Ethereum Price Mirrors Gold’s Pattern: Is ETH Rally Toward $20,000?

The post Ethereum Price Mirrors Gold’s Pattern: Is ETH Rally Toward $20,000? appeared first on Coinpedia Fintech News

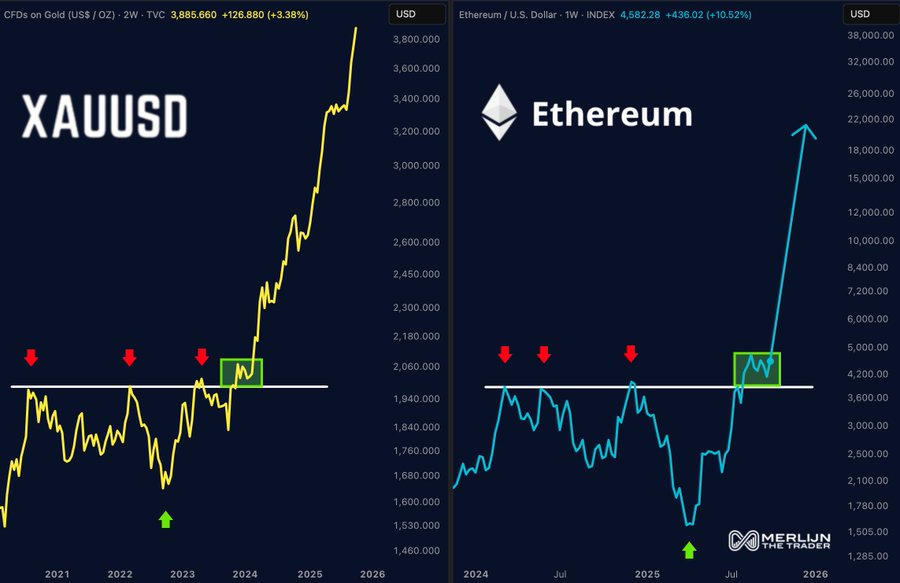

Ethereum could be on the verge of something big. A well-known trader, Merlijn The Trader, Trader Merlijn The Trader says ETH is showing the same pattern gold had before its record rally.

Just like gold, Ethereum could break higher and even reach the five-digit range above $20,000.

Ethereum Mirrors Gold’s Breakout Pattern

Merlijn’s analysis shows that gold (XAUUSD) spent years trying to break past a strong resistance level between 2021 and early 2024, only to get rejected each time.

But after finding firm support at its 2023 low, gold finally broke through the resistance in late 2024, sparking a powerful rally to new all-time highs near $4,000 per ounce in 2025.

Now, Ethereum seems to be following a similar path. After building a base around mid-2025, ETH has broken above its key resistance near $4,200, a level it struggled with before.

With this resistance turning into strong support, Merlijn believes Ethereum could be entering its breakout phase, possibly heading toward the five-digit range above $20,000.

ETH Strong Buying Momentum

Ethereum jumped past $4,500 this week, hitting $4,582, with trading volumes over $31.55 billion and a market cap near $553.87 billion. Fresh inflows from new spot ETH ETFs, totaling $1.3 billion, have tightened supply and boosted investor confidence.

Whales are also stepping in, opening large long positions and moving millions of ETH off exchanges for holding.

Ethereum Price Outlook

After moving sideways for a while, Ethereum is gaining strength again, staying above $4,500 support.

According to crypto trader Ted, Ethereum’s next big challenge is at the $4,750 level. If ETH manages to move above this point, it could open the door for a strong rally and maybe even a new all-time high.

On the downside, ETH has support at $4,250, and if it drops further, the next level to watch is $4,060.

You May Also Like

This world-class blunder has even Trump's kingmaker anguished

Gold continues to hit new highs. How to invest in gold in the crypto market?