BlackRock’s spot Bitcoin ETF nears $100b, is firm’s most profitable ETF

BlackRock’s iShares Bitcoin Trust is close to hitting $100 billion in assets under management but is already the asset manager’s most profitable exchange-traded fund.

- iShares Bitcoin Trust is the leading exchange-traded fund for BlackRock, surpassing S&P 500 and gold ETFs.

- The spot Bitcoin ETF is nearing $100 billion in net assets, a rapid growth for a fund that launched in 2024.

- Bitcoin price has jumped to a new all-time high of $125,800.

The iShares Bitcoin Trust, trading under the ticker IBIT, launched in January 2024. According to Bloomberg ETF analyst Eric Balchunas, the spot Bitcoin fund has quickly become BlackRock’s most profitable.

IBIT has more than $97.7 billion in assets under management (AUM), putting it close to the $100 billion mark.

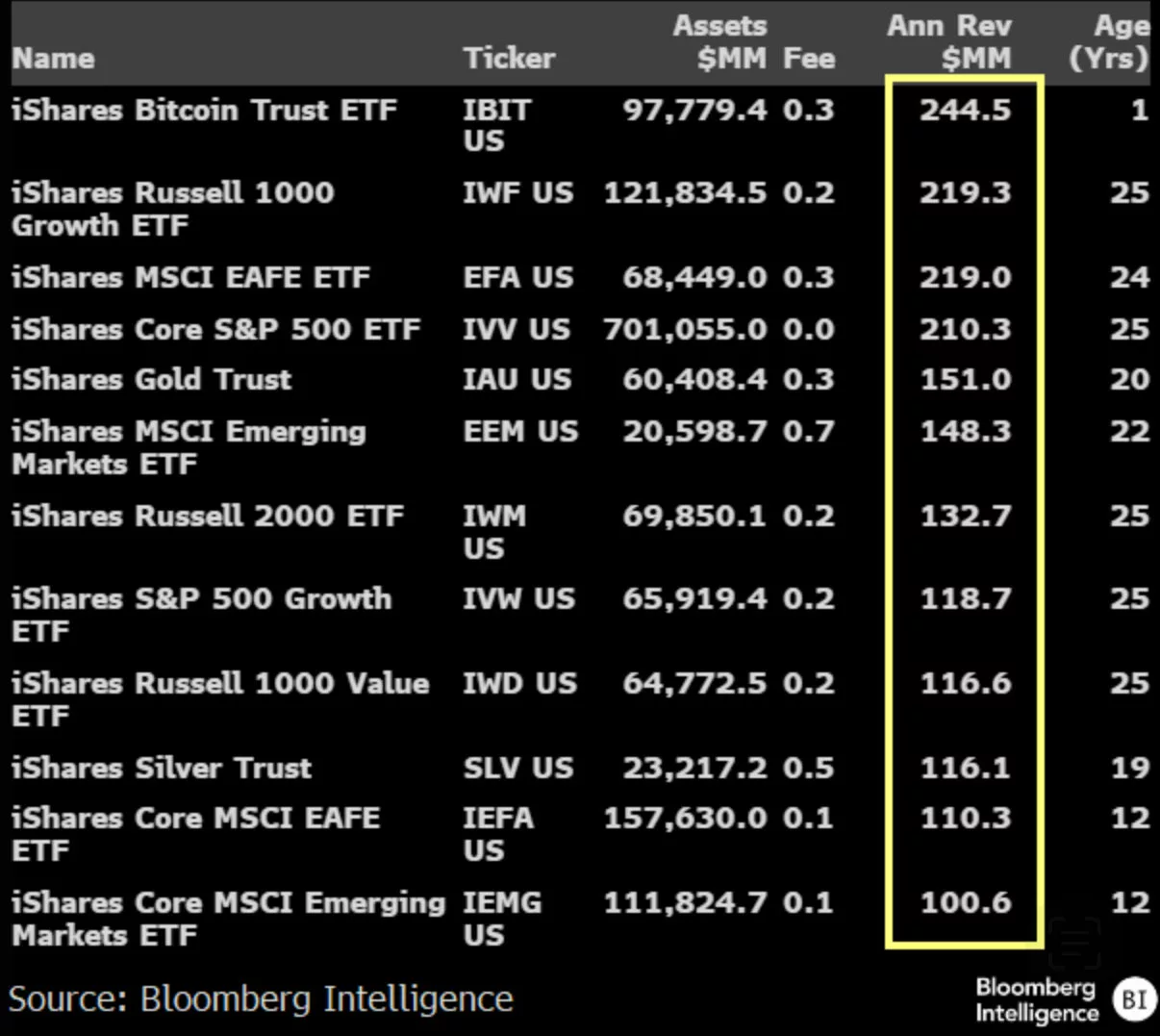

IBIT vs other BlackRock ETFs

A list that Balchunas shared via X shows the spot Bitcoin (BTC) ETF has risen to the top of BlackRock’s oldest exchange-traded funds by annual revenue. Notably, IBIT has managed to climb to the top of the list in under two years.

Based on fee revenue, IBIT currently sits on top with more than $244 million in annualized earnings from fees.

In comparison, the iShares Russell 1000 Growth ETF and iShares MSCI EAFE ETF, launched 25 and 24 years ago respectively, are second and third with $219.3 and $219 million.

Others, like the iShares Core S&P 500 ETF and iShares Gold Trust, with $210 million and $151 million in annual revenue, rank fourth and fifth. BlackRock’s gold ETF has been trading for 20 years.

Meanwhile, the iShares Core S&P 500 ETF, which offers exposure to the performance of the U.S. benchmark index that tracks 500 large U.S. companies, has been in the market for 25 years.

Crypto ETPs see record inflows

Bitcoin’s rise as an asset has attracted significant attention from Wall Street, and inflows into related investment products continue to grow. BTC’s surge to a new all-time high above $125,800 has fueled some of the frenzy.

The latest report on digital asset investments products, including ETFs, shows the benchmark asset saw over $3.55 billion in weekly net inflows the week ending Oct. 4, 2025. Overall, the crypto market saw record inflows of nearly $6 billion over the week.

Year-to-date, Bitcoin ETPs have attracted more than $27.5 billion in inflows. Total assets under management have jumped to more than $195.2 billion. Global crypto investment products’ AUM stands at around $254 billion as of Oct. 6, 2025.

You May Also Like

Vance roasted over stunning comparison: 'Does he know what happened to the Titanic?'

Trump's 'bulldozing' will cost his party in November: WSJ editors