 50% surge since yesterday that has driven its price to well over $23 as of press time.

The cumulative market cap of all crypto assets has erased $100 billion since yesterday and is down to $3.850 trillion on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The post ASTER Plunges by Double Digits, Bitcoin Slides Toward $110K: Market Watch appeared first on CryptoPotato.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Trump's border chief insists Americans support ICE – and is shut down by host: 'Come on!'