Trade War Chill Lifts Crypto: A Sunday Rebound

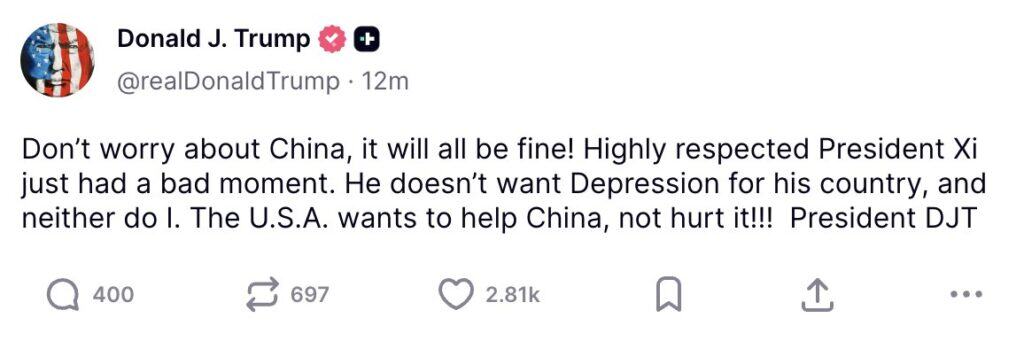

President Trump — never one to shy away from a diplomatic mic drop — took to Truth Social late Saturday to announce that “The U.S.A wants to help China, not hurt it!” He added that President Xi “just had a bad moment,” reassuring markets that neither superpower wants a depression. Traders, apparently relieved that the weekend wasn’t going to devolve into an economic cage match, started buying again.

President Trump: Don’t worry about China, Source: Truth Social

Beijing’s tone shift helped too. China’s Ministry of Commerce clarified that its new rare-earth export controls weren’t the hard stop many feared — the kind of bureaucratic olive branch that matters when your country supplies 70% of the world’s rare-earth materials. The ministry emphasized that licenses would still be issued for eligible applications and that the policy would have a “minimal impact” on global supply chains. Translation: the door’s still open, just maybe not wide.

In D.C., Vice President J.D. Vance — who’s apparently auditioning for the “calm counterpart” role — assured the press that Trump “appreciates his friendship with Premier Xi” and is ready to be “reasonable.” In Trump-world, “reasonable” is practically a safe word for markets.

Crypto Bounces (But Don’t Call It a Comeback)

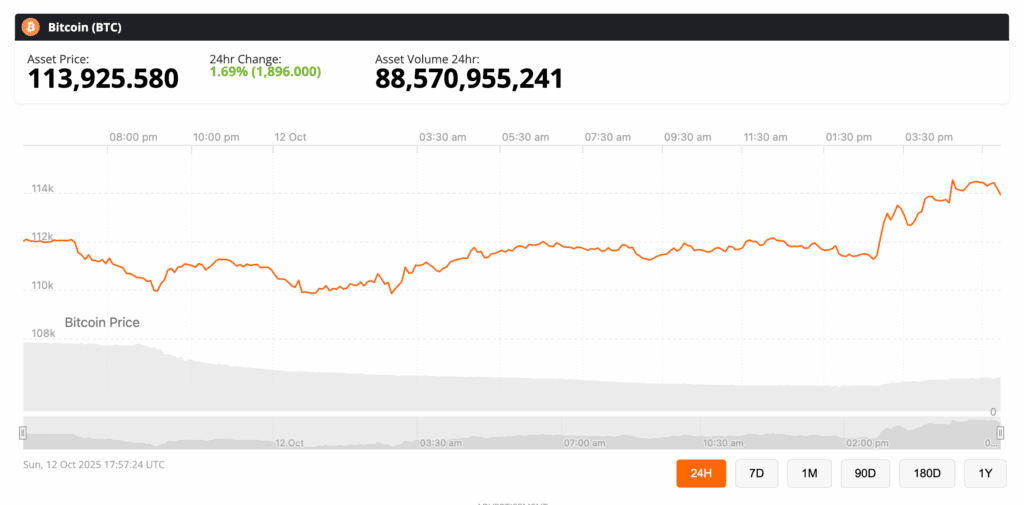

Bitcoin popped back over $114,000, up roughly 3% over 24 hours. The altcoin bloodbath eased, too — Ether rose 6%, Solana gained 8%, and Dogecoin barked back with a similar move. Traders desperate for green candles finally got them, even if the rally looks more like a dead-cat bounce than a full recovery.

Bitcoin popped back over $114,000, Source: BNC

Still, context matters: this rebound barely dents the wreckage from Friday’s selloff, when Trump’s saber-rattling about tariffs and “China unfairness” nuked sentiment across risk assets. For the week, Bitcoin remains down about 7%, Ethereum 8%, Solana 15%, and Doge an eye-watering 19%. Even the meme coins can’t meme their way out of geopolitics.

Bigger Picture

This weekend’s mini détente underscores how crypto has become hypersensitive to macro narratives. What used to be a self-contained ecosystem of speculation now trades like a high-beta sidecar to global risk sentiment — a digital thermometer for anxiety about trade wars, inflation, and AI-driven industrial reshuffles.

So yes, there are green shoots. But they’re growing in soil that’s still radioactive from Friday’s meltdown. Whether this marks the start of a turnaround or just a brief moment of optimism before another round of political chest-thumping — that’s the $114,000 question.

You May Also Like

Understanding Employee Wage Payments and How They Work

CME Group to launch options on XRP and SOL futures