SEC Hit With More Than 30 Crypto ETF Filings In One Day — ‘Just The Beginning’

More than 30 crypto ETF applications were filed with the Securities and Exchange Commission (SEC) on Friday, a tsunami NovaDiusWealth president Nate Geraci called ‘’just the beginning.’’

The rush follows the regulator’s September 17 approval of generic listing standards for the New York Stock Exchange, Nasdaq, and Cboe, which created a faster path than the old 19b-4 process.

While the US government shutdown has stalled near-term reviews by the SEC, analysts say that is only a temporary bump in the road before crypto ETF approvals ramp up.

“Any crypto ETF you can possibly imagine will be filed w/ the SEC over next several months,” said Nate Geraci, president of ETF Store and NovaDiusWealth. “You all have no idea what’s coming.”

New Crypto ETF Applications Come Amid Multiple October Deadlines

The new filings come during a month that was expected to be a pivotal one for the crypto ETF landscape, with 16 decision deadlines for these funds in October. These funds track a variety of cryptos such as Solana (SOL), XRP, Litecoin (LTC), and others.

But the US government shutdown due to Congress’s failure to reach a deal on funding has delayed the process as the SEC now operates with reduced staff.

Earlier this week, the SEC sent out an Operations Plan saying that it will be unable to review or approve certain filings including new registration statements, new financial product filings, and similar regulatory actions during the shutdown.

Many analysts saw that notification as an indication that the SEC will not deliver a decision on pending crypto ETF applications through the 19b-4 process until the shutdown ends. This appears to be the case, as the agency stayed silent on the proposed Canary Litecoin ETF when the deadline for the decision came and went earlier this week.

The shutdown can last a week or longer. In one instance in 2018, the government shut down for as long as 34 days.

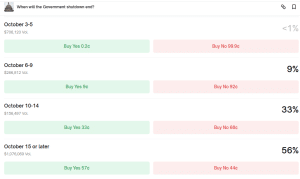

Contract asking how long the US shutdown will last (Source: Polymarket)

Traders on the decentralized betting platform Polymarket have placed the biggest odds of 56% that the shutdown will last until Oct. 15 and possibly even later. Others see a 33% chance that it will continue up until between Oct. 10 and Oct. 14.

Spot Bitcoin ETF Inflows Top $900 Million

The high volume of crypto ETF filings also happened the same day that over $900 million flowed into Bitcoin funds.

According to data from Farside Investors, investors poured $985.1 million into spot Bitcoin ETFs in the latest trading session.

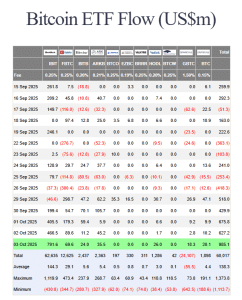

US spot BTC ETFs flows (Source: Farside Investors)

BlackRock’s IBIT, which recently entered the top 20 list of the biggest funds globally and now holds over 3% of BTC’s supply, led the charge yesterday with $791.6 million inflows. IBIT’s inflows were over 10X the amount recorded by the next-biggest inflows for the day, posted by Fidelity’s FBTC after investors pumped $69.6 million into the ETF.

Following the latest net daily inflows, the US spot Bitcoin ETFs have extended their positive flow streak to five days. They have also pulled in over $3 billion during this period.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

SEC dismisses civil action against Gemini with prejudice