SOL Regains $200 But This Emerging DeFi-TradFi Coin Explodes in Presale – Find Out Why it Could Flip XLM

The post SOL Regains $200 But This Emerging DeFi-TradFi Coin Explodes in Presale – Find Out Why it Could Flip XLM appeared first on Coinpedia Fintech News

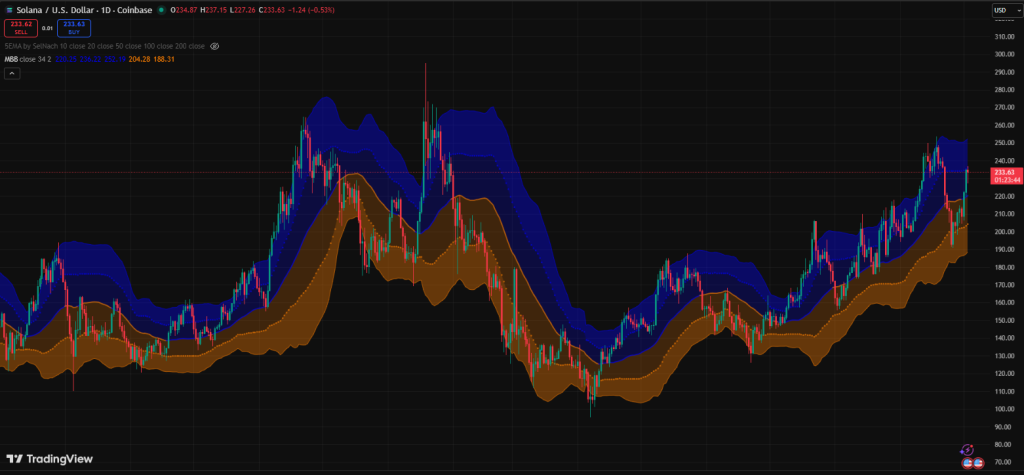

Solana is taking full advantage of Q4 and Uptober, shooting way above $200, proving itself as one of the most resilient blockchains in the market. But while traders celebrate the short-term rebound, analysts are increasingly focused on a different kind of play—one that blends the worlds of TradFi and DeFi.

Digitap ($TAP), the world’s first omni-bank, has been gaining attention rapidly, and its presale has recently shot past $500,000 in days since opening. Tipped as one of Q4’s hottest tokens, some even believe it has the potential to flip XLM in the global payments hierarchy.

Here’s what investors should know.

Solana’s Return and the Limits of L1 Plays

Solana has been one of the greatest success stories of recent years. From trading below $10 in late 2022 after the FTX debacle and everyone gravedancing, to it hitting nearly $300 as the president decided to launch his memecoin on the network.

Solana is the leading hub of on-chain activity, and its performance is a great bellwether of the broader appetite for scalable infrastructure. While short-term momentum looks good, SOL is a mature play at a nearly $130 billion market cap. Anyone holding SOL and hoping for a 50X is going to have a rude awakening. Investors should instead ask themselves which projects will onboard the next cohort of users and make crypto mainstream.

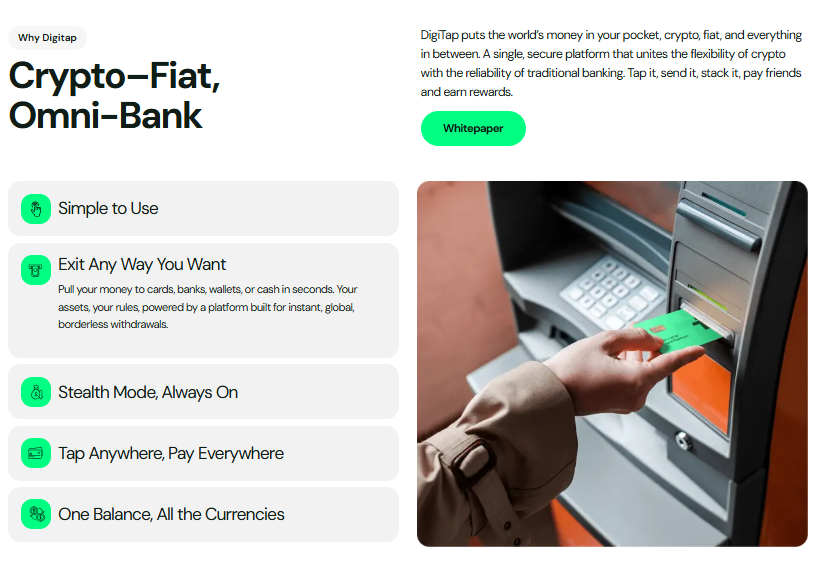

DigiTap: The Omni-Bank for the Digital-First Century

Digitap is precisely the type of project that could onboard the next generation, and as the world’s first omni-bank, this is crypto under the hood, with banking compliance enabled and a fintech feel.

Instead of being another payment chain, Digitap is positioning itself as the banking layer for the 21st century. It aims beyond fast and cheap transactions, aiming to solve the fragmented experience and siloes of traditional finance and crypto. Thanks to the Digitap app, the days of juggling various bank accounts, multiple crypto wallets, and fintech apps are over.

With a single interface, users can now deposit fiat, pay with stablecoins, withdraw in Bitcoin, or settle payroll in euros. Under the hood, DigiTap routes transactions via both traditional banking rails (SWIFT, SEPA, ACH) and blockchain rails. To the user, it feels seamless. To institutions, it looks compliant. To analysts, it appears to be the kind of front-end that can finally take crypto mainstream.

Why Analysts Say $TAP Could Flip XLM

Stellar Lumens still commands a multi-billion-dollar market cap, but who actually uses it? Digitap is built with Gen Z and the unbanked in mind. Smartphones are the primary vehicle for managing finances, and Digitap taps into this niche.

Not to mention that the demand for faster, cheaper international transfers is in a secular bull run, with cross-border payments set to hit $290 trillion annually by 2030. Digitap feels like a neobank—familiar and intuitive—but its engine is powered by blockchain rails. And the Visa card gives users another reason to download it today.

XLM never achieved mainstream traction, whereas Digitap is all-in on consumer adoption first.

Best Crypto To Buy Now: Digitap’s Banking Advantage

Solana has proven its strength. Yet at the same time, Digitap is building out a new category: omni-banking. It is a simple proposition: make money digital first. As Q4 kicks off, the season when small-caps historically outperform, the current price of $TAP, $0.0125, could look like an excellent buy in retrospect.

Even better, anyone buying today will already be in profit by the time the token launches, thanks to the dynamic pricing mechanism with $TAP increasing to $0.0159 in the next round.

Many analysts are already calling Digitap one of the best altcoins to buy now and the project most likely to onboard the next generation into crypto. XLM once promised disruption, but stalled. Now Digitap looks ready to finish the job.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

You May Also Like

This world-class blunder has even Trump's kingmaker anguished

Gold continues to hit new highs. How to invest in gold in the crypto market?