Cardano Price Prediction; Ethereum Latest News & The Best Crypto To Buy Now For Maximum Returns

The post Cardano Price Prediction; Ethereum Latest News & The Best Crypto To Buy Now For Maximum Returns appeared first on Coinpedia Fintech News

As the market gears up for Q4, attention is split between legacy giants like Cardano and Ethereum and fast-emerging contenders such as Remittix (RTX). The latest Cardano price prediction hints at moderate recovery potential, while Ethereum continues building momentum ahead of its next major upgrade.

However, early-stage PayFi projects like Remittix are quickly becoming the go-to choice for investors focused on big multipliers and functional utility. With a working wallet in beta, verified security from CertiK, and over $27 million raised, Remittix is now trending as one of 2025’s most credible launches.

Cardano Price Prediction: Gradual Upside Ahead

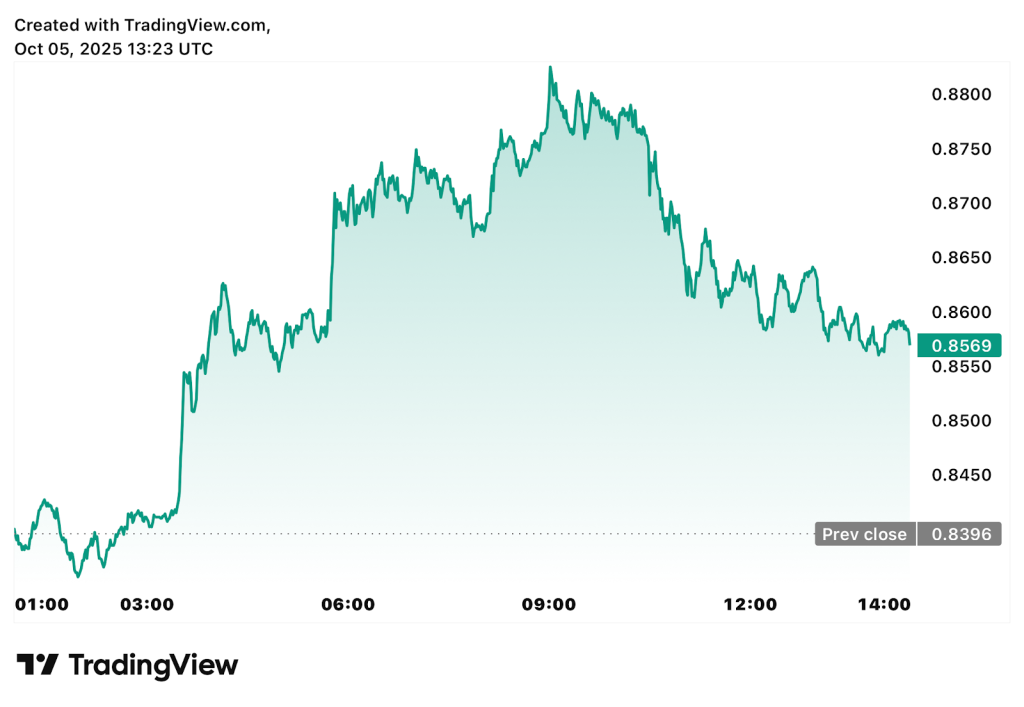

The Cardano price prediction remains cautiously optimistic heading into October. ADA is stable following recent market declines, trading close to $0.85. If buying pressure increases, analysts predict that ADA will touch $0.90. However, breaking above $1 will depend on overall sentiment and Bitcoin movement.

That’s why some ADA holders diversify into newer assets with real-world use cases and strong upside potential. One standout is Remittix (RTX), a PayFi altcoin tackling the $19 trillion remittance sector with an active user base and verified on-chain progress.

Ethereum: Market Stability Before The Next Move

Ethereum has remained stable in recent weeks and is trading around $4,540. Due to robust Layer-2 development and steady staking demand, ETH exhibits strength even as the larger market consolidates. According to analysts, Ethereum may go toward $5,000 later this month if it sustains support above $4,500.

The upcoming Pectra upgrade is also generating excitement and promising improvements to wallet recovery, smart contract efficiency, and transaction throughput. This keeps Ethereum firmly positioned as the most used smart contract platform. However, many traders are shifting some focus toward new Ethereum-based tokens like Remittix, which leverage the network’s stability while offering higher growth potential.

For those searching beyond blue-chip assets, projects like RTX represent the next wave of innovation within the Ethereum ecosystem. They offer real products and active adoption instead of speculation alone.

Remittix: Early Adoption And Verified Progress

Remittix (RTX) is emerging as one of the most complete Ethereum-based projects in 2025. Designed as a PayFi solution, it enables users to send crypto directly to global bank accounts, handling real-time FX conversion for smooth transfers across over 30 countries.

The Remittix wallet beta has now gone live for early testers, allowing real transactions with transparent conversion rates. This isn’t a promise, it’s proof of functionality. Over 40,000 holders are now part of the network, and transaction data from testing continues to validate the project’s design.

Remittix has also been verified by CertiK and ranked as the #1 pre-launch token on Skynet, signalling strong trust within the security community. Meanwhile, its 15% USDT referral program drives viral adoption, rewarding community members daily for helping grow the ecosystem.

Remittix highlights:

- Wallet beta live, supporting crypto-to-bank transfers in 30+ countries

- Over $27M raised and 40,000 holders onboarded

- CertiK verified, ranked #1 pre-launch token globally

- 15% USDT referral rewards, paid daily through the dashboard

- Expanding PayFi access across multiple blockchain networks

By blending verified delivery with accessible pricing, Remittix is demonstrating early-stage adoption in real time.

Cardano Price Prediction Holds Firm As Ethereum Stability Boosts Investor Confidence In Remittix

The Cardano price prediction suggests steady, modest gains through Q4, while Ethereum continues to anchor the broader smart contract ecosystem.

But for investors seeking exponential growth with tangible results, Remittix stands apart, delivering working PayFi tech, verified trust, and viral momentum before listing.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

You May Also Like

This world-class blunder has even Trump's kingmaker anguished

Gold continues to hit new highs. How to invest in gold in the crypto market?